Market Scorecard

Yesterday was a nasty day for global stock markets, and today will probably be another ugly day. Part of the reason for the drop has been the steady rise in interest rates, where a higher interest rate means future company profits are worth less to investors today. The shift causes some turbulence for markets, which then leads to further market pressures. I have no doubt that we are at a point where there is some panic selling going on, fear is a powerful driver.

Trump reacted to the market turmoil yesterday by further criticising the Fed for raising rates, where he said

"I think the Fed has gone crazy", amongst other things. Politicians prefer low interest rates because it is normally coupled with higher growth rates and the voting electorate feel better because their debt costs less. Both those factors are positives for a politician to get re-elected.

As we say in the message below,

market drops are normal. Investing in stocks is not easy, you have to endure these types of corrections, the fear and panic that goes with them, to enjoy the long-term superior returns of equity investing. If it were easy, everyone would do it, and there would be no returns left. Head down, this to shall pass.

Yesterday the

JSE All-share closed down 2.54%, the

S&P 500 closed down 3.29%, and the

Nasdaq closed down 4.08%.

Our 10c Worth

One thing, from Paul

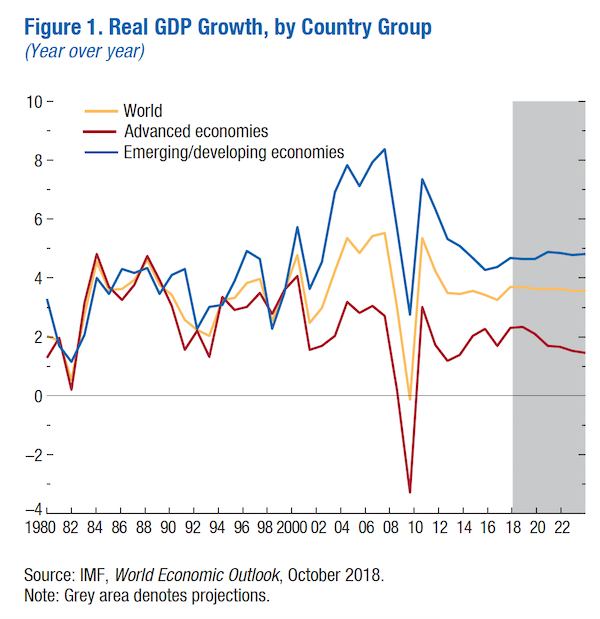

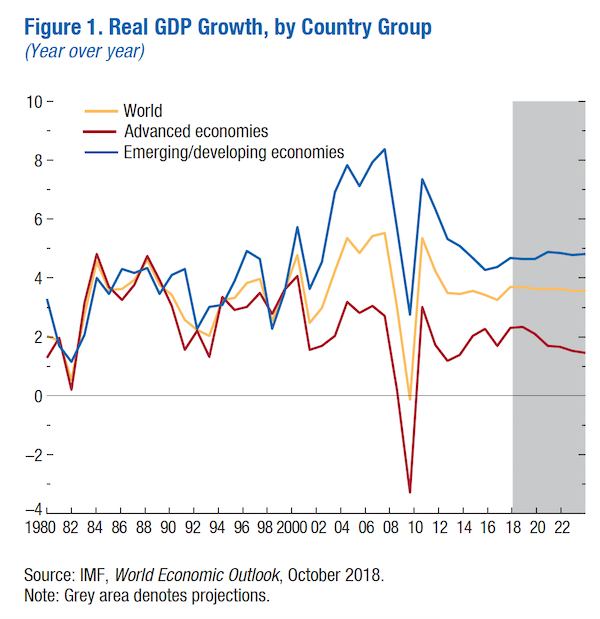

Another factor weighing on global markets in recent days was the IMF cutting its global economic outlook for the first time in more than two years. The econowonks in their forecasting department now expect that the world economy will grow by 3.7 percent this year and next, down from the 3.9 percent forecast in July.

The main reason cited was

rising trade tensions and weakening prospects in emerging markets from Brazil to Turkey. IMF Chief Economist Maury Obstfeld, who is American and was trained at UPenn, Cambridge and MIT, said growth was still relatively solid "but appears to have plateaued."

For the record, 3.7 percent is not bad, and reflects solid aggregate growth, notwithstanding all the political noise out there. In a growing economy,

we strongly prefer to invest in the shares of leading corporations, rather than government bonds or other asset classes.

Byron's Beats

I have always enjoyed following Bill Ackman's antics within the investment community. For a hedge fund billionaire, he is relatively young and likes to ruffle the feathers of some of the grumpy, old-school titans of the industry. I don't necessarily agree with all his investment decisions but none the less he is very smart and talented.

Earlier this week it was announced that he has taken a $900m stake in one of our recommended stocks, Starbucks. He feels the shares could double in the next three years. His thesis is very similar to ours in this regard. The stock market is underestimating the potential of China. In his 43 page report (which I will try to get my hands on) he says that Starbucks China will grow twice as fast as the rest of the business and this will make that part of the company very significant in years to come.

Remember, Ackman also did something similar when Nike was going through a slump and reaped the rewards. Having said that, he did sell the Nike stake a little early. His timeline is different from ours. Regardless, having someone smart and influential like that to invest alongside us, is good news.

Michael's Musings

During this week, I have seen many articles talking about the $200 billion wiped off of Tencent's value. Rubbing salt into the wound is that the company has fallen out of the list of the top 10 biggest companies in the world. These articles went mainstream which resulted in a number of queries from clients, should they be worried about Naspers?

Naspers was down 6.5% yesterday, even though Tencent was only down 2.5% on the day. Personally, I think panic selling from retail investors is the reason for the overreaction.

Since the Steinhoff saga last year, whenever a stock is down, we get asked 'Will this be another Steinhoff?'

The Steinhoff collapse is not a normal occurrence of events for the market. Normal companies don't operate on fraudulent activities. Fraud is the exception, not the norm.

Drops in share prices are normal. See this graph on the Tencent share price, see how many times a third of its value gets wiped out. There is no doubt that investing in Tencent was a good idea, and has given a great return. To get that return though, you had to weather those pullbacks.

Found at Tencent's $214 Billion Rout Is Breaking All Kinds of Records

Found at Tencent's $214 Billion Rout Is Breaking All Kinds of Records

This sell-off in Tencent and Naspers has momentum behind it; we can't tell you when the share price will stabilise and then recover.

A share price is not a company though, so in time the momentum will fade, and the real value of the business will shine through again.

Bright's Banter

Last night I was watching the legendary quant pioneer, Jim O'Shaughnessy of O'Shaughnessy Asset Management (OSAM), talk at

Talks @ Google about his book

"What Works On Wall Street".

The conversation was eye-opening for me as an investor because he went through all the traits you need to have to be a successful investor. I think this video will be very helpful, especially at present since markets are so volatile.

My favourite story from the video was of his friend Arthur, aka Art. Art invested with OSAM for himself and his kids. Art always bought and sold at the extremes. He bought high and sold low without fail because most of his investment decisions were based on emotions.

However, he never touched his kids' portfolios, and over a 7-10 year period his kids' portfolios outperformed his by a big margin because of the low churn rate and doing absolutely nothing during tough times. In a way, the kids were stomaching the tough times and enjoying the ride in a rising tide. In that ten year period, Art's kids were richer than him.

The lesson here is obviously not to panic during tough times and don't let our biases and emotions lead us astray. In the talk, there are many more real-life examples like the one above which I hope you will enjoy.

For those that prefer podcasts. Jim was first on Bloomberg Radio, Masters In Business, where he spoke to Barry Ritholtz about investor biases and how to not be your own worst enemy during tough times. Listen to the interview

here.

My all-time favourite interview of Jim is the one with his son Patrick O'Shaughnessy, on his podcast named after his dad's book "Invest With The Best". You can also listen to it

here.

Linkfest, Lap it Up

Singapore Airlines, now holds the record for the longest flight in the world. It is 19-hours long, and goes from Singapore to New York. What I found interesting was that it only has two seat classes, Business and Premium Economy. Imagine doing 19-hours in standard economy -

The World's Longest Flight Will Have No Economy Seats

Being young, it is in our nature to be optimistic about our futures -

Young People See Hope for Future.

You will find more infographics at

Statista

Vestact Out and About

Paul writes a monthly piece for Business Days' Wanted magazine. Here is a link to the latest piece, talking about the changes in the luxury goods market, and how well the industry is doing -

Gucci Doubles Revenue Under The Luxury Goods Group Kering

"I visited the Gucci store on Fifth Avenue in New York in December, and it was packed with tourists. Revenues last year shot up to EUR 6.2-billion, from EUR 3.9-billion three years ago."

Team Vestact gets a mention in this Reuters market update -

South Africa's rand weakens, stocks hit three-month low

Signing off

Signing off

As expected, the JSE All-share is deep in the red this morning. Tencent was down 7% in Hong Kong today, meaning Naspers opened down 4.7%. It is hard to believe that the stock is back at the R2 500 levels, from being over R4 000 a share in January. Data out today are August figures for RSA mining and manufacturing, and then in the US they release their CPI September figure. Despite the market sell-off, the Rand has held steady at around $/R 14.65.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista