Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

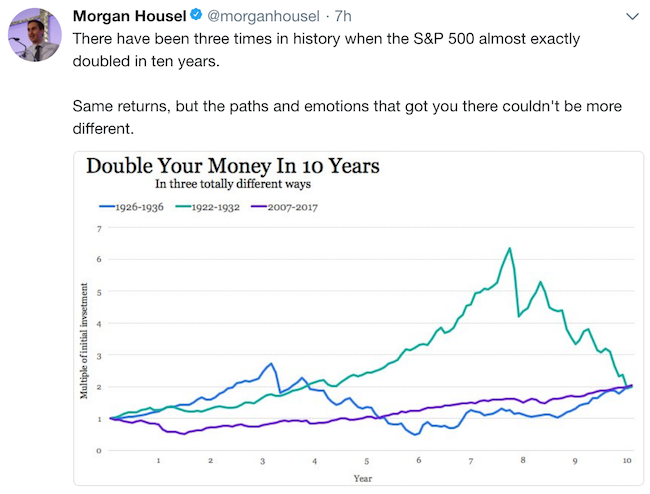

To market to market to buy a fat pig. While doing my daily Twitter catch-up, I came across a fascinating graph from Morgan Housel. Most people will know him from his 12-years at the Motley Fool or his general awesome Tweets. Before we discuss his graph, let me ask you this question. If you could double your money every ten years in an environment with low inflation would you take it? Now onto the very thought-provoking graph.

The graph shows three different ten year periods where stocks doubled. If you had the choice which journey would you rather take? Most people would probably take the purple path, the least volatile. Remember though that buying in 2007 meant that you basically started losing money from day one of your investment and continued to do so for the first 15-months. After being down 45% and thinking investing in the market was a terrible idea, the market starts turning. From there it is a 'steady' eight and a half year ride to doubling your original investment.

Imagine taking the green path. The first seven years are all bliss. You sextuple (growth of six times, I had to google the term) your money and the sky's the limit. Then the next two and a half years are spent crashing and burning. After ten years, you have doubled your investment but have one-third of the value when your portfolio was an all-time high.

Lastly, there is the blue line which is broken into three clear phases. In the first three years you triple your money, then the next three years you lose all your gains plus half of your original investment. Ouch! Luckily, the next four years are spent recovering some of the loses, with the result being, you double your initial investment.

Breaking down each line, it is clear that the path to doubling your money was a tough one. At some point on the road your NAV halved! Equity investing is risky but over the long run you are rewarded for that extra risk.

You never know which path you are on, and because of that, it is key to be regularly adding to your equity portfolio. The more frequently you add, the less timing luck comes into play. We see it from our end; generally the clients who add regularly are less anxious about price movements and have a better equity market experience all-round.

Market Scorecard. Yesterday was a tough day for all markets, including crypto currencies. The Dow was down 0.07%, the S&P 500 was down 0.11%, the Nasdaq was down 0.14% and the All-share was down 0.22%. The main thing on business TV this morning was South Korea's plan to ban trading in crypto currencies and it's negative impact on the Bitcoin price. There are rumours swirling now that Viceroy are not in fact going after Aspen but rather Resilient, the property company. Resilient is down 18% this morning, accompanied by affiliate company NEPI Rockcastle which is down 11%.