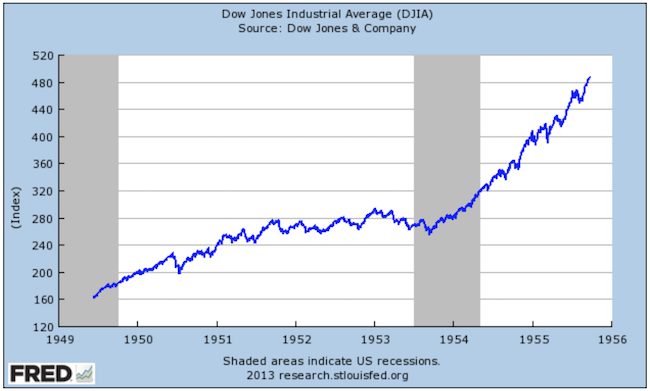

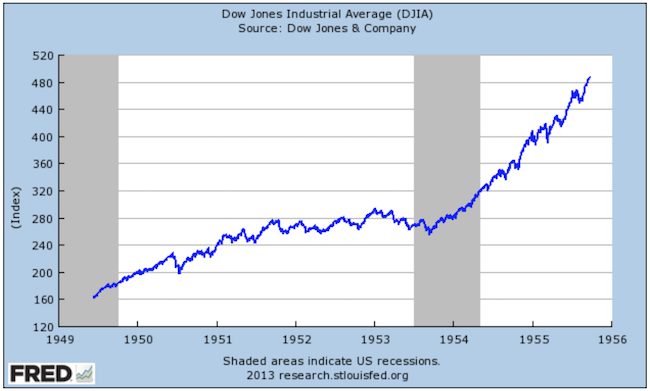

To market to market to buy a fat pig. Reading Eddy Elfenbein's Crossing Wall Street this morning, he talks about the bull market of the late 1940's. The Dow tripled in seven years, which is on par with the move of the market since the lows of 2009. Here is the graph:

The bull market starts during a recession, given that markets are forward-looking, this start is not surprising. Note that the US then goes into another recession during 1953. How does the market react? Well, there is a slight pullback, and sideways movement leading into the recession. Then still in the early phases of the recession, the market puts 'pedal to the metal' and zooms up the page, doubling in less than two years. The move shows how markets dance to a different tune versus the economy. Eddy's closing paragraph is also noteworthy:

"But here's the important question: why isn't this bull market better known? My guess is because it never came to a crashing end. There's no way anyone can moralize about greedy bubbles when it never popped. The 1950s stock market continued to climb for several more years. We really didn't experience a major crisis until the 1970s."

Forecasting is a fools' errand, and saying that the market will correct soon just based on nine years of gains is a huge assumption! Here is the full blog post -

The Forgotten Bull Market 1949-1955.

Market Scorecard. Nothing to report for the US due to their markets being closed.

That leaves the All-share, which was up 0.26% I noticed this morning that during the December break Capitec now trades above R1 000 a share! As a Capitec customer, I can testify to their quality product. I can understand why they are growing so quickly. At the current share price, R100 000 invested in them during 2008 would be worth around R3.4 million today.

Company Corner

Yesterday

Aspen announced that they received approval in China for their Alula brand of infant milk formula. The company indicated in their last set of results that they were on track to get the approval, it is still a huge step for the company. You may remember the

2008 Chinese milk scandal, where babies in China died and thousands were hospitalised due to poorly manufactured infant formula. The result of the scandal is that brands matter in China. You would rather pay up for a well know international brand than an unknown local brand.

In years gone by, Aspen's baby formula was purchased in Australia by tourists and then sold in China. Due to regulation changes in China, that changed and resulted in nutritional sales dropping by 8% during the last financial year for Aspen. Having a presence directly in China is an important stepping stone to future growth coming out of the country.

Byron's Beats

At the beginning of the year we always get trading updates from the retailers which tell us how well these businesses have done over the festive season. The years of 2016 and 2017 have been tough for our economy; expectations are certainly lower than previous years.

Yesterday Woolworths released their 26 weeks sales number for the period ending 24 December. Most people had done their Christmas shopping by then surely?

Group sales increased by a meagre 2.5%. In SA - fashion, beauty and home declined by 0.2%. Comparable store sales were down 3.4%. Food in SA increased by 9.4%, inflation contributed 4.4% to that growth though.

In Australia, David Jones increased 0.6% for the period. Country Road increased by 5.2%. Net retail space declined by 2.2% for David Jones as they continue to restructure their stores.

Due to lower sales and probably a drop in operating margins, Headline Earnings will drop 12.5%-17.5%.

All in all these numbers look stagnant. There is no point trying to put a shine on the tough environment in SA and the hard turn around in Australia. Food is doing well, the clothing is struggling. Ian Moir's strength is clothing; I'm sure he is working very hard at staying on top of that fast-moving sector. Let's remain patient.

More details when the full numbers come out.

Linkfest, lap it up

Michael's Musings

Lego and Tencent are teaming up! -

Lego Plans Video Games, Social Network for Chinese Children

Michael Jordaan (FNB's ex-CEO) announced this morning that he is launching a new bank -

Bank Zero. Having more competition and hopefully lower prices in the banking space is welcome!

Vestact in the Media

Bright chatted to PowerFM yesterday -

Bright Khumalo - Who is Viceroy.

Byron chatted to Business Day about Aspen yesterday -

Aspen wants trades audited.

Home again, home again, jiggety-jog. Our market is off to a green start this morning. The Rand is much stronger, suddenly strengthening by over 10c to $/R12.22. Later today, we have a UK CPI read and then a local mining production number.

Sent to you by Team Vestact.