"He (Robert Johnson) went into business with a fellow called Seabury, back in 1873, selling medicated plasters. In other words, the precursor to the bandaid. In a few short years they were a global business, Robert promptly went to the World Fair in Philadelphia in 1876, where a large gathering of doctors (the biggest in US history) heard of the business more widely than before."

To market to market to buy a fat pig That was kind of unexpected. The Reserve Bank governor and the Monetary Policy committee team surprised the market with a 25 basis point cut in the repurchase rate, effective from this morning. I wondered what tough job these folks had taken, the fact that they are willing to stick their neck out in a very "fluid" environment and what that means. I suspect it doesn't matter where you are in the world, being a central banker is a tough old task. Anyhows, here is the -

Statement of the MPC, which includes the reasoning behind (four votes for and two votes for no change) the 25 basis point rate cut, to 6.75 percent. An

"improved inflation outlook and the deteriorated growth outlook", you knew that though.

The SARB in their expectations sees low growth and moderating inflation through 2019. They see core inflation below 5 percent, which may well give them room to manoeuvre more, should that base case stay the same. Confidence is out of their control, as is the political landscape, both those are linked currently. A return in confidence would be the best kind of stimulus that this economy needed, I suspect that for many businesses, December (16-20) and the ANC National conference couldn't come quick enough.

The upshot of it all was definitely a market caught off guard. The Rand weakened - yields lower, marginally less attractive, weaker economic outlook - which boosted the market somewhat. Equally, consumer sensitive stocks were boosted, at the top of the majors were the likes of Woolies and Tiger Brands. The stocks in the negative column included the likes of Anglo American and Amplats. Vodacom was also there, notwithstanding what looked like a decent quarterly update. We will look into that one in a bit.

Session end the Jozi all share index had rallied over one-third of a percent, financials added six-tenths, whilst resource stocks lagged, draining the last close by two-thirds of a percent. There were new 12 month highs for the likes of Discovery, Clicks and Vodacom (before the stock turned tail), there was a new 12 month print for AngloGold. We are back at levels not seen since May this year, and first seen in May 2015. It has certainly been a tough old slog out there.

Stocks in New York, New York closed the session mixed,

another score for the nerds of NASDAQ, that index up marginally, just shy of one-tenth of a percent. The broader market S&P 500 lost one-fiftieth of a percent, they may as well of stayed at home. The Dow Industrial Average closed the session out a little more than one-tenth of a percent lower. Microsoft and Visa reported numbers post the market, for Bill Gates' empire the stock first popped and then settled a little lower, the conversion to the cloud based environment has worked really well for Microsoft. And of course their users, who get to benefit from being anywhere and having the ability to login and enjoy their files and emails.

Visa reported numbers after-hours, the stock ticked up a little after what was a pretty good beat in expectations, the stock is nearly at 100 bucks, can you believe that? Since the company has been a seperately listed entity, it is up nearly six-fold, in less than ten years. We will take a more detailed review and then revert in the coming days, normally the overwhelming feeling is this business is a long term hold. Electronic transactions are going to replace cash and checks (cheques).

Company Corner

Johnson & Johnson or JNJ if you like, reported numbers for their 2nd quarter of their 2017 financial year earlier this week. The history of any business always fascinates me, in this case there were three brothers (obviously called Johnson), the eldest became a pharmacist and went to NYC to start a career as a drug salesman. He (Robert Johnson) went into business with a fellow called Seabury, back in 1873, selling medicated plasters. In other words,

the precursor to the bandaid.

In a few short years they were a global business, Robert promptly went to the World Fair in Philadelphia in 1876, where a large gathering of doctors (the biggest in US history) heard of the business more widely than before. It was there that Robert Johnson learnt about antiseptic surgery (from Dr. Joseph Lister), and was taken with the idea. Not all were struck with that, it was a long time ago, remember. 10 odd years later, Robert teamed up with his younger brothers, James and Edward Mead to form JNJ. Making what? Mass produced sterile surgical supplies. Treated gauze made infection less likely, remember that this was a time before antibiotics.

Today the company is synonymous with health and well-being, some of the products are part of many middle income households across the globe, the company estimates that their company touches the lives of a billion people a day. Many of the products find their space inside of hospitals and medical centres, they have

three distinct and separate businesses. Whilst we often associate the billions in use with the technology companies, this business certainly has the reputation and history to continue to advance medical science for the better of their customers. And their shareholders,

JNJ have increased their dividend payment every single year for 54 years. Forget all the stock market and economic gyrations in-between, the company has still delivered to their shareholders.

Their three businesses consist of the following, firstly

the consumer segment, which is the best known of the lot, brands include Listerine, Neutrogena, Pepcid, Clean & Clear, Stayfree, Carefree and of course Band-Aid. Then there are other brands like Tylenol and Sudafed, over the counter drugs that are well known globally. Who hasn't used JNJ products when they had (or were) kids? In their

Pharma division, the biggest of the lot, there are

five key segments, immunology, infectious diseases and vaccines, neuroscience, oncology and cardiovascular and metabolic diseases. The

Medical Devices segment is a competitor to another recommended stock, being Stryker. All sorts, a copy and paste from the annual report:

"products used in the orthopaedic, surgery, cardiovascular, diabetes care and vision care fields."

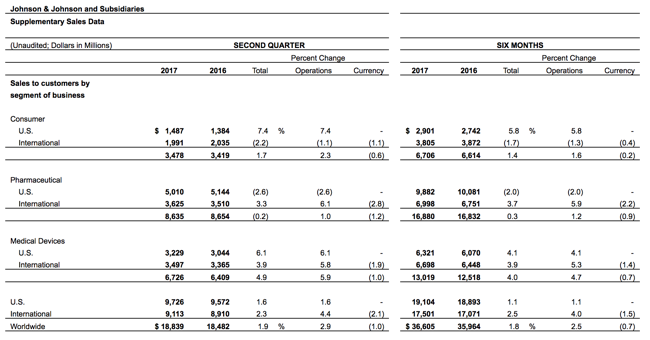

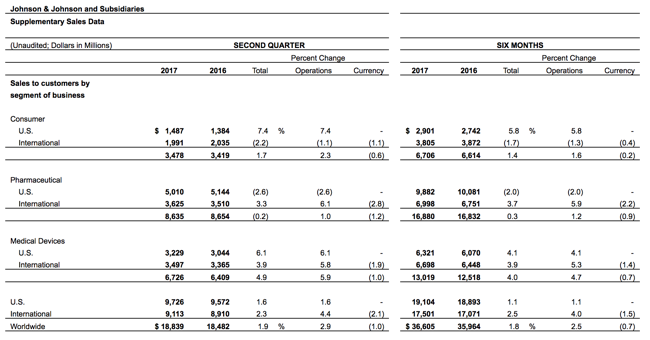

Here is a breakdown of their sales by region and segment:

The business is basically more than half the US, and mostly pharma at that. There has been calls over the years to unbundle or break the business up into the separate entities, to "unlock" shareholder value. We think that the business is better together, steadier and stronger, less volatile. JNJ also has a strong pipeline of 10 new products by 2019 (each expecting sales of 1 billion Dollars plus), as well as an additional 40 "line extensions" by that date too (10 of which will potentially have sales of 500 million each). I suspect that even though many consider the business "boring" and less exciting than some of the other biotechnology sector, there is a LOT to be said for "steady".

The company also updated their guidance:

"The Company increased its sales guidance for the full-year 2017 to $75.8 billion to $76.1 billion. Additionally, the Company increased its adjusted earnings guidance for full-year 2017 to $7.12 - $7.22 per share." So where does that leave us, from a valuations point of view? The share price is roughly 135 Dollars. With those earnings, the stock trades on 18.7x at the top end of the range. The dividend is 84 cents a quarter, pre-tax that equates to just shy of 2.5 percent. It is neither cheap, nor is it expensive, Goldilocks obviously washes her hair with the Johnson's baby (golden) shampoo, no more tears.

It is always a good time to own this business. Their unblemished track record is something that they are no doubt very proud of, and perhaps the envy of their peers.

If you are looking for the blue in blue chip, look no further.

Linkfest, lap it up!

As the world of entertainment moves online in a big way, one of the major hurdles is how to protect your content -

4 in 10 Premier League Fans Stream Illegally.

You will find more statistics at Statista

The below graph might be for the US

You will find more statistics at Statista

The below graph might be for the US but it is a good reminder of how varying peoples views on politics and policies can be -

Most Republicans Say Universities Negatively Impact U.S.

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. Across Asia stocks are all lower, we should expect the same here today. Tencent is up a smidgen after having touched 300 HK Dollars yesterday, no mean feat! The reaction in the aftermath of the rates decision will no doubt be felt today .....

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

You will find more statistics at Statista

You will find more statistics at Statista

You will find more statistics at Statista

You will find more statistics at Statista