Market Scorecard

Global markets were pleased to hear Fed chairman, Jerome Powell, say last night that 'the Fed can be patient' when it comes to raising interest rates. The immediate impact on markets is for equities to move higher and for the US Dollar to weaken.

Talking of central banks, our MPC meets next week to decide what will happen to interest rates in South Africa. You will remember that at the last meeting it was decided to increase interest rates in anticipation of hikes in the developed world, particularly from the US Fed. The comments from Powell last night, highlights that our SARB was probably a bit premature in raising rates. The silver lining though is that we probably won't see another rate hike locally for the foreseeable future.

Yesterday the

JSE All-share closed up 0.09%, the

S&P 500 closed up 0.45%, and the

Nasdaq closed up 0.42%.

Our 10c Worth

One thing, from Paul

An interesting

new research paper suggests that professional investors typically underperform their benchmarks because they buy stocks well, but sell them very badly.

The team of economists and decision scientists lead by Klakow Akepanidtaworn from the University of Chicago Booth School of Business, studied a

group of institutional investors with portfolios averaging $573 million and found that they exhibit costly, systematic biases. The key line in the abstract: "while investors display clear skill in buying, their selling decisions underperform substantially - even relative to strategies involving no skill such as randomly selling existing positions".

In other words, they usually devote weeks of painstaking research into to what to buy, carefully checking fundamental indicators. They read analyst reports and might even talk to company management. They also try to ignore past share price performance, in the hunt for bargains.

However, when raising cash from portfolios, or trying to look like they are doing something useful, or making space for a new holding,

they tend to victimise stocks which have done very well or very poorly. They use shallow, technical reasons like "trimming winners", "cutting dead wood" or "kicking out losers". These academics found that the fund managers would have done better by selling stocks at random, or not at all.

Another problem is selling directly after companies report their quarterly results. The researchers found that

even these well paid hotshots made hasty decisions on scant information. As they say – act in haste and repent at leisure.

The implication here is clear.

Accumulate quality. Never panic. Avoid stock sales. Ignore the noise. Be patient. Over time, we (you) will do better than the herd.

Link to the paper abstract on SSRN:

Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors

Byron's Beats

Here is a little fun for you on a Friday. As Michael mentioned yesterday, many investors think it is smart to sell after a good bull run and then buy the dip. But when will the dip end? How big will the dip be? Is this really the dip you were looking for? Maybe another one will come later? Maybe it doesn't and the market surges 20% in a year. Maybe you bought the dip and then it crashes further but then recovers again after you panicked. There are so many "what ifs" that you cannot simplify it.

Eddy Elfenbein added this link to his weekly Friday piece.

It is a market timing game . See how well you can do. Sometimes the biggest curse is that you get lucky and succeed the first time. That makes you think you are an expert and then you "lose" everything the next time you play. I have read enough trading books to realise that it is much harder than it looks. . Like golf, any one can play, but only a select few can make a living out of it.

Michael's Musings

I have mixed feelings about this new initiative from Amazon,

Amazon will use AI to deliver free samples of products it knows you want.

On one hand,

I like the idea of getting free stuff that Amazon's algorithms think I will like. On the other hand, it is slightly creepy to think about how much data Amazon has on me.

From Amazon's perspective this is a brilliant move. They will

open up a new revenue stream through selling this service to large consumer brands. Currently, it is easy to delete an advertising email without reading it. To throw away a free product on the other hand, at the very least you have to handle it.

My biggest worry though is getting too many free samples. In the early days of e-tail, you would get a handful of promotional emails, which were interesting to read. Now I get too many and just delete all of them.

Bright's Banter

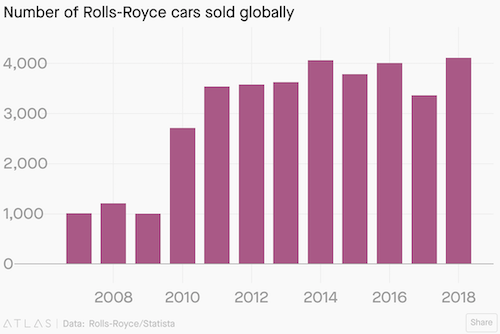

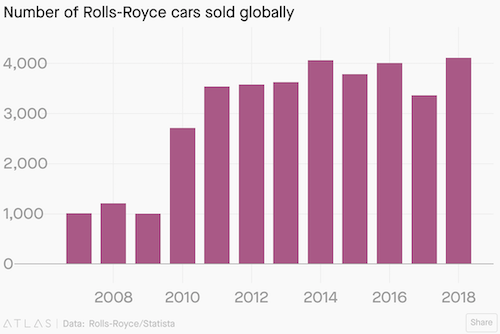

Trump's tax cuts have resulted in record sale for Rolls-Royce. The luxury car-manufacturer had a fantastic 2018. The company reported that it sold 4 107 cars - up 22% from the year before- their best year in their 115-years of existence. I never thought I'd say this but thank you Trump!

CEO Torsten Muller-Otvos, in an interview, told financial times that

"The tax reform helped a lot to fuel our business," referring to the tax cuts introduced by President Trump in 2017, which have benefitted companies and investors.

You can read the Financial Times article

here for more.

Linkfest, Lap it Up

This is a type of tourism that South Africa can target -

Burned-out billionaires are hunting with Bushmen and diving with sharks in SA on extended multimillion-dollar 'sabbaticals'

Electric vehicles are still a drop in the ocean of total car sales.

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

Our market is off to a green start this Friday morning. There are a number of key data releases today, the first is a GDP figure from the UK and then this afternoon there is US CPI. Next week, things kick into high gear when US companies start reporting their quarterly results. Good luck to the Proteas this weekend, things are going to be festive at the Wanderers!

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista