Market Scorecard

With earnings season kicking off before the US market opened on Friday, the major banks did not disappoint. They mostly beat analysts expectations, which provides positive momentum going into the rest of earnings season. For Vestact stocks, we have Johnson and Johnson reporting tomorrow, along with Netflix. Given how rapidly Netflix is growing, and how relevant the company is to most of us on a daily basis, it is always interesting to read how things are progressing for them.

Over the weekend, political events have put a damper on the market rebound. Brexit talks fell apart again, Trump threatened further tariffs on China, the IMF and World Bank further warned about global growth and things are heating up between Saudi Arabia and the rest of the world around the disappearance of a journalist. As I look at it, Asian markets are down over 1% this morning.

On Friday the

JSE All-share closed up 2.38%, the

S&P 500 closed up 1.42%, and the

Nasdaq closed up 2.29%.

Company Corner

Bright's Banter

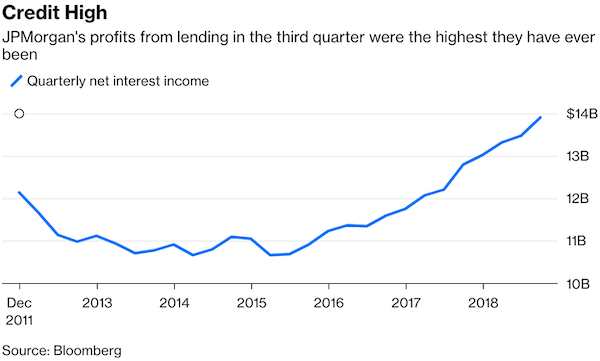

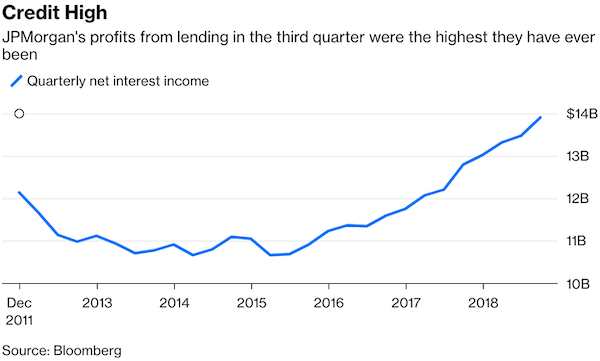

New York-based bank JPMorgan Chase & Co. reported its third-quarter numbers, the first Vestact company to report their earnings in this earnings cycle.

The numbers were much better than expected, with profits rising by 24% from a year ago, thanks to lower taxes and rising interest rates which enabled the company to charge more for loans. Quarterly revenues came in at $27.82 billion, up from $26.45 billion a year ago.

The bank's earnings for the third-quarter were $8.38 billion, which was higher than the $6.73 billion from the same quarter last year. Earnings per share came in at $2.34 up 33% from a year ago, which also beat analysts expectations of $2.26 per share, according to FactSet.

The thriving U.S. economy helped considerably, as the company saw fewer loans going bad in the period. They have now lowered their credit loss provision by 35%.

The bank reported a 6 percent increase in its core loan portfolio and a 12% increase in credit sales volume. The bank's net interest income - revenues from customers' loan payments minus what the bank pays to depositors - increased by 9% from a year ago. Interest income for the bank has grown to $13.9 billion for the three months, paving the way for the best interest income year ever in the bank's history.

"The U.S. and the global economy continue to show strength, despite increasing economic and geopolitical uncertainties, which at some point in the future may have negative effects on the economy,"

"The U.S. and the global economy continue to show strength, despite increasing economic and geopolitical uncertainties, which at some point in the future may have negative effects on the economy," Jamie Dimon, JPMorgan's CEO and Chair, said in a statement.

Investors are worried because of rising interest rates (which is good for the bank but up to a point) and the potentially weakening corporate earnings which led to the recent market selloff. We can see that this has not been the case so far with JPMorgan as they've continued to post strong earnings to justify their current valuation. We like JPMorgan as it is a more diversified bank when compared to its rivals; giving it more legs to stand on come tough times.

Byron's Beats

Famous Brands released a trading update this morning which prepped the market for their six months results which will be released on the 29th of October. As expected, GBK ruined the dinner party. Excluding a massive R874 million GBK impairment, the group expects earnings to increase between 3% and 14%. That is a pretty big range.

GBK itself has a loss of around GBP 2.6 million. What a disaster. On that note I came across this article in the The Times titled

Gourmet Burger Kitchen set for clash with landlords.

The article is short but it says a lot. I have plugged it here below.

Ailing restaurant chain Gourmet Burger Kitchen (GBK) is poised to press ahead with an insolvency process to close outlets and cut rents.

GBK, which is owned by South Africa's Famous Brands, had appointed restructuring advisers from Deloitte to thrash out deals with landlords.

It is understood that it is now close to launching a formal company voluntary arrangement (CVA) process, where landlords are required to agree to a rent reduction or face having the keys handed back on loss-making sites.

The property consultant CBRE is also advising.

GBK, which has more than 100 sites, has become the latest chain to fall victim to a crunch in casual dining that has already wiped out hundreds of restaurants and thousands of jobs.

The share price has held steady around R100 for a while now. Probably because the rest of the business is still in good nick.

Our 10c Worth

One thing, from Paul

A

Chinese crackdown on the daigou trade poses a threat to luxury goods companies.

Daigou is a Chinese phrase that means "buying on behalf of", so daigou trade is when tourists, friends and relatives buy high-value products overseas and bring them or send them back into the country to avoid China's hefty sales and import taxes.

We have already seen shares of companies like LVMH, Kering, Richemont and Luxottica slip in recent weeks, although it's been a noisy, softer market in general.

China now accounts for about a third of luxury sales, and contributed about three-quarters of spending growth in the sector in the eight years up to 2016.

Of course, the backdrop here is the ongoing trade war between the US and China, which Donald Trump has made a cornerstone of his "America First" economic nationalism agenda. For better or worse, he is obsessed with trade balances in manufactured goods. The Chinese are probably thinking that if more luxury goods were purchased in Yuan, their trade surplus will be narrowed.

This article by David Fickling on Bloomberg, is sceptical that the Chinese authorities will succeed in slowing the daigou trade anyway, but we will have to wait and see.

Read more here.

Michael's Musings

The Fed and rising interest rates has been the second most talked about thing this year. Right behind Trump and all that comes with his presidency. For many, these rising interest rates makes them nervous. It means higher home loan payments and stock market volatility.

As this article points out though (

Interest Rates Are Rising for All the Right Reasons), rates are rising from a position of strength instead of a position of weakness. Well, the Fed is, if the SARB raised rates now it would be from a position of weakness.

What does a position of strength mean? Well, US inflation is still relatively subdued, and is forecast to stay subdued for years to come. They also have an economy growing at 4% and full-employment.

Their economy can take these rate hikes in its stride, which is a good thing for stocks long-term.

Linkfest, Lap it Up

Sometimes, less is more. When it comes to choice, having too much choice can be paralysing and discomforting -

Why you find it hard to pick your lunch or a Netflix show, according to new research.

"the ideal number of options is probably somewhere between 8 and 15, depending on the reward, and your personality. And although we may feel freer and in control when we have lots to choose from, this actually ends up distressing us when it comes to making the decision."

Thanks to companies like SpaceX and Blue Origin, the private sector is starting to spend more on Space R&D. Showing that the private sector thinks there are more commercial opportunities now -

Private Investment in Space Blasts Off

You will find more infographics at

Statista

Vestact Out and About

Team Vestact gets a mention in this Reuters/Moneyweb article -

Rand buoyed by US inflation miss, stocks fall to 15-month low.

Signing off

Signing off

Unfortunately the very green Friday, has not translated into a green Monday. The JSE All-share is down on the open. A big data read out of the US today, is their retail sales number for September. With the US being a consumer driven economy, retail sales are a litmus test of how the rest of their economy is doing.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista