Market Scorecard

The US economy can raise its bat for getting a century. On 'Jobs Day Friday' the country reported a record-breaking 100 consecutive month of jobs growth. The previous record for the US economy was only 48 months and ended in June 1990. The economic engine didn't just splutter over the century mark, it flew through by adding 304 000 jobs where only 164 000 jobs additions were expected.

This record run from the globes largest economy highlights why we should not base our future investments on the

'every seven years there is a recession' theory. I agree that recessions are part of the cycle of economic growth, but it is near impossible to forecast the dips. We could have had a 'double-dip recession' like was called for in 2009, we could have had one in 2016 marking seven years since the Great Recession, or maybe the global economy continues to grow and we only see another recession in 2028. This is why the Wall Street bank CEO's are saying that

we shouldn't talk ourselves into another recession. If we think a recession is going to happen, then we slow our spending, which then slows growth.

Two very good reasons why the stock market should be much higher in the coming decade is because the

global population is growing, and the global middle class is growing quicker than population growth. More consumers, means more profits which translates into higher business values.

On Friday the

JSE All-share closed down 0.42%, the

S&P 500 closed up 0.09%, and the

Nasdaq closed down 0.25%.

Company Corner

One thing, from Paul

When a

company reports its results, we immediately look at four key pieces of information. Firstly, its

reported profits in Dollars or Rands per share, relative to market expectations. Secondly,

sales revenues relative to consensus. These two tell you right away whether we are dealing with a 'beat' or a 'miss'. Thirdly, we look at the tone of the

management guidance for the year ahead. Is the outlook good, or are they guiding us lower? Finally, and

most importantly of all - what is the share price reaction.

The fact that the market reaction is the most telling of all reveals an important truth: the market sets the price of shares and that's what counts in the end. As they say,

talk is cheap but money pays the bills.

When

Amazon reports its earnings, they can be hard to judge. The massive online retailer is one of the world's most valuable companies. It has done tremendously well as a listed company. However, it has not been profitable for much of that time, as a result of a conscious management decision by CEO and founder Jeff Bezos, to favour revenue grown over profitability.

Late last week Amazon reported

fourth quarter profitability just above consensus forecasts, driven by strong sales at cloud-hosting Amazon Web Services (AWS), advertising, and operational efficiencies, but offset by rising marketing expenses, mostly from sales hiring. Notably, capital expenditure and investment in infrastructure re-accelerated to +19% year-on-year.

Amazon reported fourth-quarter revenue of $72.4 billion. Excluding its Whole Foods physical stores, that represents a slight cooling to (just) 23% growth year-on-year. Growth in the international business accelerated, especially in India.

AWS contributed $7.4 billion in revenue in Q4, growing 46% compared to last year, even as profit margins in the division expanded. That's just amazing. Did I mention yet that Vestact is an AWS customer? Yes, we are. There, I did it again.

Guidance for the first quarter of 2019 was for revenue growth on an FX-neutral basis of about +20% and operating income of $2.3 to $3.3 billion compared to consensus of $3.0 billion. Amazon's guidance is pretty useless.

Over the last eight quarters Amazon has exceeded the high-end of its operating income guidance seven times.

In reaction to all of the above,

the stock price of Amazon slipped by 5.4% in Wall Street trading on Friday. While that sounds bad, remember that it had a strong month, rebounding from the selloff in the last part of 2018. It's trading now at around $1,626 per share. The all-time high is $2,050 per share, which it reached last September when the whole market was flying high.

We

hold Amazon because we believe that online retailing is still in its infancy, and they are the global leader. Its digital hosting and subscription business has plenty of space to grow. Now is a good time to be accumulating Amazon shares.

Byron's Beats

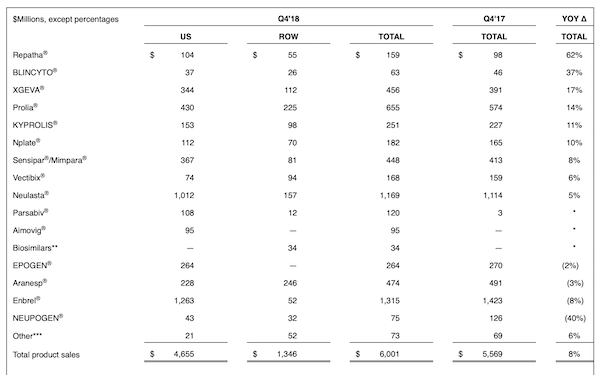

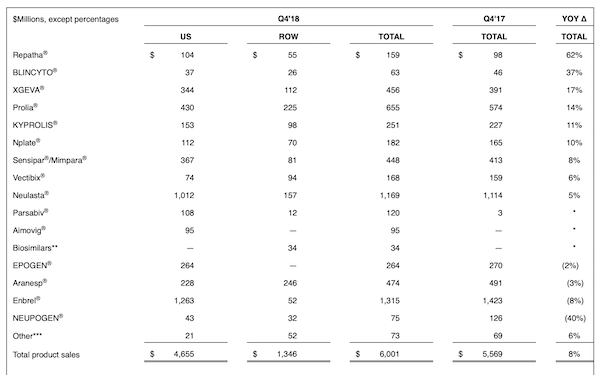

Last week our favoured biotech stock, Amgen, released results for the fourth quarter and full year 2018. As we have alluded to before, Amgen is going through a phase where a few of their blockbuster drugs are slowing down because of off-patent competition. At the same time they are pushing new exciting drugs into the market. That is not always as easy as it sounds, even if you assume the drug works really well. You still need to convince the doctors, insurers and hospitals to endorse the product.

Let's look at the numbers then we can delve into the products. For the full year, revenues increased 4% to $23.7bn. Because of the favourable tax rates, earnings per share increased by 14% to $14.40. Of that, $5.41 is paid out as a dividend, providing a very solid yield of 3%.

The share is currently trading at 11 times 2020 predicted earnings.

Take a look at the sales mix. This may look foreign to you but I'll do some explaining.

As you can see, Enbrel, a super drug that fights five chronic diseases, is slowing down in sales because of competition from another blockbuster called Humira, owned by AbbVie. This is the biggest gap that needs to be filled. Having said that, management expect sales to be stable in 2019.

Amgen have earmarked Repatha (heart disease) to become a big blockbuster. They are currently trying to convince the insurers to hop on board. Even though it works very well, it is expensive.

Aimovig is another drug with big aspirations. It is very good at fighting migraines. As you can see from the sales, it has just launched. This launch brought in double the expectations. Sales estimates for this drug in 2019 are $570mn.

I won't bore you too much more with the ins and outs of the pipeline but I hope you get the picture.

Amgen is a biotech ETF in its own right. It is very hard to tell which of these drugs will succeed and become blockbusters.

We love the sector and we have chosen the diverse Amgen portfolio to gain exposure.

They spent nearly $4bn on research and development last year. That is 16.5% of sales. Some drugs are slowing, others are growing. You are being paid a 3% yield while you patiently wait for the pipeline to reap the rewards.

We are very happy with Amgen as a core holding in our portfolios.

Our 10c Worth

Michael's Musings

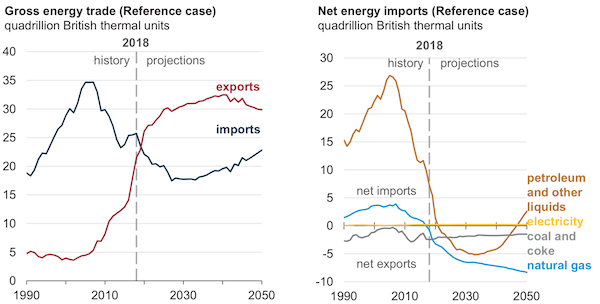

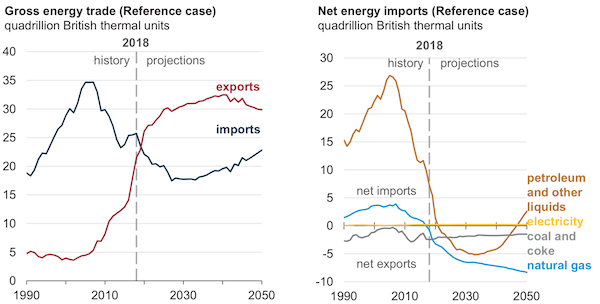

Last week the US Energy Information Administration (eia) realised their forecasts for US energy over the coming decades. Here is the report -

Annual Energy Outlook 2019

Probably the most significant forecast is that the US will be a net energy exporter by 2020.

This is a shift for global energy markets, particularly the oil market.

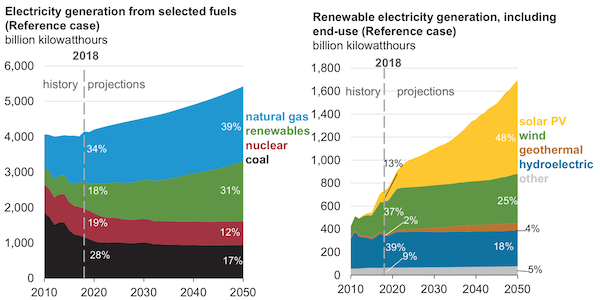

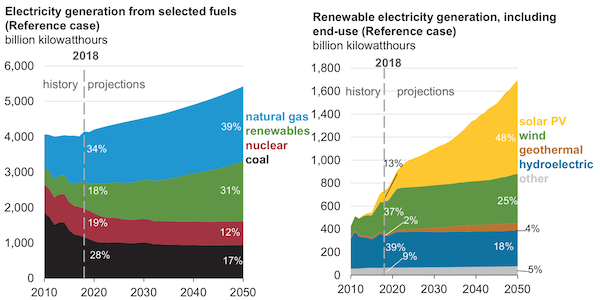

Another forecast that caught my eye is the forecasted breakdown of how energy will be generated in the coming decades.

The big push toward solar is clearly visible, and will probably be more prominent if there is a breakthrough in battery technology. I was very interested to see the significant increase in the forecast of geothermal energy. When last did you hear someone talk of geothermal generation?

Bright's Banter

The next generation of Apple iPhones will feature laser-powered 3D cameras that can map everything around you; their answer to augmented reality. The company is reported to be testing a triple camera system for 2019 phones and something even bigger for the 2020 versions.

The introduction of a laser scanner makes sense as it

will improve a variety of features such as the FaceID, picture quality, augmented reality gaming and imaging. The good news is that Apple will finally introduce the universal and fast charging USB-C, something I've written about before.

In the interim, the clearance page on

Apple's website has been actively restocking the iPhone SE - - the only iPhone you can buy for less than $300, and consequently the only iPhone that seems to sell out without fail.

Below is Apple's revenue breakdown by product category.

You will find more infographics at

Statista

Linkfest, Lap it Up

What do you do when you have a massive desert, loads of sunlight and a pile of cash? Build a monster solar farm and record breaking battery storage -

The world's largest "virtual battery plant" is now operating in the Arabian desert

Even having the largest oil reserves

Even having the largest oil reserves has not translated into prosperity for the people of Venezuela.

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

Alphabet reports their numbers this evening but after that US earnings are mostly done. Now we head into the local reporting season. This week is the much anticipated six month numbers from Aspen. Will these results shift the negative sentiment currently hanging over the stock? Then on Thursday is the State of the Nation Address (SONA). Will there be any policy changes so close to the election? Asian markets are largely closed or are closing early for the Chinese New Year. Google tells me it is the year of the pig. The JSE All-share is higher this morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista