To market to market to buy a fat pig. At the start of the year, there are often clients asking if they should invest in the stock market or their bond. If the subsequent year had strong market returns, normally we have people saying they are dipping into their bond to send money. The opposite is also true, during lacklustre years, we see clients selling shares to pay down their home loan. So what is the best route to go?

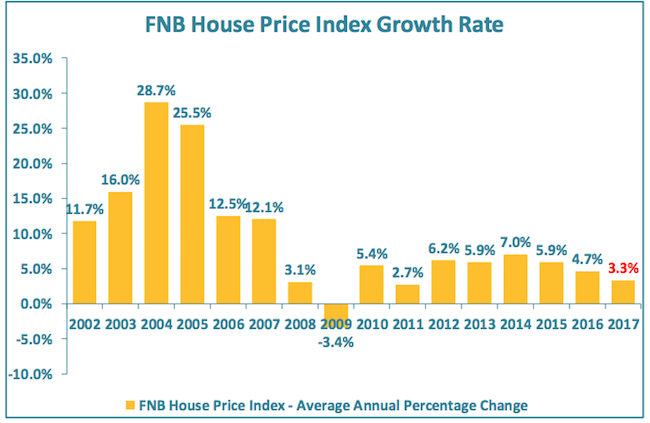

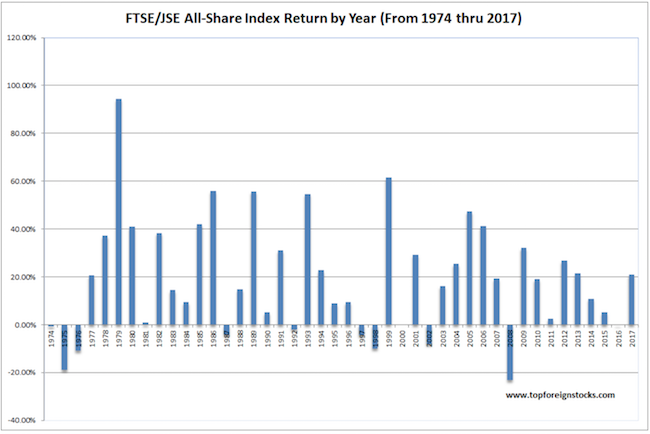

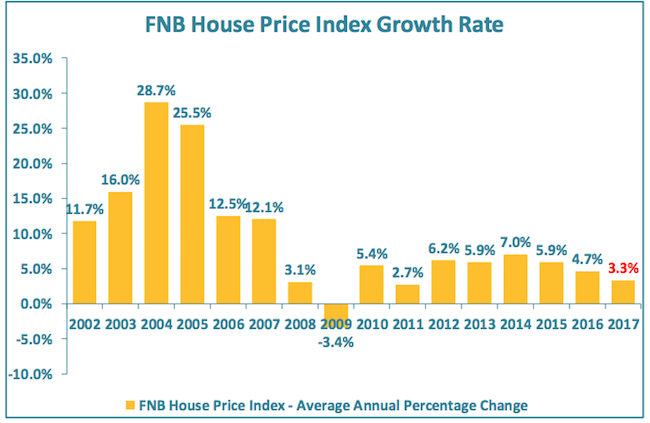

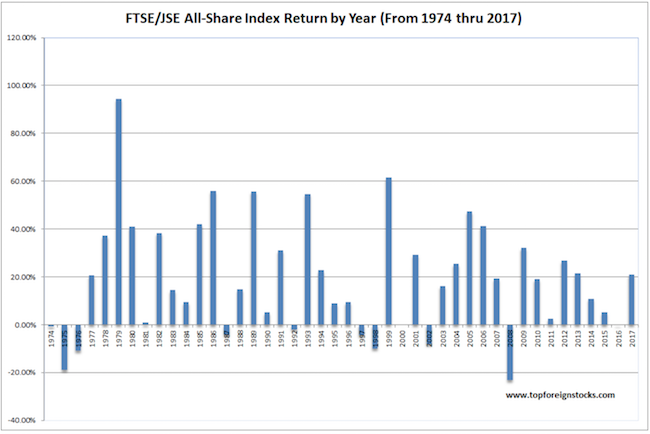

If we don't take emotion into consideration, having money in the stock market is a much better long-term return than having money in your house. Having a look at the recent FNB House Price Index, if you bought property in January 2000, on average it is now worth just over four times what you paid for it. Over the same time period the JSE All-share is up over 11 times! See the graphs below of how each sector has done over the years.

Found at South Africa's FTSE/JSE All-Share Index Returns By Year

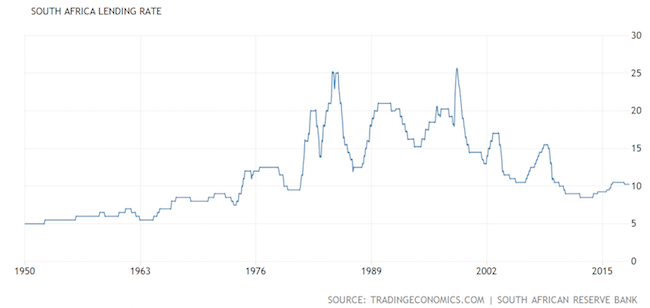

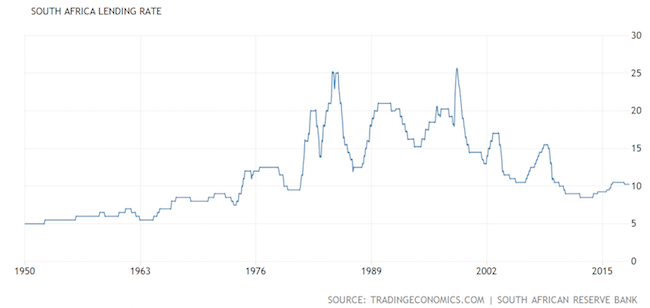

We are not comparing apples to apples though. The real choice you need to make is - put spare capital into your home loan and pay less interest, or put it in the stock market and hope for superior returns. Do you remember the late 90's and early 2000's when interest rates were around 20%!? Between the period 1 January 2000 and 31 December 2008, it was better to have your money in your home loan than the stock market. Expanding the time frame though to 1 January 2000 until the 31 December 2017, stocks beat your bond. So when people say stocks are a good long-term investment, they mean LONG term.

For many people, it is worth something knowing that they own their property. Knowing that if you hit a financial speed bump, the roof over your head is not going to be taken away by the bank. That is worth giving up a few percentage points of return. The ideal situation is having enough capital to pay a bit extra into your home loan and still have some money to top up your share portfolio. My strategy is to have spare funds sitting in my home loan that I can draw on during market pullbacks. I still put something into stocks monthly though; dollar-cost averaging is a very powerful weapon in the arsenal of long-term investors.

To conclude, generally keeping your life simple is the best strategy. Don't stress about where you will get the best return, rather focus on making sure that your budget leaves room for monthly saving.

Market Scorecard. New York kicked the day off, seemly forgetting all about the Fed minutes from the day before. The Dow was up 0.66%, the S&P 500 was up 0.10%, the Nasdaq was down 0.11%, the All-share was down 0.77%.

Company Corner

Michael's Musings

Yesterday

Woolworths released their 6-month trading statement. Off the bat, you can see the company is in a transition phase. Locally they no longer have the luxury of taking market share from Edgars and Stuttafords, coupled with three years of poor economic growth. In Australia, the David Jones turnaround is still in full swing and still has another 18-months to go before tangible results will be seen.

The David Jones purchase is part of a string of poor international purchases by South African CEO's. Poor South African growth and cheap debt, were excellent reasons to spread their wings on the international stage.

For Woolworths shareholders, the David Jones asset was bought for A$ 2.1 billion and has now been written down by A$ 712.5 million. Not to mention the R400 million odd spent on the rights issue needed to raise the funds.

Here are the headline numbers,

Sales are up 2.5% to R38.8 billion, HEPS are down 15%, and the dividend is down 18.4% to 108.5c. The pain has come from 'Fashion, Beauty and Home' where sales were down 3.4%, this was compounded by operating profit margin dropping from 16.5% to 14.4%. In Australia, with all the changes being made, David Jones saw sales decline 3.3% and its operating margin drop from 9.6% to 6.9%.

The bright spot is the food offering. Sales were up 9.4% and operating margins grew from 6.9% to 7.4%. That is the beauty of the Woolies business model, there is some diversification. It is not like a TFG that is purely clothes or a Shoprite that is mostly food retail. In our view, the biggest short to medium term threat to the Australian business is the recent arrival of Amazon. Ian Moir on CNBC last year said he wasn't concerned about Amazon; maybe he was just putting on a brave face? In the next two years David Jones wants to have 10% of their sales coming from online, the company definitely acknowledges the importance of being online.

The stock was up 2% on these results. Going forward there is RSA optimism, which should be good news for retailers. Added to that the David Jones turn around should start showing in the Woolies share price in the not too distant future. The stock market is forward-looking, if profits are expected to rise in the next 18-months, it will be featured in the valuation today.

Linkfest, lap it up

One thing, from Paul

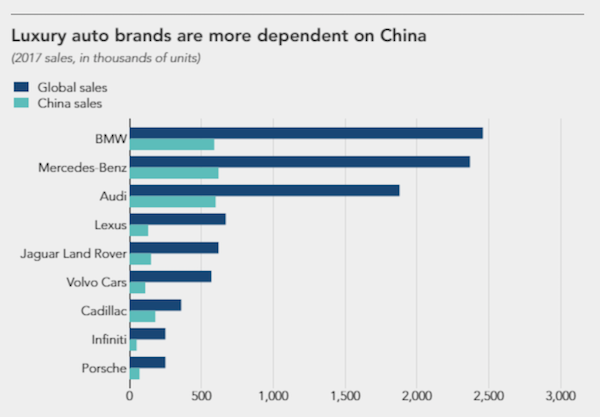

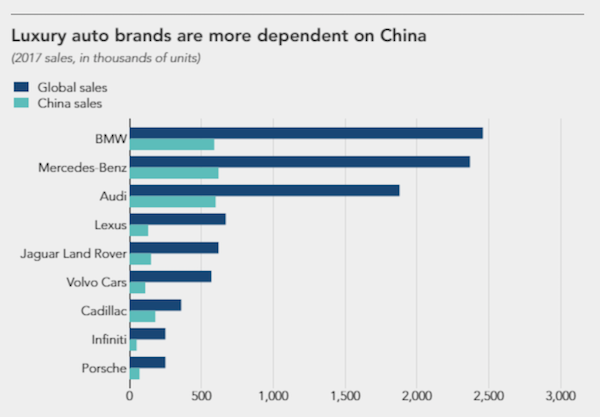

Chinese people really like fast cars. China accounted for almost 90% of sales growth at leading luxury automakers in 2017.

The top global luxury brands are BMW, Mercedes-Benz, Lexus (part of Toyota), Jaguar Land Rover, Volvo, Cadillac (part of General Motors), Infiniti (part of Nissan) Audi and Porsche (both part of Volkswagen).

According to a report by Nikkei, that group of companies increased sales by 5% to just under 10 million vehicles last year. All but Lexus logged their highest-ever annual sales, while the Japanese brand scored its second-best year on record.

China made up 27% of overall global luxury vehicle sales. Growth in that country was 17% year-on-year, compared to a sputtering 1% rise in the rest of the world. German models did especially well.

They should call 2018 the year of the car, not the year of the dog!

Here is a link to the report summary:

https://asia.nikkei.com/Business/Trends/Chinese-buyers-spur-rise-in-global-luxury-car-sales

Byron's Beats

If you read my recent commentary about Discovery's latest results you may have picked up my passion for preventative healthcare. This Business Day article titled

Discovery offers aid in public health got me thinking about how this could be implemented.

Clearly, this needs to be targeted to the poor.

It should be implemented along with the social grant's network. If you qualify for social grants, you qualify for a special Vitality programme. Discovery can offer their networks and manage it for a fee (they have shareholders, they cannot do it for free). It needs to be subsidised by the government as part of government's healthcare spend.

The first target should be consistent healthcare screening. Members can be rewarded with incentives for getting their blood screened for all sorts of potential ailments including diabetes, cholesterol and HIV.

Eating healthy should also be rewarded. A simple card swipe or phone scan can reward members for buying fruits and vegetables. Rewards can include Shopping vouchers and airtime. You can even get more specific like school uniforms or electricity vouchers. Incentivising people is easy.

Virgin has opened a few low-cost gyms.

Subsided contracts that rewards exercise can also be implemented. In fact, any small gym can join the program whereby members can check in their workouts.

Judging by the data Discovery have gathered over the years, this will save much more money than it will cost over the long run. We just need private and public to cooperate.

Home again, home again, jiggety-jog. Byron is really excited about Super Rugby being in full swing this morning. The biggest data out today are CPI numbers from the EU, the expectation is that it will remain stable at 1.3%. Still well below the 2% target. The rumours are we will get a new cabinet next week? I have learnt that when it comes to politics, it will happen when it happens.

Sent to you by Team Vestact.