Market Scorecard

It was 'Jobs Day' on Friday for the US economy. Currently they are on 90 consecutive months of gains to the job market! The overall number of new jobs added was 103 000, lower than expected but not to be worried about due to February having a much higher than average job growth of 326 000. Overall unemployment stayed at 4.1%.

The jobs numbers were a side show though, Wall Street was still mostly focused on the increasing chances of a trade war. Big companies that are most likely to be hit by new tariffs were sold off the most. Overall it was a pretty gloomy day for US stocks.

On Friday the

JSE All-share closed up 0.21%, the

Dow closed down 2.34%, the

S&P 500 closed down 2.19%, and the

Nasdaq closed down 2.28%.

Our 10c Worth

One thing, from Paul

As I've said many times before,

I'm a huge fan of Uber, and a very active client of the company. My adult kids use it all the time, and so do I. I look forward to the day that they list on the market in New York, so that I can become a shareholder too.

The successful listing of Spotify in New York last week probably brought that day closer. The Swedish music streaming company now trades with a market capitalisation of $27.2 billion. That is well above previous private valuations.

That valuation almost puts Spotify on a par with video-streaming giant Netflix, according to the Wall Street Journal. They say cryptically, that "after adjusting for debt, Spotify trades for about 24 times gross profits, compared with 31 times for Netflix".

I'd argue that Netflix is a much more powerful company, since it now produces its own content, where Spotify (and Apple Music for that matter) does not.

Anyway, back to my main point. Uber needs to be publicly traded on the stock exchange. I'm sure that CEO Dara Khosrowshahi has been paying close attention to all these events.

Byron's Beats

For some reason South African analysts do not like the current Naspers management team. They feel they get paid far too much for riding on Tencent's coattails. But when you look a little deeper, you will see that management have been very busy with other investments. One of the more prominent one's is Flipkart, the biggest online retailer in India.

Naspers first invested in Flipkart in 2012 for an undisclosed amount. Then last year they added $71mn to bring their stake up to 16.5%. This was during a $1.4bn funding round which valued Flipkart at $11.6bn. On Friday my colleague Bright pointed out that

Walmart completes due diligence for its big Flipkart buy.

According to the article the deal could value Flipkart at $20bn, almost double the value from the 2017 funding round. That values Naspers stake at $3.3bn or R40bn. If the 2017 funding round has nearly doubled, the 2012 entry price would have been far lower.

To add even more excitement to this story, it looks like Amazon might throw in a counter bid. Remember Amazon have made a big push into India. Buying the biggest online retailer there would make sense, if the competition authorities allow it.

The article suggests that Naspers would be one of the sellers were the deal to go through. Sound like money well deployed.

Michael's Musings

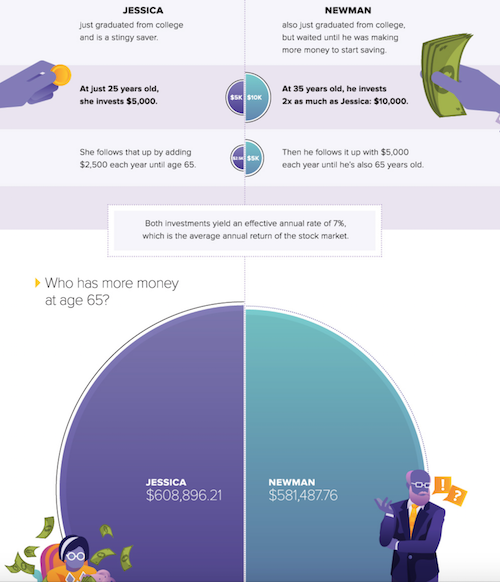

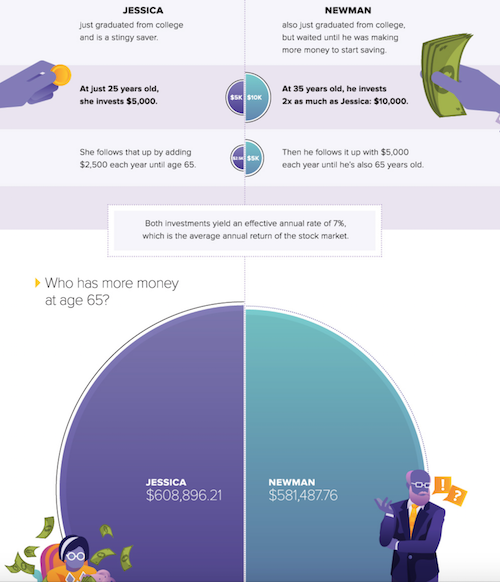

We have all heard about how powerful compound interest is. When you have a look at an exponential graph you can see, with enough time, your initial investment grows quicker and quicker each year. I've never put numbers to calculation though. The key to a comfortable retirement is more about starting to save early, than about how much you put away. Have a look at this infographic, starting to save 10 years earlier allowed Jessica to invest half the amount annually as Newman, and still come out with the same amount at the end.

Compounding is something that Buffett and Munger talk about frequently. When they talk about it, they generally include other areas of life where compounding can be very beneficial too, like knowledge creation, networking or building a company brand. In Buffett's case, he reads between 600 and a 1 000 pages a day! The main message here is that it is never too late to start harnessing the power of compounding. But start early if you can.

Bright's Banter

Europe has had a slow recovery from the financial crisis of 2008 compared to the U.S.

Part of the European recovery is thanks to the low the interest rate environment that we are in. The most notable contributor to the recovery has been startup companies that have helped provide employment by pulling their weight in adding to the growth of the European economy.

The U.K. seems to be home to most of Europes fast flourishing startup companies that are growing their revenues double digits every year.

The graph below shows the fastest growing companies in 31 different European countries by revenues.

You will find more infographics at

Statista

Linkfest, Lap it Up

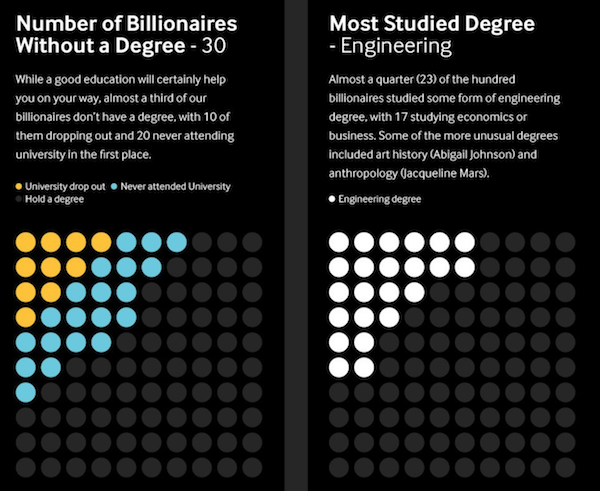

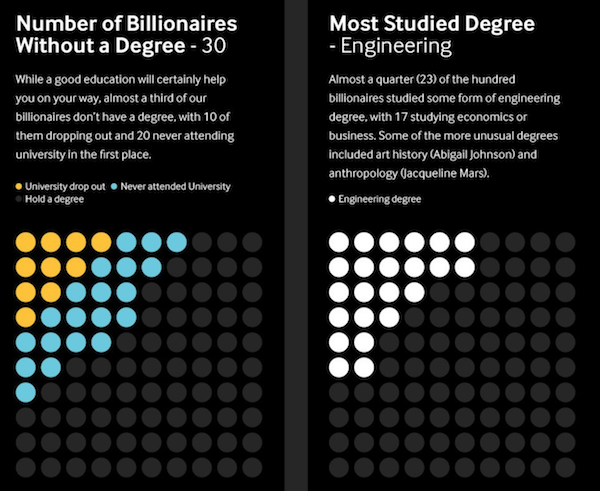

I can't say that I have ever wondered how long it has taken millionaires to become billionaires, but if you ever wondered here is a great infographic. More interesting to me is that the average age someone becomes a dollar millionaire is 37 -

The Jump from Millionaire to Billionaire, and How Long That Takes.

Some perspective

Some perspective of how big Musk's new rocket will be -

SpaceX Mars rocket tooling dwarfs Tesla Model 3 in new Elon Musk teaser

Signing off

Signing off

Over the weekend, top US officials reiterated that they don't see a trade war on the cards, the result is Asian markets are slightly higher today. The JSE All-share is also up. This week marks the next round of US earnings. We will get a better idea how the recently implemented tax cuts have impacted companies. Exciting times!

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista