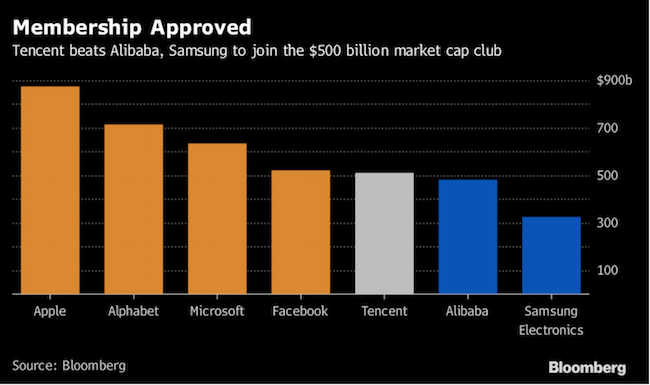

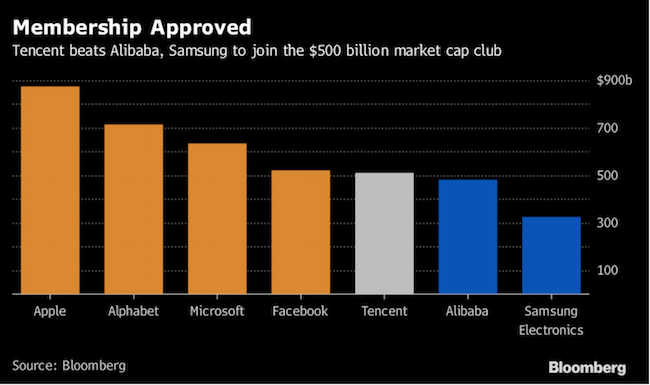

To market to market to buy a fat pig. Yesterday we spoke about Naspers, today we will move onto the first derivative of Naspers, Tencent. The stock is up 126% this year, which has propelled it to become the first Asian company to break the $500 billion market cap milestone.

I remember reading about Tencent last year in US research notes, where the author was talking about them as an insignificant participant on the US market. Since the Alibaba listing, Jack Ma's company have been the go-to stock to take advantage of China's growth. I would say that is no longer the case, Tencent is firmly on the map and in play.

Market Scorecard. Green, everywhere I look I see green. The Dow was up 0.31%, the S&P 500 was up 0.13%, the Nasdaq was up 0.12% and the All-share was up 0.62%. Even though our market is sitting at record highs, I was interested to see that the list of stocks at a 12-month low is much longer than the list of stocks at 12-month highs. Good to see Mr Price on the 12-month high list, they had a solid set of numbers out yesterday. Another stock that is on the list, sitting at 12-month high and an all-time high is Capitec who is about to cross the R1 000 a share mark.

Company corner

Michael's Musings

Last week

Woolies released their 20-week trading statement, which as expected showed that they are under pressure. Their most important division from a profit margin perspective is what used to be called 'clothing and General Merchandise' and now is called 'Woolworths Fashion, Beauty and Home'. The division declined on a like for basis by 2.4% for the period.

Their food division, which I am a huge fan of, had a positive period with like for like sales increasing 5.3%. Unfortunately for the group, the operating profit margin in the food division is around 7%, and the operating margin for clothes is around 17%.

David Jones had a tough time as they transition to their new business model, like for like sales were down 5.3%.

A key contributor to the drop in sales is the revamp of the David Jones flagship store. The pictures I have seen look amazing; the goal is to make shopping there an experience.

The second most profitable division, Country Road, had mixed results. They saw like for like sales down 0.4% but they gained market share and overall sales were up 8%. I will be interested to see if they have given up margin to gain market share. In their full-year results, Country Road had an operating margin of 10% with management pegging their medium-term target at 12%.

All in all, David Jones contributes 28% of Woolies profits, it's their biggest division. The newly named 'Woolworths Fashion, Beauty and Home' coming in second with around 24% of the profit. Because David Jones is struggling to turn around, the market is feeling down on Woolies, only giving it a P/E of 13. Compare that to Shoprite on a P/E of 21 and Pick'n Pay on a P/E of 25.

There is no doubt that the Woolies share price going forward is very much tied to the fate of David Jones. If management gets the turnaround right you will see Woolies re-rate to a P/E around 20, which would mean the share price going up 50% without any increase in the underlying profit number. For now, the share price probably won't do much in the short term.

Linkfest, lap it up

One thing, from Paul

Vestact is an asset manager, so we don't actually offer advice about setting financial goals, taxes, retirement or estates. We just try to protect and grow the surplus capital that our clients bring to us.

Having said that, conversations about money often stray into those related topics. I enjoyed this Humble Dollar blog post by Jonathan Clements. He makes the point that the most important determinant of the quality of our financial lives is containing our fixed living costs (those are our regularly recurring expenses such as bond, rent or car payments, rates and taxes, insurance premiums and groceries). The lower those are, the easier it is to save. Living within one's means is the key to a stress free life.

Read the whole thing here:

Number One Number

Byron's Beats

The theory of investing can get very complicated and philosophical. That is why Warren Buffett is so great to read, he manages to keep things simple in his explanations.

At the moment we are going through a very interesting period. Tech stocks are soaring, making everything else look bad. Many people feel it is necessary to sell out of other sectors and follow the momentum.

The FOMO is real.

Others feel the opposite, they want to sell the high fliers and buy into shares that have done badly. These people have a more contrarian nature.

We feel it is important to stick with quality companies but diversify the sectors you have exposure to. Sectors go through cycles. Tech is doing well and justifiably so. We are heavily exposed here and are very pleased with the way things have gone. But we are maintaining exposure to other areas where we feel growth is imminent like healthcare and retail. Their time will come. Remember the Buffett quote which we repeat so often. "The stock market is a device for transferring money from the impatient to the patient."

Bright's Banter

Since Amazon bought Whole Foods, they have slashed most of their prices on 'cool kid' grocery staples such as apples, bananas, eggs, avos, kale, almond butter etc. The company is now offering up to 20% off on turkeys for Thanksgiving - but there's a catch! You see, if you're not an Amazon Prime member you'll have to sign up for the 12 month $99 membership to enjoy this Thanksgiving deal.

Current Amazon Prime members have a lot to be thankful for this Thanksgiving! However, we wonder how Amazon is going to integrate Prime successfully into Whole Foods without leaving non-Prime members feeling excluded in the process -

Amazon is ruining the Thanksgiving spirit.

Vestact in the Media

Here is Michael talking about Naspers being A Whisker Away From R4000, on CNBC Power Lunch.

Bright gets a mention in this IOL piece on the Vodacom numbers last week -

Vodacom pushes government for allocation of high demand spectrum.

Home again, home again, jiggety-jog. Tencent is up around 3% this morning, which means Naspers will probably open with a '4' at the front of its share price! Asian markets are well in the green which means our All-share will be aiming to break 61 000 points for the first time.

Sent to you by Team Vestact.