Market Scorecard

With the US markets back in positive territory for the year, it seems that the market changed gear into 'risk on'. Volatility is dropping, bond prices are down, commodity prices are higher and ultimately stock prices are higher.

Yesterday the

JSE All-share closed up 1.56%, the

Dow closed down 0.16%, the

S&P 500 closed up 0.83%, and the

Nasdaq closed up 0.19%.

Our 10c Worth

One thing, from Paul

These days, the Johannesburg Stock Exchange is located in Sandton, and market participants such as ourselves are spread all over the place. We connect electronically to the exchange servers to execute trades. There is no open outcry trading floor.

Here is an interesting article about early Johannesburg, which includes a paragraph about the

third Johannesburg Stock Exchange building. It was located on Hollard Street was designed by Leck and Emley and built between 1902 and 1904. It was a huge building filling the block on Hollard Street. It comprised 210 offices and an enormous trading hall with coffered ceiling and a visitors gallery. It had an imported steel framed structure. The building was demolished in the late 1950s to clear the site for the construction of the Fourth Johannesburg Stock Exchange which opened in 1961.

More on the new book that shows off these pictures:

The Heritage Portal

Michael's Musings

When Stats SA releases our CPI data, I always enjoy having a quick look at their table of what prices moved the most. I generally look for the numbers much higher and lower than the headline number reported. It gives you a good idea of many underlying trends. For example, thanks to technology and increased number of people using mobile networks, the cost of communication is lower by 1%.

Year on year inflation was up by 3.8%, the lowest since 2011. Low inflation is good news for consumers, particularly those who are struggling to make ends meet. Unfortunately, two costs above the average were healthcare up 5.1% and education up 6.7%. I think technology will go a long way to bringing down the cost of education.

Also based on the data, having a big steak and a glass of red wine is out.

Meat prices were up 10%, and alcohol was up 6.5%. Luckily on the downside, bread and cereals dropped by 4.8%, and Fruit dropped by 5.5%.

Remember that these are the average changes in prices over the whole country. Meaning the numbers reported by Stats SA, probably won't match those you have seen at your local supermarket. Here is a link to the report if you want to read the numbers for yourself -

Consumer Price Index - March 2018.

Bright's Banter

My learned colleague Byron wrote a great piece on Netflix, so I'm here just to echo his point on the international business.

The graph below shows the contribution to margins from Netflix's international business; which was virtually non-existent about 3/4 years ago.

You will find more infographics at

Statista

Company Corner

Byron's Beats

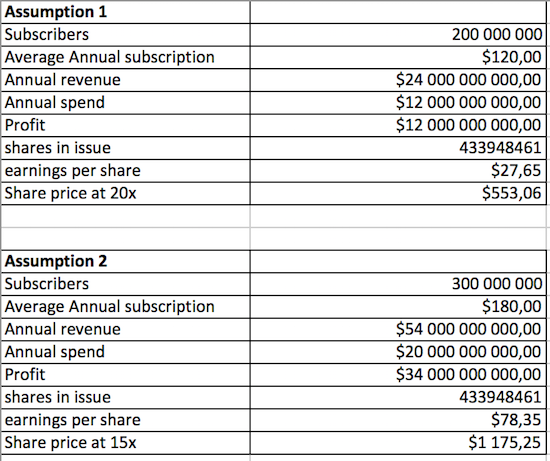

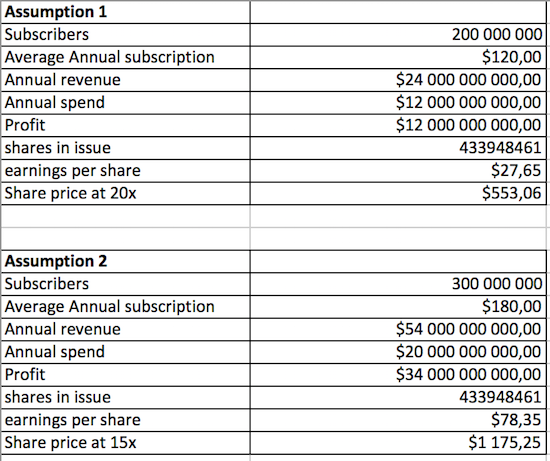

I did some number crunching on Netflix yesterday to try and understand why the share price has flown so fast. I wanted to see the potential profits this company can make.

I assumed 200 million subscribers. They currently have 125 million and growing fast so this number is not outrageous. I then assumed an average monthly subscription of $10 per month. This is higher than the current average of $8 but I feel the fee does have room to trend upwards.

That equates to revenues of $24bn (currently $11.2bn). I then assumed annual expenditure on content, advertising and operations of $12bn (currently $8bn). This resulted in the company making $12bn in profits which equates to $27.65 a share.

The share currently trades at $338. Assuming a PE of 20 (the market average) and you get to $553 a share.

I don't think these projected numbers are unrealistic in the near term at all. They are growing subscribers by 30% per annum.

When you play around with these numbers the potential profits are staggering. Assume 300 million subscribers are paying on average $15 per month. That equates to annual revenues of $54bn. Even if they bring their spend up to $20bn (their spend does not need to match their growth) and

the business will be making $34bn in profits or $78.35 a share. Apply a 15 multiple and we get a share price of $1175.25. Again I don't think these assumptions are unreasonable.

That is why Netflix has flown and why we continue to like it as an investment, even after this great run.

As we mentioned yesterday,

Mediclinic released their full-year trading statement, which pushed the stock higher by 7%. We can expect their audited results on the 24 May, so we will just do a very high-level look at them. Probably the biggest reason for the positive share price reaction is due to the turnaround in their Middle East operations. The Middle East EBITDA margins have improved from 11.7% to 12.5%. Added to the good news, a new hospital in Dubai is going to open 6-months ahead of schedule.

In South Africa, revenue is expected to be marginally higher and EBITDA margins to remain flat at 21%. Then due to legislation changes in Switzerland, revenues will mostly be flat but with a drop in margins. We will cover the results in detail when they come out at the end of May. Overall though, it is good to see their Middle East division on the up, and getting closer to their other divisions regarding profitability.

Linkfest, Lap it Up

Plastic is something that doesn't decompose, making its impact on our environment significant. This breakthrough could help lessen its impact -

Scientists accidentally create mutant enzyme that eats plastic bottles.

Online retail has disrupted many things. Included in that, is where do online companies have to pay tax? I suspect that it will still be years before the tax question is resolved -

Will You Soon Have To Pay Sales Tax OnEvery Online Purchase?.

Vestact in the Media

Bright was on Business Day TV last night, chatting about Aspen and Clicks, among others -

Stock Watch - 18 April 2018.

Bright was also chatting to print media about Mediclinic's trading statement -

Mediclinic Shares Climb

Signing off

The JSE All-Share is higher again this morning; nice to string a few of these green days together. On a political front, markets will be looking to see what comes out of the US and Japan meeting. On the other side of the pond, will there be any major agreements signed with The Commonwealth nations meeting this week? Our president was on Bloomberg yesterday, putting South Africa in a good light; we desperately need Foreign Direct Investment (FDI).

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista