Market Scorecard

It was good to see some 'green on the screen' yesterday. I remember last year when it almost got boring talking about how the market was only going up and how there was no volatility. The good news came from President Donald Trump who directed officials to explore rejoining the Trans-Pacific Partnership (TPP); on the condition that the US gets a better deal than it had before he pulled out last year.

Yesterday the

JSE All-share closed up 0.55%, the

Dow closed up 1.21%, the

S&P 500 closed up 0.83%, and the

Nasdaq closed up 1.01%.

Our 10c Worth

One thing, from Paul

Earnings season is about to kick off in the US. Remember, companies listed in New York report every quarter.

Thanks to the GOP (Republican Party) tax cuts,

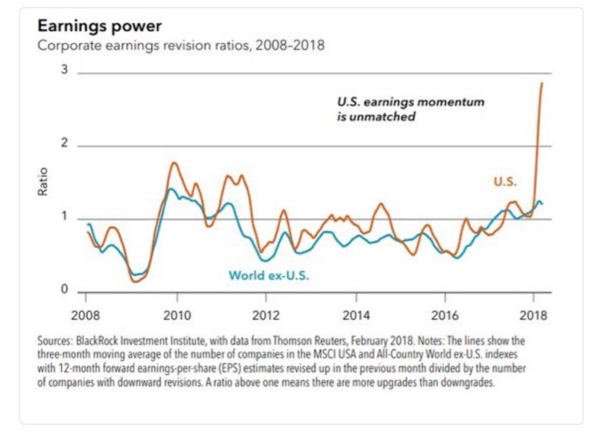

these earnings are going to be amazing. Industry analysts polled by Thomson Reuters are expecting that S&P 500 companies' earnings jumped by 18.5% year on year in Q1. Analysts have been revising their expectations up smartly.

Here is a picture of what that looks like on a chart, from Blackrock. Look at that brown line fly!

As foreign investors in US stocks, we have the best of both worlds. We get higher profits, higher share prices, and we don't even have to worry about US government fiscal shortfalls down the line. Bonus!

As foreign investors in US stocks, we have the best of both worlds. We get higher profits, higher share prices, and we don't even have to worry about US government fiscal shortfalls down the line. Bonus!

Byron's Beats

As Paul pointed out, earnings season is upon us. One sector I will have my eye closely fixed on is biotech. This Wall Street Journal article (paywall) titled

How Big Biotech Can Win Back Investors looks at the underperformance of the sector versus the market. And this is strongly represented in the sector's valuation.

The big players in the sector trade at less than 11 times earnings versus the market which trades at 17 times. One of the reasons, according to the article, is a lack of new blockbuster drugs hitting the market. Big biotech has gone through a dry spell.

We think this is a good entry opportunity into a sector that will recover. We continue to add to Amgen aggressively. And Charley Grant (the author) seems to agree.

Michael's Musings

I saw a headline recently from a US publication, saying that soon you won't need to sign credit card slips. The only time that you need to sign a credit card slip is when you haven't entered a pin code to get the transaction done. When was the last time you swiped and didn't need a pin? I was shocked that in the US, they don't bring the credit card machine to you, your card goes with the waiter and then comes back 5-minutes later!

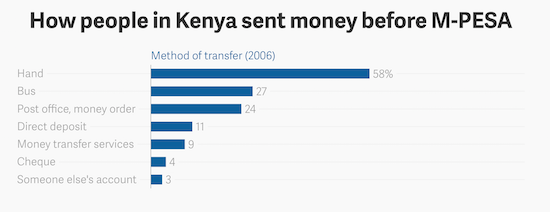

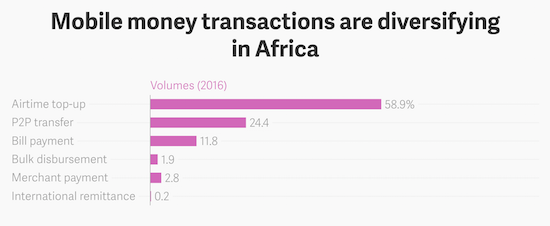

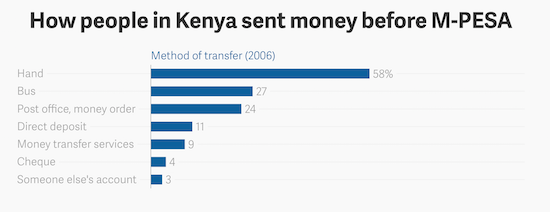

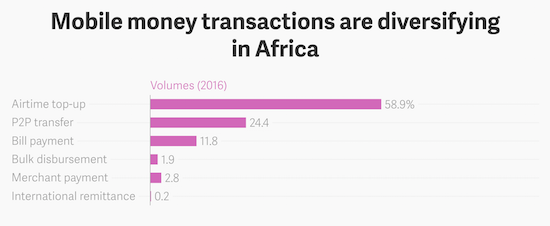

The point I am making is that Africa is ahead of the curve when it comes to fintech. These two graphs show how mobile money has changed things.

Found at How people in Kenya sent money before M-PESA

Found at How people in Kenya sent money before M-PESA

Found at Mobile money transactions are diversifying in Africa

Found at Mobile money transactions are diversifying in Africa

Bright's Banter

I get a lot of questions from my friends about whether I still listen to Podcasts and which ones are the best. The answer is yes, I listen to at least one podcast a day when I'm on the Wattbike.

These podcasts range from Barry Ritholtz Bloomberg's 'Masters in Business' which I rate one of the best podcasts out there if not the very best. 'The Knowledge Project', 'Success! How I Did It', 'Animal Spirits', and 'Invest Like The Best'.

These podcasts are available on the Apple's podcast app at no additional cost for everyone subscribed to Apple Music. If you're not subscribed, now you have a reason to!

Recently Paul sent us the link below. This is a podcast series by Alec Hogg called "The Rational Perspective". The episode below was with Dawid Krige of Cederberg Capital. Cederberg is a China-focused investment management firm that has done exceptionally well since inception.

This was a master class on value investing, Chinese equities including the famous BATs (Baidu, Alibaba, and Tencent). I really enjoyed this one and I hope you do too -

Meet One Percenter Dawid Krige China Focused Buffett

Linkfest, Lap it Up

Following on from Byron's Beats last week, here is the latest from the potential Flipkart take-over:

Walmart Favored Over Amazon to Buy India's Flipkart and

Amazon offers $2 billion breakup fee in Flipkart-Walmart deal talks. When you are a seller, it is great to have more than one person competing to buy your business!

Creating wealth in society occurs when more efficient systems are developed. In this case, containers save time and money when it comes to 'building' a home -

Container homes take South Africa by storm.

Vestact in the Media

This week on Blunders: Danish demolition fail; Sagarmatha is not really an 'African Unicorn'; Salt Bae's restaurants are now worth $1,2 billion; and Boda-Boda hearses in the DRC -

Blunders: Episode 96

Byron gets a mention in this Biznews piece on Naspers and Flipkart -

Move over Tencent. Flipkart will turbo charge Naspers next!.

Signing off

We have entered earnings season! Kicking it off for 'Team Vestact' is JP Morgan this afternoon, who are expected to post a healthily increase in profits and a slight increase in revenues.

Sent to you by Team Vestact.