Market Scorecard

At this time yesterday, we knew that the SA Finance Minister Nhlanhla Nene has offered his resignation, but we did not if that would be accepted by the President, and if so, who would replace him. Uncertainty makes markets jittery. Late yesterday the news came through that Nene was out and his replacement was Tito Mboweni. He brings credibility to the job and that seems to have had a calming effect on South African markets. I don't envy Mboweni though, he has a tough medium-term budget speech to deliver in two weeks' time, and he might end up only being a caretaker minister until after our national elections next year.

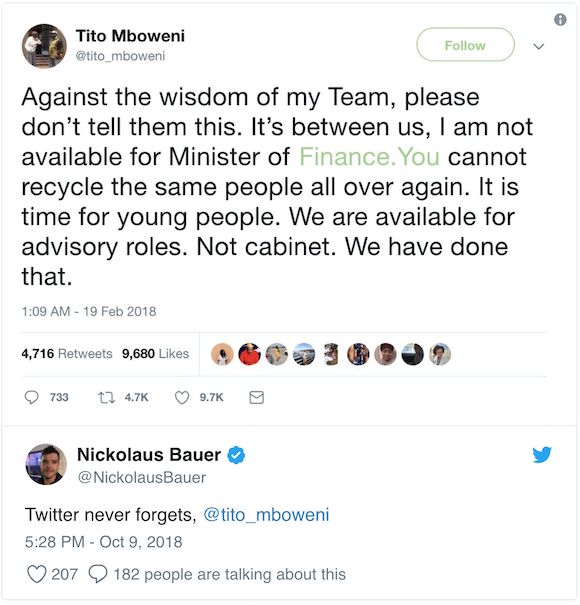

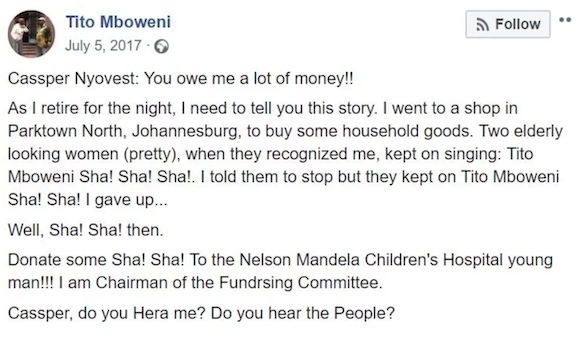

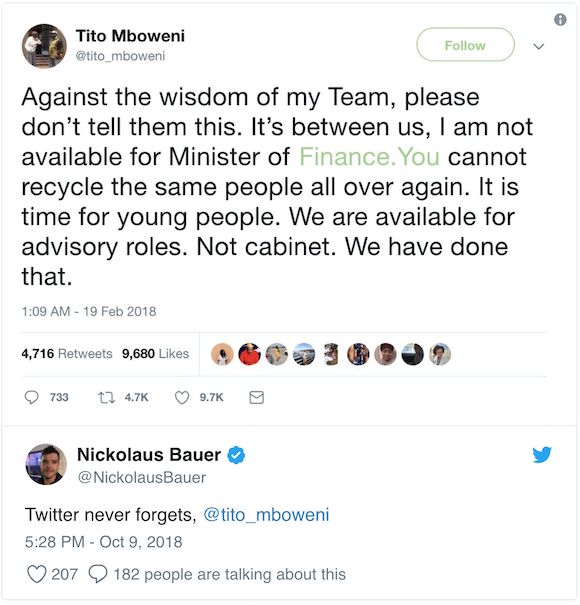

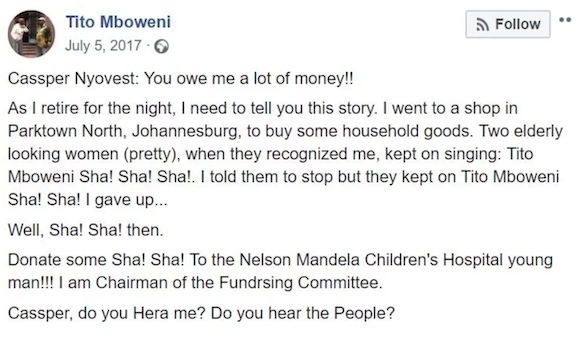

Tito Mboweni has been an active Twitter user, and today many of his old Tweets have made a re-appearance. Here are some of the more entertaining ones.

Someone commented on Twitter, "I know for sure some people were surprised to find out that Tito Mboweni is an actual person coz they have only known that as Cassper's hit song". That's a reference to popular rapper Cassper Nyovest, who recorded a song called Tito Mboweni. Here is a link to the song, give it a listen. The visuals are quite striking! -

Cassper Nyovest - Tito Mboweni (Official Music Video).

Yesterday the

JSE All-share closed down 0.06%, the

S&P 500 closed down 0.14%, and the

Nasdaq closed up 0.03%.

Our 10c Worth

One thing, from Paul

So,

President Cyril Ramaphosa accepted Finance Minister Nhlanhla Nene's resignation and appointed Tito Mboweni in his place.

The fact that Nene got booted is significant, because lying about his meetings with the Guptas seems to have disqualified him from a senior role in government. Also, his role in obtaining PIC funding support for his son's business ventures has raised questions. If this is to be the new standard, there are surely many other members of the cabinet who will be shaking in their boots? Those people's conduct in the Zuma era, and association with the Guptas was much more significant.

It should be noted that

history will probably remember Nhlanhla Nene fondly. He stood up to Jacob Zuma's insane wheeling and dealing, especially the daft idea of building a fleet of Russian nuclear power stations.

Ramaphosa will probably leave the significant restructuring of the cabinet and the purging of more rotten apples until after the 2019 election. At this point he needs to keep his team together to avoid distracting voters?

As for the new Finance Minister,

Mboweni is a steady pair of hands. The Rand rallied on the news. He was Governor of the Reserve Bank for a decade, and served in that post with distinction. He's an economist and understands the rules of global finance. He's not some jumped up politician in a snappy suit who is secretly a fan of Hugo Chavez (we have had one of those recently). Given that the South African government has already has run up huge debts in the last decade (relative to our stagnant GDP), and that Eskom is tottering, Mboweni will have his work cut out for him.

Michael's Musings

On Monday the

Nobel prize in economics was awarded to William Nordhaus and Paul Romer. Nordhaus was cited for his work on the implications of environmental factors, including climate change. Romer is noted for his work on the importance of technological change. To slow rising global temperatures, we will need technology to change the way we do things.

The announcement of the award came at the same time as the release of a

major new UN report which says that we need to reduce our carbon emissions drastically,

The Dire Warnings of the United Nations' Latest Climate-Change Report.

Then this morning I saw that a

Dutch court has instructed their government to cut greenhouse gasses by 25% before 2020 -

Dutch appeals court upholds landmark climate case ruling

Bright's Banter

Today I was listening to Prof. Scott Galloway's Podcast called

Pivot with Kara Swisher & Scott Galloway. I've written before that he's a professor at New York University's Stern School of Business, and author of

The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google (all companies we own).

Prof. Scotty is an investor, marketing consultant, author amongst other things. He's founded many companies including Red Envelope and Prophet. His most recent company is L2 Digital a business that tracks and ranks the top brands in the world according to their Digital Performance. Visit his

website for more info on that.

In the most recent episode,

Prof. Galloway calls Snap Inc a loser, and he says that they were sold last week and they just don't know it yet. And here's why:

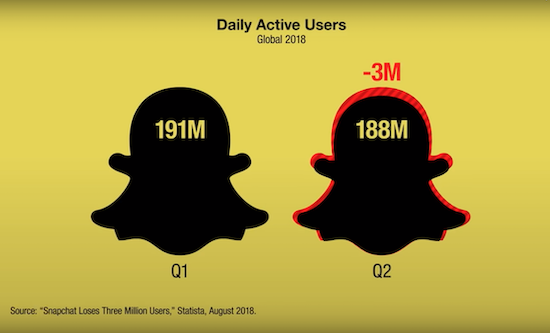

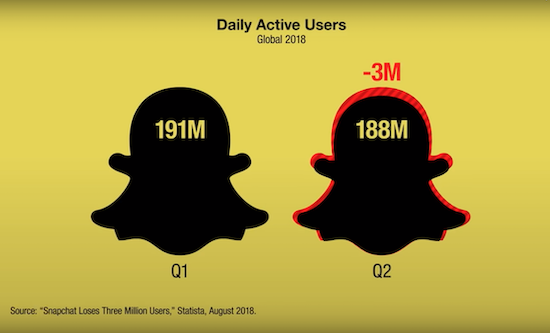

"Snap lost three million users globally in the second quarter of this year. Mind you, this is a company that is trading at 10 times revenues, is actually losing users. Why? I'm sure every millennial reading this already knows the answer. However, for the benefit of other generations and completeness sake; the reason is because everyone has decided they like a better version of SnapChat and that is Instagram Stories. Keeping up so far?

For the past two years Mark Zuckerberg has taken Evan Spiegel (co-founder & CEO of Snap Inc.) behind the gym and kicked the living daylight out of him every single day! What would happen if the four largest retailers in America i.e. Walmart, Home Depot, Kroger and CVS all got together every morning and said "how do we put number five, Target, out of business?". Target will go out of business, and that's exactly what is happening in the app economy where the four largest apps Facebook, Instagram, WhatsApp and Messenger meet every morning to put number five SnapChat out of business.

The Key question here is who will buy Snap Inc. and we predicted that it'll no longer be an independent firm buy the end of 2019. With market capitalisation of $11 billion, someone will need to show up with seven or eight billion dollars which makes the universe pretty narrow. Our bet is on Amazon, why, the company wants to get a cohort on board that buys a lot of stupid high margin junk i.e. specifically teenagers. In addition, the real reason why we think this might get done is because the new CFO of Snap Inc. is the former VP of Finance at Amazon, Tim Stone.

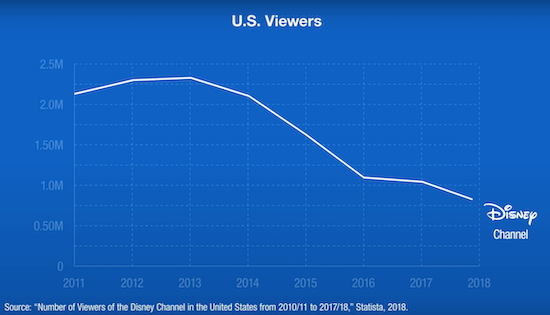

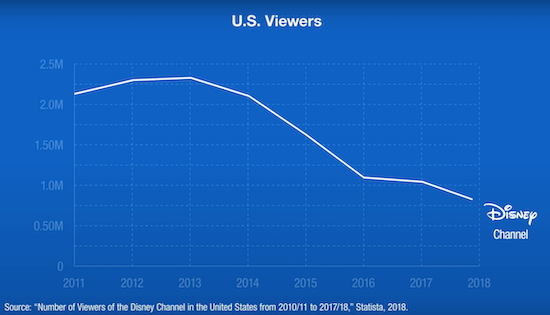

Mr. Stone can call Mr. Bezos on his cellphone at home and say this is where we are and this is the deal and short-circuit the entire awkward experience known as mergers and acquisition process. Our best bet is Amazon, but who else can it be? Disney. Disney has; One, the balance sheet. Two, they need to reinvigorate the brand among teens and three, Evan Spiegel gets to decide what is going on here.

This demonstrates the problem not only with monopolies who are putting a great company out of business. Who do we know won't buy Snap Inc.? Facebook. See above, Zuckerberg has been kicking the living daylights out of Evan Spiegel for the last 24 months. With Disney however, any young man can and will learn from CEO Bob Iger. So it's the mouse of the river. Take your pick, but Snap Inc. this is the end as we know it by 2019.

Linkfest, Lap it Up

After a rough week for Tesla, here is some positive news from the company -

Tesla says its Model 3 is safest of any car ever tested by NHTSA.

Sticking with Tesla

Sticking with Tesla, the below graph shows why Elon Musk has some very dark rings under his eyes. Ramping production up like this is no easy task -

Tesla's Vehicle Production Is Ramping Up

You will find more infographics at

Statista

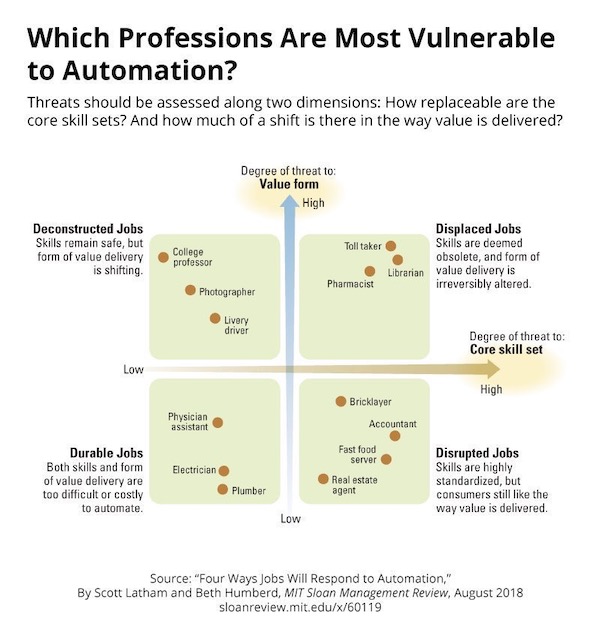

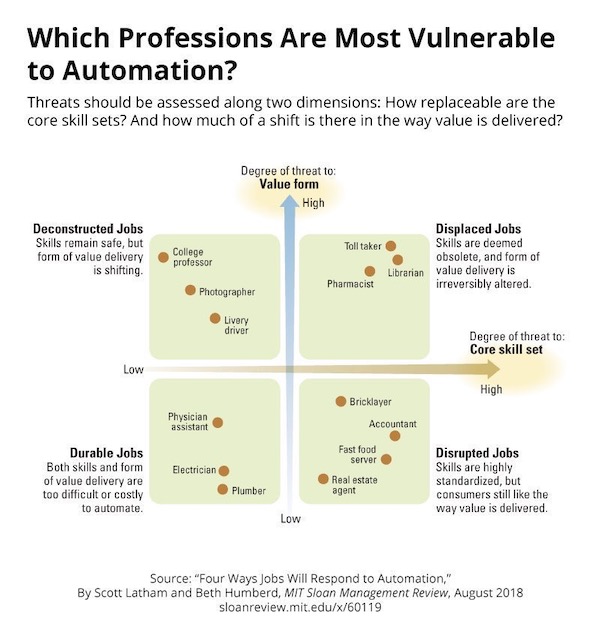

One of our daily readers sent us this interesting graph yesterday, about jobs at risk of disruption. Use it for career planning!

Vestact Out and About

Vestact Out and About

Signing off

Signing off

The JSE All-share index is in the red again this morning, thanks mostly to a further decline in Tencent which leads to further weakness in the Naspers. In addition, some of our dual-listed companies are in the red, because of the stronger Rand. In data releases later today we have a UK GDP reading and a read of South African business confidence. Later this week, all eyes will be focused on US as earnings season kicks off with results from the big banks. As you know, we are heavily invested in JP Morgan, which reports on Friday.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista