Market Scorecard

It is weird to do a morning market review and not see a change in Hong Kong, particularly not seeing the price of Tencent moving. We don't have to wait much longer though, Hong Kong will be back to trading tomorrow. Given the strong moves in tech stocks over the week, how will Tencent open?

After five days of gains, US markets closed in the red yesterday. Due to China being closed this week, only a handful of corporate releases, not much in the way of economic data and no real political news, the market is lacking a driving factor. Enjoy the lull because it doesn't last long. Theresa May goes to the EU today to try to get a better deal, which is very unlikely. Then next week the US and China sit down again to try to resolve their trade war.

Yesterday the

JSE All-share closed up 0.74%, the

S&P 500 closed down 0.22%, and the

Nasdaq closed down 0.36%.

Company Corner

Bright's Banter

Monday after the market's close,

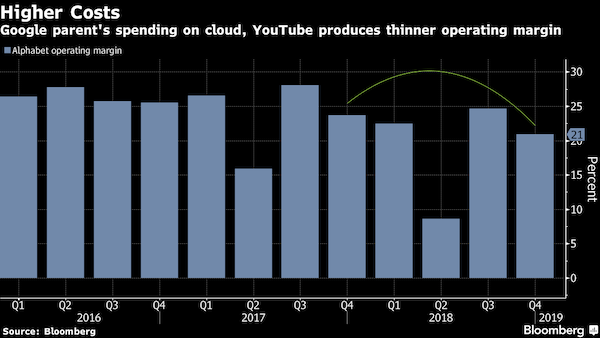

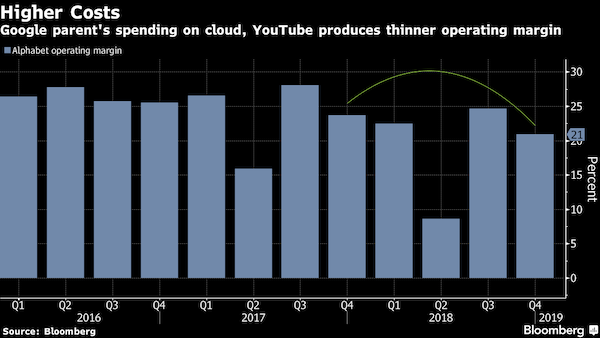

Alphabet reported a very strong set of numbers, but which weren't really cheered by Mr market. Mr market was concerned about the CapEx expenditure put towards enhancing technical infrastructure, Google's cloud business and YouTube, which in turn has compromised margins.

Revenues for the fourth-quarter beat analysts expectations, less all the fees paid to partners, came in at $31.8 billion up 23% from last year. About 83% of the revenue is still attributable to the Google advertising business.

Capital expenditure for the quarter came in at $6.85 billion, up 64% from last year.

The higher spending led to margin contraction from 24% to 21%.

The spending was on boosting cloud computing staff to service the new data centres, promoting consumer devices, buying new office buildings in New York City and Silicon Valley, as well as making YouTube subscription packages more competitive.

Sundar Pichai, CEO of Google said that

"Google's cloud computing division doubled the number of $1 million deals it made. Google clouds' G suite productivity product now has over five million customers."

Google is obviously playing catch up with AWS and Azure in the cloud space, currently a strong number three. Any form of investing in the business should be encouraged as it helps the company stay twelve steps ahead of the competition in things like search, ride-hailing, and services.

Ramp Capital (a financial Twitter account)

said that YouTube should stop

paying 10 year olds $25 million a year to do toy reviews. I am totally against that because YouTube is nothing without the creators and that's why YouTube red hasn't really gained any momentum. Kids like Ryan, Pewdiepie, and other creators make the platform!

The big takeaway from these numbers is that Alphabet is slowly realising its dream of diversifying profits streams and dropping the "one-trick pony" stereotype. We like what Alphabet is morphing into, and like all good things, the outcome will be worth the wait.

Patient investors get rewarded dearly, so

buy this one for the grandchildren!

Our 10c Worth

One thing, from Paul

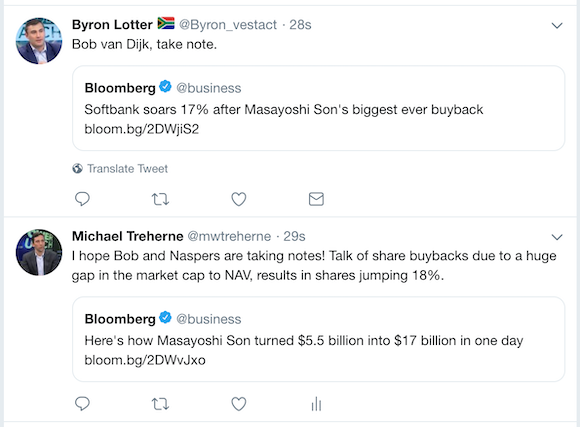

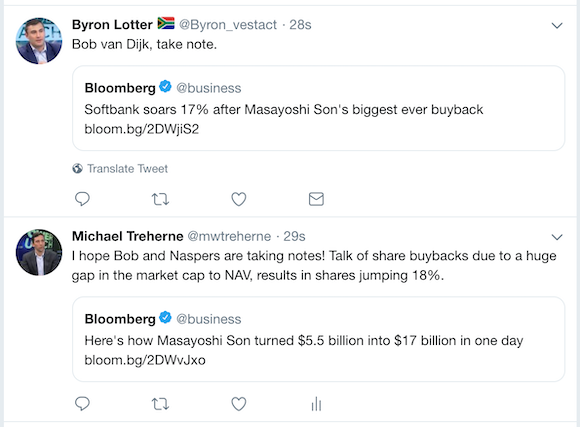

Share buybacks are good for current investors, especially if they are done at what turns out (with hindsight) to be good price levels. Companies which generate a lot of cash can either return it to shareholders by paying dividends or by entering the open market to buy back shares, then cancelling them. This reduces the number of shares in issue and increases profits per share in the next reporting period.

Apple is one such company. Its magnificent margins result in huge net cash build up. So,

I was most disappointed to read yesterday in a Goldman Sachs research note, that Apple did not repurchase any shares in December 2018. They bought back a whopping 31.3 million shares in October 2018, but chickened out to just 6.7 million in November 2018 as the price weakened.

Come on, that was a great time to buy shares, when they dipped down to $142 a share! Look at the chart below. Now they are back at $174. What a missed opportunity! As we like to say around the office, Harry Hindsight is the world's best trader.

Byron's Beats

The fight for cloud real estate amongst heavyweights, Amazon, Microsoft and Google is heating up. After seeing the latest results from these three companies, they are all thriving in this area. AWS, for example, had annual sales of $25.6 billion, up 47% from the previous year. Eventually, the market will become saturated so it is crucial to win over big customers now. Once you use a certain cloud service provider you become entrenched.

Business Insider reports on how Amazon is trying to attract the retailers by leveraging off Amazon's own retail experience. Check the article out

here. They are telling potential clients that they can service their platforms in a way that will make them as seamless as Amazon.com.

Those sales algorithms have billions of Amazon transactions to learn from. I am sure for a retailer, this is a very attractive offering.

Michael's Musings

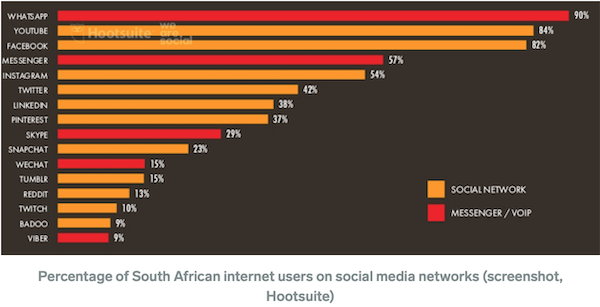

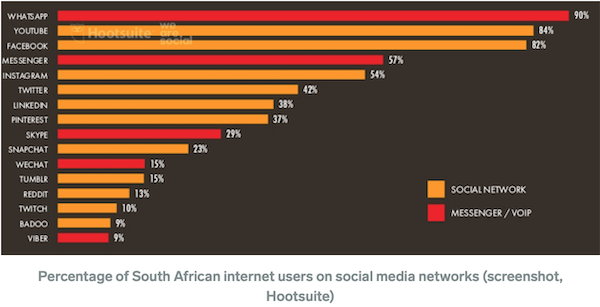

This Business Insider article, talking about the average time that people spend online, surprised me -

South African internet users spend much more time online than Americans and Europeans.

When you read the above headline, how much time do you think the average South African or average person globally spends on the internet per day? South Africans are at the high end of the scale, with 8 minutes 23 seconds. The global average is 6 minutes 42 seconds.

Think about how much potential there still is for internet based companies. If the average usage went up fivefold to 33 minutes, how much more advertising will that be for the likes of Alphabet? Before I have even eaten breakfast I have spent more than 6 minutes on the internet.

Another thing to keep in mind is that 2018 was the first year that more than half the globe had access to the internet. This article says the number is up to 54% now. Not only will current internet users use the internet more, but nearly half the planet still needs to come online.

Long internet companies!

Linkfest, Lap it Up

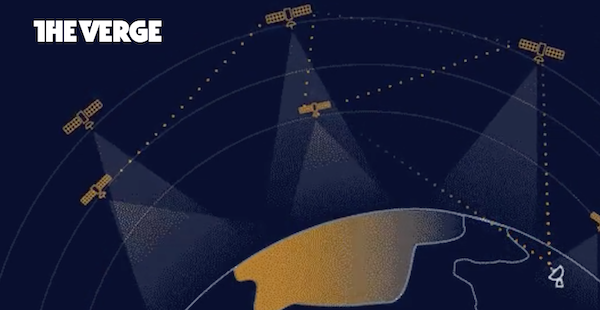

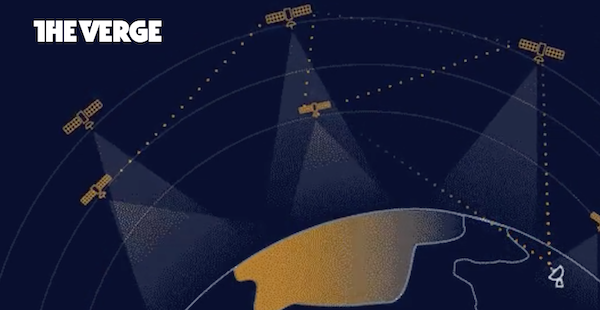

Here is another Alphabet non-core business that could start making money -

Alphabet's Loon sets sights on the starlight industry.

Umm, no thanks.

Umm, no thanks. Can you imagine having darkness for two months and then having only sunlight for a few months at the height of summer? -

After 2 Months, The Sun Rises In The Northernmost U.S. Town

Vestact Out and About

Vestact Out and About

Great minds!

Signing off

Signing off

The JSE is mixed this morning, with the All-Share lower by 0.1%. Later today the Bank of England gives their interest rate decision, where it is expected to keep rates on hold. Then this afternoon we have the weekly jobs data from the US. Of course tonight is the SONA, which as a tax payer I'm glad to hear will be costing us less this year than last year.

Sent to you by Team Vestact.