Market Scorecard

Even with very little economic news out and 'disappointing' numbers from Alphabet, global markets still managed to post a strong day out. Don't under estimate the power of strong economic data coming through, the hope of a trade truce and knowing that the Fed won't be raising rates anytime soon.

Lower rates for longer has a significant knock-on impact on asset prices. The anchor to all asset prices is the number you use when discounting the future to arrive at a present day value for potential profits. The lower the interest rate, the lower the discount factor and the higher asset prices. Adding strength to this cycle is that lower interest rates typically result in higher growth rates, which means higher future profits.

Yesterday the

JSE All-share closed up 1.53%, the

S&P 500 closed up 0.47%, and the

Nasdaq closed up 0.74%.

Our 10c Worth

One thing, from Paul

My colleague Bright covered

Facebook's recent results yesterday, but I am keen to re-emphasise just how

strong the company's growth metrics look. You know, because to read the market headlines these days, you might think that they were a failing company?

Facebook beat estimates on revenue, earnings and user growth and said its

making far more money per user than everyone expected, and much more than it ever has before. Facebook users and advertisers are largely unfazed by the corporate drama. The pundits may care about personal privacy, but nobody else does, it seems.

Facebook has 2.7 billion monthly active users across all of its apps,

two billion of whom are active every single day. That's a very serious chunk of the world's whole population! In particular, the Asia-Pacific region is booming, but they added more daily active users and monthly actives users across every region in the world.

Currently, 66% of Facebook core app users also are daily active users.

WhatsApp is everywhere.

There are 500 million daily active users on Instagram Stories.

Facebook has improved its ability to monetize users, and average revenue per user was up much more than expected, by 20% year over year. There are

seven million total advertisers across their platforms and they clearly like what they see, because they are increasing their spending.

I've been getting a few calls recently from investors worried that they should be getting out of Facebook?

I'd say you should be getting in.

Byron's Beats

I read a report yesterday that suggested that Google was responsible for at least 23% of Apple's services revenue. How you may ask, Google and Apple are huge rivals in the mobile space?

As Apple mentioned in their results, they now have 900 million active iPhones and 1.4bn active devices. That has a lot of value. Google pay Apple billions of Dollars every year to make Google search the default on these devices. You see, Google already steers android users to their search. But Apple clients could be swayed to other engines (not that they would want to). This is how Google can lock in an extra billion clients.

As eyes have shifted away from desktops and on to mobile screens, it has been crucial for internet businesses to adapt. Google's free Android service sounds like a charity but in truth it keeps the mobile eyes on their product and that is all they care about.

Don't feel too bad for Google and their relationship with Apple. Apple outsource a lot of their cloud services to Google,

so the money flows both ways.

Michael's Musings

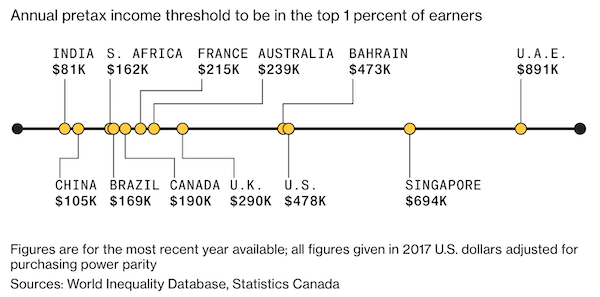

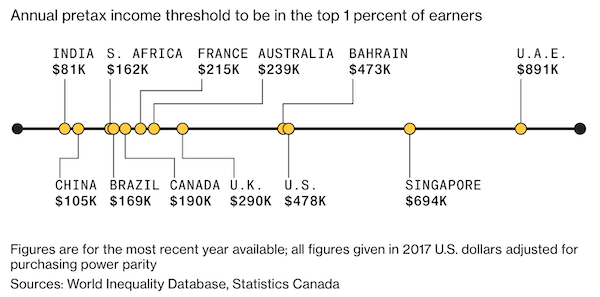

Bloomberg had this interesting article doing the rounds yesterday,

This Is What It Takes to Be in the 1% Around the World.

In South Africa you don't have to earn tens of millions to be in the top 1%, if you earn around R2.2 million a year, you are better off than the 99 other people around you.

The article goes on to show what the tax rate is for the top income brackets.

Which country do you think gets the best bang for their buck when it comes to the taxes paid for what you get in return?

I did a bit of reading around the top 1% in 2017, as you can imagine we don't truly know what everyone's wealth is, so each study finds different figures. The biggest difference comes when you measure wealth by income or wealth by NAV.

Some people have big trust funds and don't need to work. Someone like that is in the top 1% when it comes to NAV but not in terms of income. Others are very high earners, but have very expensive lifestyles, meaning they never build any NAV.

From memory, if you have a NAV of around $1 million, you are in the top 1% globally. I think South Africans needed an NAV of about $800 000 to be in the top 1% locally and you need around $4 million to be the top 1% in the US.

These numbers are probably lower than most people expect.

Bright's Banter

The workplace team collaboration messaging App Slack is coming to markets near you. Slack confidentially filed for listing yesterday, with a target valuation of around $10 billion at IPO. The most recent round of funding showed that

Slack was valued at $7 billion.

This year is going to be wild for tech IPOs from Uber, Lyft, Airbnb and now Slack. This is good for investors as the universe of listed companies will increase, creating more options for long-term investors. To channel my inner Howard Marks; our job is to avoid the losers and the winners will take care of themselves.

Slack is said to explore a direct listing, the same form of listing that Spotify elected for their IPO back in April 2018. However, this years' IPOs are all at risk due to political instability in the US. When the government shut down, the SEC was not open for business which meant a big delay in new IPO filings.

Linkfest, Lap it Up

Linkfest, Lap it Up

This blogger makes the point that you can control your expenses, but can not control your income. It is the same with investing, you can control the amount you save but cannot control your returns. Focus on what you can control -

Success Is Driven From Behaviors

"Anyone living below their means likely has a very high savings rate but also can think more in terms of accumulating a multiple of expenses not a multiple of income."

What could go wrong when you combine gene-editing and Bitcoin? -

The DIY designer baby project funded with Bitcoin

Vestact Out and About

Vestact Out and About

Bright was on Business Day TV yesterday, talking about Massmart and Aspen, amongst others -

Stock Watch - 05 Feb 2019.

Signing off

Signing off

Trump's state of the union address didn't impact markets or the dollar much. Views from the left and right vary on how well it went. For us, all that matters is what the market thinks of the speech. There is a South African Business Confidence number out at 11:30 and then this afternoon a US GDP read for the last quarter in 2018. The JSE All-Share is higher this morning.

Sent to you by Team Vestact.