To market to market to buy a fat pig. The SARB didn't do what most people were expecting; they left things the same. A Repo rate at 6.75%, means you are still paying the same for your house at month end. As we have spoken about before, certainty is key to economic growth and a stable economy in general. Certainty leads to stability and stability leads to certainty. The reason given for leaving rates unchanged was due to lack of certainty.

"Given the heightened uncertainties in the economy, the MPC felt it would be appropriate to maintain the current monetary policy stance at this stage and reassess the data and the balance of risks at the next meeting."

The good news is that the Rand strengthened on the announcement, I suspect due to happy bondholders. They next meet at the end of November, where things may be even more uncertain due to the ANC conference in December.

Our market dropped slightly on the MPC news but then recovered and finished flat. US Markets opened in the red and stayed there all day, so no records for the day.

Here is the scorecard, the Dow was down 0.24%, the S&P 500 was down 0.3%, the Nasdaq was down 0.52% and the All-share registered a change of 0.00%.

Company corner

Michael's Musings

On Monday there were

Full Year numbers from Discovery, which didn't disappoint. The results are broadcast on TV, making it easy to watch and pause if need be. Adrian Gore's passion for the business sure is inspiring. Recent books that I have read all talk about the importance of the vision from a founder. Founders generally have more credibility and business-wide support, meaning they can push companies in directions that professional managers would struggle. Adrian Gore and Stephen Saad are the first two South African leaders that come to mind when I think of inspirational leaders. But we are blessed with many.

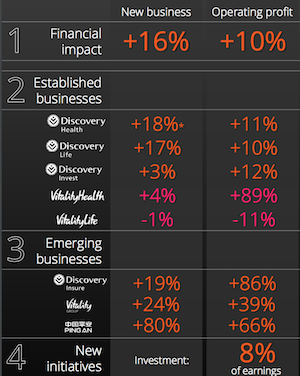

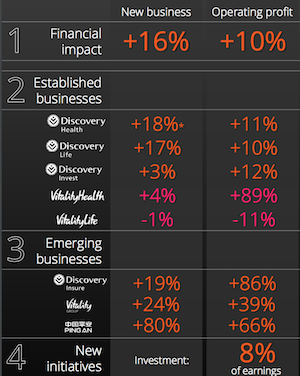

Here is a quick look at the group's performance as a whole.

The numbers in pink are their UK operations, which have been hit hard by Brexit.

The group estimate's that Brexit has had at 25% impact on the profit for the Vitality Life business, ouch! Looking at the other UK business, Vitality Health, that huge jump in profit is due to the previous period having some once-off costs, so it was coming off a low base. Both UK divisions aren't doing as well as management had previously hoped but are moving in the right direction. Vitality UK is a superior product to traditional medical aid and life insurance. Their marketing is all over the place,

you can't watch UK sport now without seeing Vitality branding somewhere.

The human behaviour data they have acquired, unsurprisingly is being put to good use in the UK. When people sign up for the Apple Watch incentive program, they saw a 42% increase in physical activity. From Discovery's perspective that is money well spent.

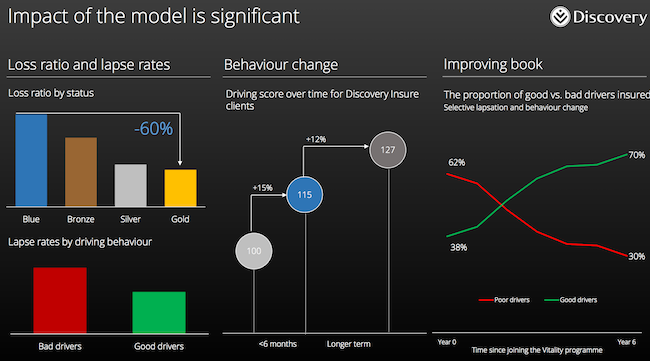

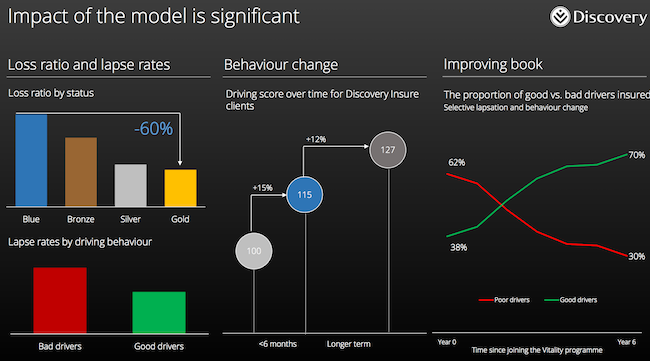

The Discovery Insure division has clear benefits from the incentives program. The division is still relatively new and falls in the group's 'emerging businesses' segment.

Discovery Insure only started making money in the second half of the year and was loss-making for the full year. For 2018 though we should see a nice juicy profit. Their focus on driving quality, has resulted in new customers improving their driving by 27% in the first year on average. Even better, bad drivers are more likely to move to other insurers, meaning they are left with a higher proportion of their book in good drivers.

A bit of shameless Discovery promoting, I am an Insure customer. Since joining, I am more aware of my driving and for my efforts, I get over R1k back a month. The only problem now is that my wife's driving score is substantially higher than mine; I get reminded of that fact frequently.

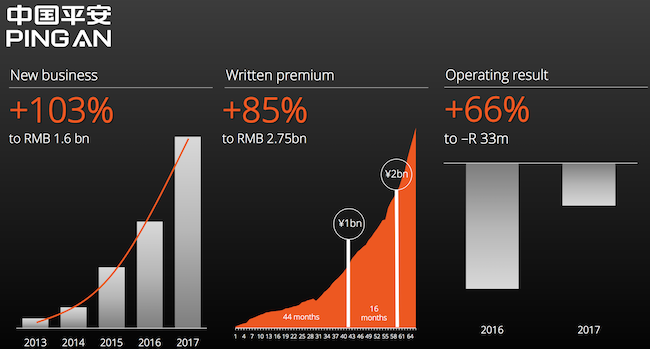

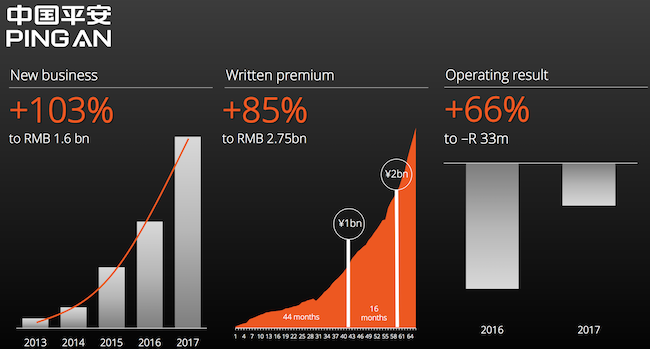

From an investors perspective, the most exciting part of the business is their JV in China.

The number of new customers increased by 428% last year to 3.7 million lives, a drop in the ocean for China. The operation is still loss-making but is expected to reach break-even during next year. Adrian emphasised that they are more focused on building a solid foundation than becoming profitable as soon as possible.

Over the last two-years the Discovery share price is flat, but since January they are up 25%. Part of the concern was that Discovery would need to do another rights issue to fund their international growth and the bank that they are launching in South Africa (expected for the second quarter of 2018).

As the year has gone on it became increasingly clear that a rights issue was not needed.

The stock is not cheap at a P/E of 21, when earnings only grew 8% last year. Going forward though, they have a long pipeline of strong profit producing businesses. Their 'emerging businesses' will become more established and

the Chinese division has the potential to become their most significant profit centre. We back Adrian Gore's vision for the company and their world-leading IP. A buy in our books.

Linkfest, lap it up

Byron's Beats

Because we are in the industry of equities,

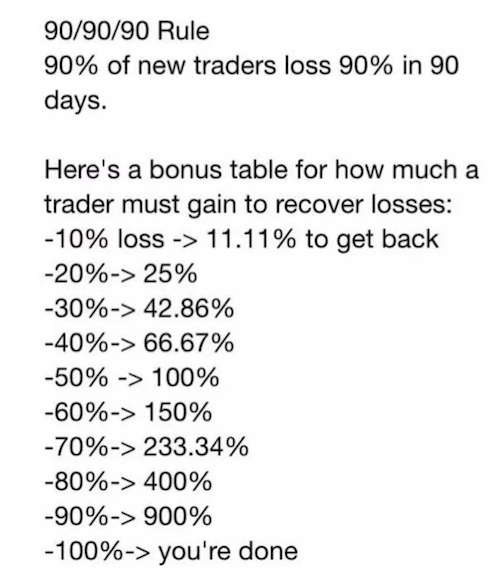

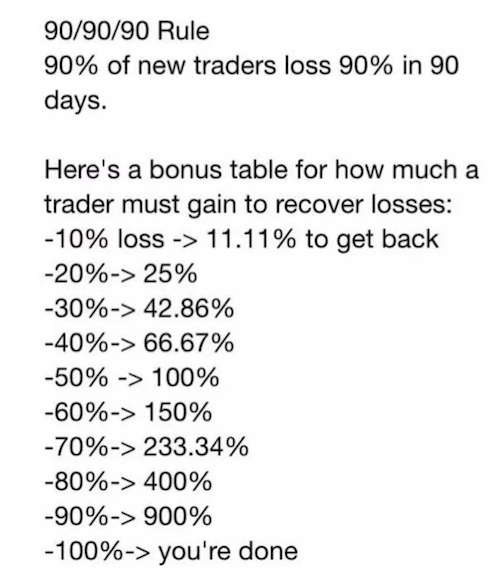

we often get inquiries about trading the market. Most of the enquiries come from inexperienced youngsters who have seen glamorous adverts about getting rich quickly from trading, especially forex trading.

I like to compare trading to playing golf. Anyone can do it but it takes years and years of practice to actually make money from it. And even with all that practice, many people will still end up losing. It is very difficult. We may have shared this image below before but it deserves another mention. It is called the 90/90/90 Rule of Trading.

Home again, home again, jiggety-jog. Asian markets are all in the red this morning, along with our market which opened down 0.3%. OPEC are meeting today, people in the know don't expect anything new to come of the meeting. With Brent trading at $56 a barrel and the Rand in the $/R 13.20's range, a petrol price hike is probably on the cards next month. Enjoy your heritage weekend; I will be putting a big piece of meat on a braai for my heritage day.

Sent to you by Team Vestact.