Market Scorecard

I was thinking this morning about a time earlier this year where it got boring writing about new record highs each day. We are now at the other end of the spectrum, where most days are down days. Our local market is down around 13% this year, but it could be worse, Chinese stocks are down 30% year to date; excuse me for being like a politician and deflecting.

In response to my comment in yesterdays message about maybe moving away from weekly statements and to quarterly statements, one of our clients told us not to touch his weekly mini-statement because it is these tough times, that make the green times sweeter. I suppose we enjoy spring and summer more because winter is unpleasant?

Yesterday the

JSE All-share closed down 0.49%, the

S&P 500 closed down 1.44%, and the

Nasdaq closed down 2.06%.

Company Corner

Bright's Banter

Medical devices, pharmaceutical, and consumer goods giant Johnson & Johnson (J&J), reported expectation beating third-quarter numbers, thanks to good sales in the turnaround of the baby care business and cancer drugs. The company rebranded and

relaunched its baby business after losing market share to the likes of Jessica Alba's

The Honest Company.

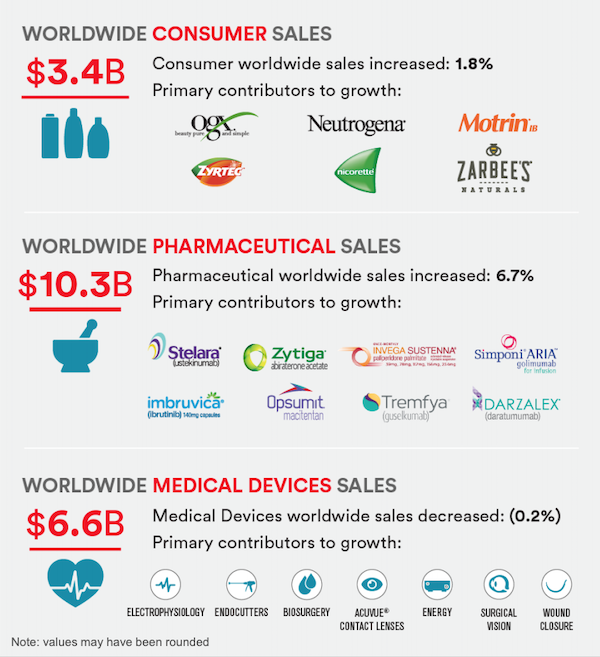

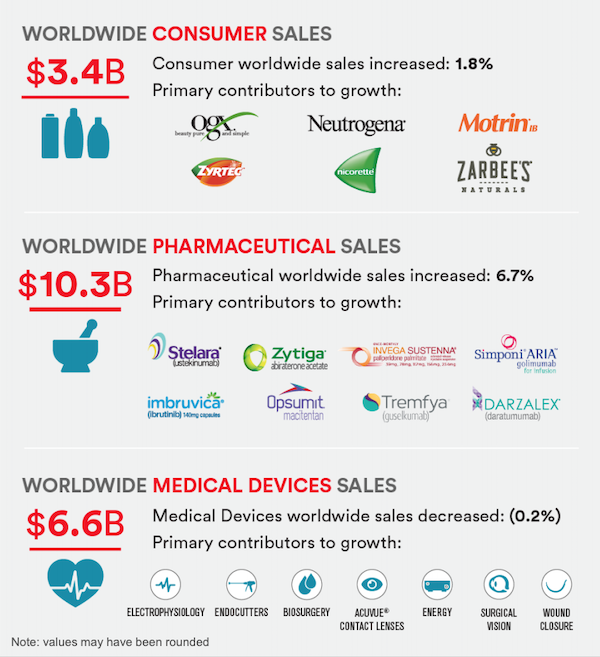

J&J reported third-quarter worldwide sales of $20.35 billion up 3.6%, but if you exclude all new acquisitions/divestures on an operational basis, the sales were up 6.1%, beating analysts expectation of $20.05 billion surveyed by Refinitiv. The segmental sales split is as follows:

Both the Pharmaceuticals and the Consumer businesses beat expectations

Both the Pharmaceuticals and the Consumer businesses beat expectations thanks to accelerating sales momentum. However, the Medical devices business missed expectation by a small margin.

In the Pharmaceuticals business, the biggest division by sales, the shining stars were immunology drug Stelara, which helps in aiding plaque psoriasis, and oncology (cancer) drug Darzalex, bringing over $1.8 billion in sales. A month ago, J&J

signed an agreement with Arrowhead Pharmaceuticals to develop gene-silencing Hepatitis B treatment in a deal that's worth over $3.7 billion. J&J will also take a minority stake in Arrowhead Pharma.

"Pharmaceuticals, I just can't say enough about that division for us… it continues to generate new products in a profound way that's transformational to the current state of care, and that's led the growth of our company for many quarters now" said J&Js CFO Joe Wolk on CNBC.

J&J sold its diabetes business LifeScan to Platinum Equity for $2.1 billion which shows that management is constantly reviewing its portfolio of assets to optimise shareholder returns. The baby care brand went through a thorough revamp by reformulating its products and getting rid of half its ingredients. J&J is removing all the junky ingredients such as sulphates, colourants/dyes and substituting it with superior, more natural ingredients like coconut oil. A hipster parents dream, I mean a woke millennial parents dream!

The medical devices business is seeing a lot of competition, and it's reflected on the operational growth or lack thereof. The Interventional solutions business saved the day with 18.1% sales growth driven by Atrial Fibrillation procedure (heart palpitations). Diabetes care and Orthopaedics are both stinking up the joint with sales contracting by 22.2% and 4.2% respectively. Overall the business avoided going backwards on sales.

Here at Vestact we subscribe to the

"buy 'em cheap, buy 'em strong, and hold 'em long" school of thought. J&J fits slap bang in the middle of "buy 'em strong" because it has proven itself to be a quality business over a very very long period of time, with dividends that have been increasing for over 50 years straight! We plan to hold this one long.

Our 10c Worth

One thing, from Paul

I like stories about big business trends, so I enjoyed the Bloomberg Businessweek coverage of the

e-commerce boom underway in India.

As they say, "reaching customers in India isn't easy, no country is more colourfully, anachronistically chaotic. Local roads are rutted with potholes and cluttered with motorcycles, auto rickshaws, and stray dogs. Making deliveries requires Mad Max-level driving skills."

Despite moves by the Indian government to encourage citizens to use credit and debit cards, four out of five Indians still earn wages in cash. The retail market is huge, of course because there are 1.34 billion people in that country.

Amazon's goal is to transform the way India buys and sells, and as usual with early-stage Jeff Bezos projects, is massively unprofitable. In one initiative, Amazon turned 14,000 local shipping offices into e-commerce training centres, called Easy Stores, where counsellors are available to escort buyers through the virtual mall. Orders are delivered to the stores a day or two later, and buyers can pay cash when they pick them up.

Walmart spent $16 billion in May this year to acquire Amazon's primary rival in India, the homegrown online retailer Flipkart. Our Naspers was a shareholder in Flipkart and benefitted from that sale.

Read the story here,

which also has great pictures.

Byron's Beats

As Michael has pointed out a few times,

central banks raise interest rates for two reasons. Either when they are in trouble or when they sit in a position of comfort. Morgan Housel's tweet the other day said it all.

I have spoken to a few potential clients who have said to me that because "interest rates are rising, the stock market will definitely come down". As the tweet above suggests, nobody really knows. Nobody even knows how long and to where interest rates will go. What the market does know is already priced in. Sometimes the obvious does happen, and that makes the layman feel smart, but more often than not, another moving part will steer the obvious off course.

Moral of the story. Ignore the noise, buy quality and hold.

Michael's Musings

When people think of the brilliance of Berkshire Hathaway, their mind jumps straight to Buffett. Very rarely the vice-chairman, Munger, gets a mention. I have personally learnt a great deal from Buffett's annual letters and interviews, but I personally prefer reading Munger's view on the world.

Munger did a speech at Harvard in the 80's where he spoke on how to be happy, in the inverse. His approach was, it is tough to pinpoint what being happy is, and it differs from person to person, but there are a couple of things that are guaranteed to make you miserable. So avoid the things that make you miserable, and you are one step closer to being happy.

There are seven things mentioned, the first three are:

Ingestion of chemicals to alter mood or perception; Envy; Resentment

Here is a copy of the speech, it is an entertaining read -

Charles T. Munger and The Prescription For a Life of Misery.

Linkfest, Lap it Up

Linkfest, Lap it Up

Gaming is gaining traction in RSA too -

BUSINESS INSIDER | TECH Some of SA's top gamers will battle it out in FIFA and Tekken in Soweto this weekend

At least not all prices are rising. Here is the comparatively shorter list of things that have got cheaper. It is worth noting that 'Packaged Holidays' was one of the highest gainers in 2017 -

11 things that have actually become cheaper in 2018

The Dutch are leading the way in building infrastructure

The Dutch are leading the way in building infrastructure to make electric cars more viable -

Netherlands Top For Electric Vehicle Charger Density

You will find more infographics at

Statista

Vestact Out and About

This week on Blunders: Nice crunchy Ouma biscuits in California; new job = Photo Retoucher; working on mega yachts of the super wealthy; and new Goldman Sachs CEO is DJ D-Sol -

Blunders: Episode 121

Signing off

Signing off

The JSE All-share is in the green. The Rand is weaker this morning, actually the Dollar is stronger after FOMC meeting minutes indicated interest rate hikes are still on the cards. Chinese GDP came in at 6.5% this morning, missing the 6.6% estimate from economists. South Africans would give up biltong for a growth rate half of that!

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista