"Since March 27, 2000, there have been some massive changes in the technology world. Amazon stock is up 1 312 percent. Apple stock is up 2 949 percent. The market cap of Amazon is nearly half a trillion Dollars (which would be a first), Apple is currently 790 billion Dollars. Alphabet has a market cap of 687 billion Dollars, Microsoft is last at 569 billion Dollars and Facebook is 485 billion Dollars."

To market to market to buy a fat pig We finally made it! 6324 days since the S&P IT index was last at these levels. Or to be precise, the S&P IT index has not been at these levels since March 27 2000. That was the prior all time high, this is the new fresh high. Seventeen years plus is a very, very long time. Obviously the composition of the index now and then is very different, back then the raging bulls were the likes of Oracle and Intel, Microsoft, IBM and Cisco. Want to know how those stocks have done since then? Me too.

Since then Oracle is down 41.4 percent. IBM (would you believe) has seen their stock price up 21 and a half percent since that date, Cisco is down a hefty 59.8 percent since way back then. Intel is down 50 percent, Microsoft (who reported numbers last evening) is up 32.25 percent since back then. Only Microsoft is trading at an all time high, the other giants of yesteryear may have to wait a decade or so to get back to those go-go days. Obviously the likes of Apple, Alphabet (Google), Facebook, Alibaba and Visa are the heavyweights these days, back then only Apple was listed.

The measure of an index often excludes the finer details of the change in the composition over time. It is easy to say something like "yeah, I like the technology sector" and then miss that the constituents have all changed over what is nearly a generation. A generation, by the very definition is somewhere in-between 22 to 32 years, let us call it 27 for ease of math. A generation is obviously the average age difference between parent and offspring. Roughly speaking, don't hold me to it.

Mark Zuckerberg is 33 years old, Bill Gates is 61 years old, they are a generation apart. Interestingly, Warren Buffett is 86, he is roughly a generation older than Bill Gates, his good friend.

Perhaps the Zuck and Bill Gates could become friends one day?

Since March 27, 2000, there have been some massive changes in the technology world. Amazon stock is up 1 312 percent. Apple stock is up 2 949 percent. The market cap of Amazon is nearly half a trillion Dollars (which would be a first), Apple is currently 790 billion Dollars. Alphabet has a market cap of 687 billion Dollars, Microsoft is last at 569 billion Dollars and Facebook is 485 billion Dollars. Forget what the market values these businesses at, the internet really did change the way that we communicate and do business, as well as various other entertainment streams. And advertisers had new channels, the older established ones had to try and stay relevant.

Many things changed. Hardware, software, virtual reality, augmented reality, the list goes on. Many things didn't change, you may still wake up in the morning, still shave with the same razor brand and wash your hair with the same brand shampoo. You still eat the same brand cereal. You may still have the same friends, I hope so at least. Some things change rapidly and some stay the same. Heck, you may still cut your hair in the same way as you did 17 years ago, and still go to the same hairdresser/barber. Hand up if that is the case ...... You will probably still like your tea or coffee the same, and still have a favourite drink/meal that hasn't changed. For all those stable things there is a Kindle, an iPhone, Facebook, Instagram, Twitter, and even things since then that became "so last year", think about your palm pilot, your Blackberry .... sniff.

More to the point, whilst owning an index can be a way of protecting against volatility, it seems that this is not always the case. Single stocks and ownership of those, has worked out "better" in the long run, making sure that you pay attention to the details of the world around us. For more on this fascinating "new high" is the WSJ article

Tech Stocks Eclipse Record From Dot-Com Era and the FT take on the same subject:

US tech sector surges past its dotcom era peak.

Session end in New York, New York, stocks all closed in the green, the Dow Jones Industrial Average added just over three-tenths of a percent, the broader market S&P 500 added a little over half a percent whilst the nerds of NASDAQ were better just shy of two-thirds of a percent gain on the day. The NASDAQ understandably is trading at an all time high, as is the S&P 500, the Dow Jones is 41 points away from the all time highs. The aforementioned IBM reported at the end of the prior session, once again missing revenue estimates and guiding to a level that Mr. Market still doesn't think is achievable. 21 consecutive quarters of declining revenues hasn't quite been arrested yet, I am pretty sure that they will "get there". For the time being, this old tech company (106 years old) is struggling to reinvent themselves. See?

Stocks in Jozi blasted through the 54 thousand mark, for the first time since late May, courtesy of a charge by some of the majors across the board. The likes of Shoprite and Bidvest were buoyed by a lower inflation read, Naspers got a strong lift from the Tencent stake, that stock traded at a record high in Hong Kong yesterday. That stock (Tencent) is up another half a percent today, having crested 300 Hong Kong Dollars for the first time. Whilst Tencent looks perpetually expensive on a 53 multiple now, the PEG ratio is "reasonable" as a result of earnings that continue to power, quarter in and quarter out.

Stocks in the losers column (there is always a loser) were the likes of Mediclinic and AB InBev, as well as Reinet, perhaps taking some heat as a result of a firmer currency. On balance it was up and away, Vodacom, Clicks and Adcock, as well as Capitec all touching new 12 month highs. Not so lucky for AngloGold Ashanti, a new 12 month low, more uncertainty in the mining sector means that a large gold miner with South African exposure becomes an unattractive investment proposition.

Talking of being in an unenviable set of boots, the Central Bank ends their meeting with an announcement that rates are likely to stay on hold at this point in time. Even though it looks like inflation is becoming more benign than before, the uncertainty around another ratings downgrade looming means that caution could be the watchword. There may well be a case to be made for a rate cut and I am sure that the decision will be closer than before. The economy could do with a little more than a shot in the arm though.

Linkfest, lap it up!

One criticism of Wall Street is a lack of accountability. The wheels of justice may be turning slowly for the big banks but there are turning -

The bill for banks behaving badly since the financial crisis: $273 billion and counting. The next step is for these banks to claw back bonuses from their employees for these dodgy dealings.

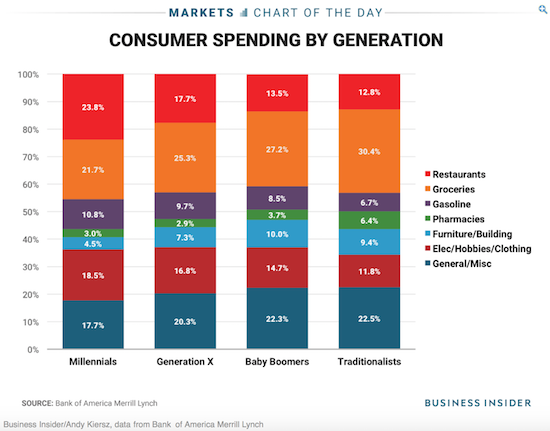

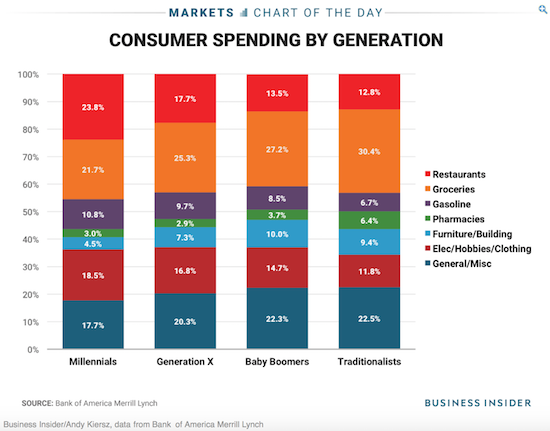

Each generation spends their money differently due to them having different priorities -

This chart reveals a huge difference in how millennials and their parents spend money. Millennials seem to care more about experiences than previous generations. As it stands, millennials have a lower home ownership rate than previous generations, partly because of not being able to afford a home and partly due to the desire to move around and have experiences before being rooted down by property. Will be interesting to see what happens when millennials start to inherit houses, what will they do with them?

There are periods when the market is too low

There are periods when the market is too low due to irrationally high levels of fear, or the market is too high due to greed blinding all. Most of the time the market is in a range of being mostly efficient -

Markets Are Right More Often Than You Think. Efficient means that the prices reflect all the available information at that point in time but given how no one knows what the future holds our predictions about the future are wrong to varying levels, hence prices change as information rolls in.

Home again, home again, jiggety-jog. Stocks across Asia are higher on balance, the European futures market points to a generally positive mood. Rates later, the ECB is also "in focus" today, some expect more intel on the tapering program.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.