Market Scorecard

This morning there was a slew of data from China. The country's GDP grew by 6.8%, in line with expectations; industrial production was lower than expectations, but retail sales were above expectations. All in all, mostly net neutral for markets. The S&P 500 returned to positive territory for the year last night, hopefully more green to come!

Yesterday the

JSE All-share closed up 0.30%, the

Dow closed up 0.87%, the

S&P 500 closed up 0.81%, and the

Nasdaq closed up 0.70%.

Our 10c Worth

One thing, from Paul

Online retailer Amazon is the third largest holding in Vestact client portfolios in the US. It has done really well, of course, rising over 10 years from around $80 per share to $1,400 per share now. It is now the fourth largest listed company in the world, with a market capitalisation of $706 billion.

It didn't get this big and successful by mistake. Its taken years of hard work and aggressive capital spending. Well done to Jeff Bezos!

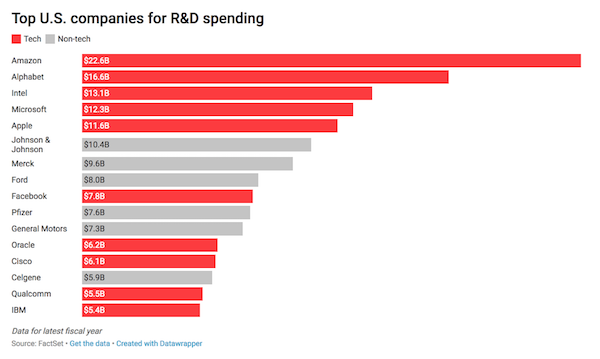

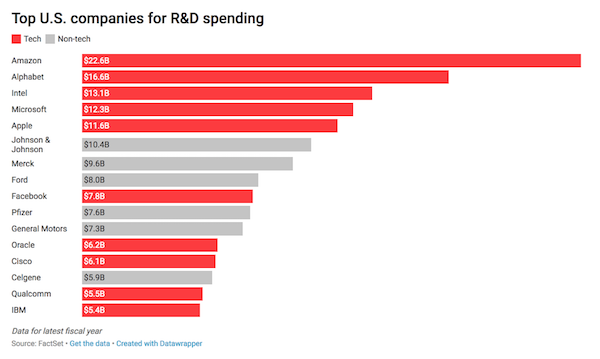

This chart from Recode shows all the really big capital spenders on research and development in 2017. Amazon topped them all, spending $22.6 billion in 2017, 41 percent more than in 2016 (when it also came first).

Byron's Beats

If you can't beat them, join them. That is what Comcast has decided to do with Netflix. Comcast is a cable company which is suffering from the cord-cutting phenomena. They have been losing clients fast to streaming alternatives. Pricing is important, but series fomo is probably the biggest reason.

To prevent this, Comcast is expanding their existing relationship with Netflix by bundling Netflix content in their mainstream offering. This is great for Netflix as it adds extra clients, while spreading Netflix content to many more households -

Comcast will start bundling Netflix into its cable subscriptions.

Bright's Banter

I had the pleasure of meeting Morgan Housel and having lunch with him at the Allan Gray Investor Conference last year. At the time he had just joined the Collaborative Fund, lovely guy.

This blog post is about Einstein and what made him such an incredible human being. Einstein was famous for his thought experiments, for example, he thought what it would be like to ride on a beam of light - how it would travel and how it would bend.

According to Morgan, outliers like Einstein have two skills that aren't related, but when put together, they create something bigger than when they're not fused together. These unrelated skills help the agent achieve unmatched success in their craft. He calls this "an art that leverages a science" -

An Art Leveraging A Science

Company Corner

Michael's Musings

Last night, after the market closed, one of the high flying stocks of the previous 3-years reported their 1Q numbers.

The Netflix share price is up 520% since the start of 2015! High flyers have some big expectations attached to the company, Netflix did not disappoint. This WSJ articles headline sums things up pretty well -

Netflix Hasn't Found an Expectation It Can't Beat.

The first, and almost only, figure the market looks at when giving Netflix a value, is new subscriber numbers.

For the 1Q Netflix added 7.4 million more people to their subscriber list, totalling 125 million subscribers. The more subscribers Netflix has, the quicker the company gets to being cash flow positive, and from there it will just rake in billions in annuity income. It is an amazing business model, assuming that they can retain the bulk of their subscribers over many years.

To get new customers and retain their existing ones, Netflix spends a huge amount on content creation.

For 2018 they plan to spend between $7.5 and $8billion on content creation. Splashing out sums like that means that they will be cash flow negative for the year. Which isn't expected to change soon:

"We continue to forecast free cash flow of -$3 to -$4 billion in 2018, and to be free cash flow negative for several more years as our original content spend rapidly grows."

The company expects to add 6.2 million customers in the 2Q, which is higher than the 5.2 million analysts had expected. Thanks to the strong beat on new subscribers, the stock is currently up 5% in after-hour trade. Then lastly, a random figure from their results. Netflix still made $100 million in the last quarter from DVD rentals. Yes, you read that correctly, DVD rentals! Who still owns a DVD player?

Linkfest, Lap it Up

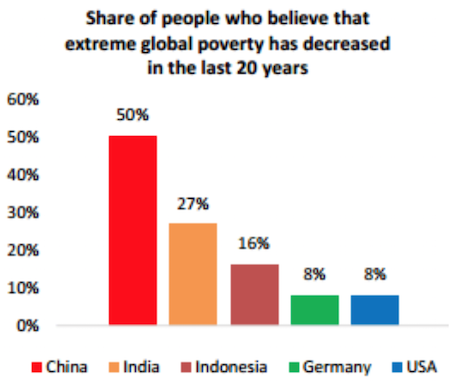

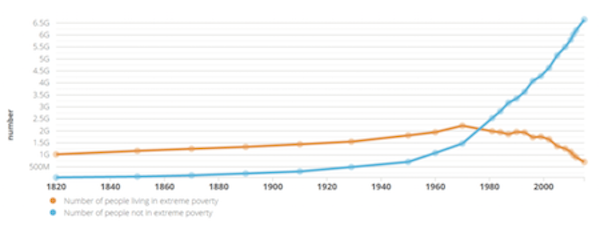

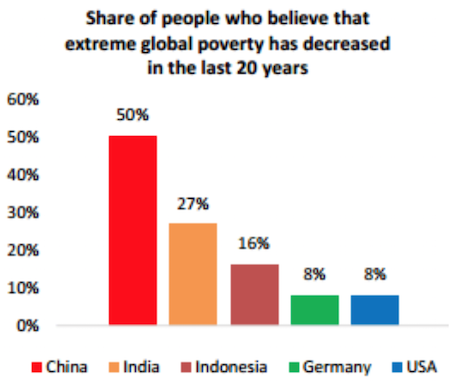

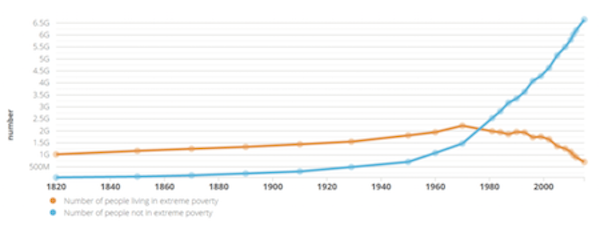

Your view on the development of the world is heavily influenced by where you live. In the US for example, the middle class feels like they haven't made any progress over the last few decades. If you are in China, the opposite is true. As a result of your personal situation, you extrapolate that to what is happening globally -

Five Graphs that Will Change Your Mind About Poverty.

Then to cap our Netflix theme for today's newsletter

Then to cap our Netflix theme for today's newsletter, here is a look at Netflix's 20-year history. Interesting to see how the company has evolved -

Twenty years ago, Netflix.com launched. The movie business has never been the same.

Signing off

Our market is down this morning, due to Tencent being lower in Hong Kong. Trump has made noises about taking on China around their reluctance to let US tech companies into China. Then later today, a couple of the FOMC members will be speaking. Generally, these are non-events but sometimes they say something the market wasn't expecting.

Sent to you by Team Vestact.