Market Scorecard

Sigh. . . . Just as it looked like markets had bottomed and global trade would return mostly to normal, Trump came out saying he thinks China is being unfair by matching US tariffs. The US proposed implementing tariffs on $50 billion worth of trade, China responded with their own tariffs on $50 billion worth of trade. Trump now wants to add tariffs to a further $100 billion worth of trade.

On the news breaking, US after-hour trading went from being higher, to be sharply lower. Asian markets also turned red on the news. If Trump goes ahead with his additional $100 billion, China will then match that amount. All of a sudden, we have moved from 'only' $100 billion of global trade having tariffs to $300 billion of global trade.

Because White House officials are saying that they don't want a trade war and that they are talking with China, most people think Trump is just posturing. I've never read 'Art of the Deal', but I suspect one of the negotiating tactics mentioned is lowballing with the initial offer, to set an advantageous reference point. From there you can back peddle a bit and still come out well on top.

Yesterday the

JSE All-share closed up 2.12%, the

Dow closed up 0.99%, the

S&P 500 closed up 0.69%, and the

Nasdaq closed up 0.49%.

Our 10c Worth

One thing, from Paul

This week on Blunders: Trump's economic adviser is just a TV celebrity; NYSE flag guy confuses Sweden and Switzerland; George Foreman has five sons and he named them all George; Makita makes a rugged construction site coffee maker; and Blac Chyna loses her baby stroller endorsement deal -

Blunders - Episode 95

Byron's Beats

New listings on the JSE are always exciting. It gives us investors more choices and represents economic progress. The latest sizeable listing looks to be Consol, the Glassmaker.

The story seems quite compelling. They have some massive bluechip clients such as AB InBev, Diageo and Heineken. They will also benefit from a push away from plastic which apparently destroys the planet. If our economy picks ups, they are well exposed to the South African consumer.

Brait also owns a stake of the business and have been looking to offload it for a while now. This should raise some much needed cash for that business.

This Moneyweb article covers the details.

Consol eyes stock market return

Michael's Musings

One of the truest measures of how companies are doing is dividends. Having paper profits is one thing, having the cash to back up those profits is another. So with the US market trading near record highs, it is understandable that companies are also paying out record amounts of cash -

A record amount was spent on dividends in the first three months of 2018.

Over and above the dividends paid, companies have been shelling out for share buybacks too (

U.S. corporate share buybacks 'explode' in February: research firm). Which makes the above record even more impressive. If you are a long-term holder of a company, it is more tax efficient to have the company buy back stock, than to pay you a dividend that you instantly get taxed on.

Bright's Banter

Here at Vestact, we acknowledge that the mobile phone screen is the most important screen in our lives. The average person devotes more than 10 hours staring at a screen and a large portion of that is their mobile phone screen.

Studies show that 80% of the time spent on our phones is "in App" and five of the top ten Apps on Android are owned by Facebook. The phone isn't just a piece of technology, it's a utility for Facebook Inc.

Here's the proof.

You will find more infographics at

Statista

Linkfest, Lap it Up

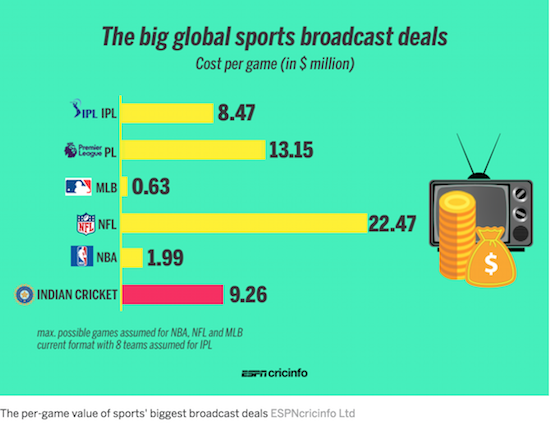

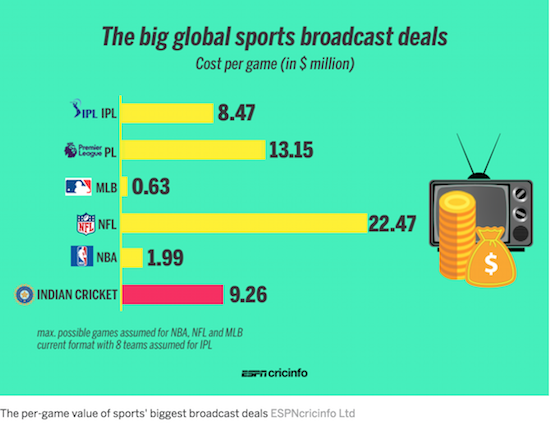

Yesterday Indian cricket sold the broadcasting rights for the next four years, at an increase of 52% from the previous time they sold the rights. Sport is a very unique type of entertainment, and having over a billion people watching cricket in India means monetising it is fairly easy -

How valuable is Indian cricket?

JP Morgan released their annual report yesterday

JP Morgan released their annual report yesterday, where iconic CEO and Chairman Jamie Dimon delivered his letter to shareholders. This letter does not get nearly as much attention as Buffett's but it definitely gets more attention than most -

Jamie Dimon set out how his new venture with Amazon and Berkshire Hathaway plans to tackle some of healthcare's biggest problems. As Byron has said before, this venture sounds like they need to bring in Discovery and their Vitality IP!

Vestact in the Media

Bright was on Business Day TV with Wayne McCurrie, talking stocks -

Stock Watch (04 April 2018)

Signing off

As expected, our market is off to a negative start. Unfortunately for RSA, the business confidence index was lower for March than it was in February. Today is 'Jobs Day' in the US. Will their unemployment rate break below 4%? The forecast is for unemployment to go from 4.1% to 4.0%. Enjoy The Masters this weekend, and brace yourself for a 5-day week!

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista