"Revenues of 22.2 billion Dollars produced net income of 5.8 billion Dollars, diluted earnings per share clocked 107 US cents, up 6 percent from the prior reporting period. Total average loans grew only a percent to just shy of 957 billion Dollars, what is more interesting is that net deposits grew 5 percent to 1.3 trillion Dollars."

To market to market to buy a fat pig A magic weekend for fans of the Lions, The Fed (the real one, see the WSJ article -

Roger Federer Is Just Ridiculous) and the Proteas (thanks Faf). Equally, a magic weekend for those watching and feeling the afterglow of the new record highs for the US equities markets, both the Dow Jones Industrial Average and the broader market S&P 500 climbed to record highs. The reason given was "investors see rates lower for longer".

Now, without being too critical of the headlines, investors do not "invest" around what the Fed say and do. If you were in the business of trying to second-guess the Federal Reserve and what they are likely to do next, then you may well find yourself in a deep hole over the last half a decade plus. The main reason was an inflation read Friday, which suggested that the CPI was flat from the prior month. Flat as a pancake.

And that means in terms of the Federal Reserve dual mandate, they can continue to be patient with low rates.

The "other" thing that happened Friday was the start of earnings season. And in this case, one of our recommended stocks kicked off alongside two of the other big banks in terms of earnings for the second quarter of 2017. Earnings quarter is my favourite season, and seeing as I have never watched a GOT series (or episode) in anger, it may well be that it may be my only favourite season. No, I lie, Seinfeld reruns are currently on, and I find those hugely entertaining, even if the hairstyles and clothes are just "terrible". Then why did we wear them? They were cool at the time.

Session end the Dow closed up four-tenths of a percent, the broader market S&P 500 nearly half a percent on the day, whilst the nerds of NASDAQ (remember the June slump?) added just over six-tenths of a percent by the time the bell rang for the close. JP Morgan, although ending the session lower, posted a record setting quarter as far as their numbers were concerned - see the BusinessInsider -

JPMorgan beats, posts record-breaking quarter. The guidance part was what Mr. Market was focusing on, and why not ..... that is the nature of the equities market. The other company that reported numbers that we are more interested in is Wells Fargo. We will go into details in a minute or two, see below.

Locally stocks mounted a comeback from mid afternoon when we were off a smidgen, we managed to close out the day at the highs of the session. The Jozi all share index added over half a percent, a broad based rally for stocks across the board. Of the movers and shakers, Mondi was the biggest loser followed by AB InBev, the stronger currency dragging them lower. In the winners column was a diverse bunch, Nedbank, Anglo American and Amplats, as well as Discovery and PSG all rallied around one and three-quarters of a percent or better. There were more new 12 month highs, the likes of Vodacom and Clicks, as well as Adcock Ingram all during the trading session touched their best levels in a month.

There is not too much on the corporate front as far as South African businesses are concerned, you get the sense that a lot of introspection is currently taking place and that is definitely related to the environment as it exists currently. There are some businesses that use an economic down cycle to shed unnecessary costs, sadly that comes at a human level. As we discussed last week though, if you leave the business to idle along, you are stuck with bigger problems further down the road. Businesses owned by shareholders in a public environment mean that they are more nimble, there is no politics involved. They can and do make the hard decisions quickly. Public businesses .... not so much.

Company corner

Wells Fargo reported numbers Friday, before the market opened, here is the news filing -

Wells Fargo Reports $5.8 Billion In Quarterly Net Income. Revenues of 22.2 billion Dollars produced net income of 5.8 billion Dollars, diluted earnings per share clocked 107 US cents, up 6 percent from the prior reporting period. Total average loans grew only a percent to just shy of 957 billion Dollars, what is more interesting is that net deposits grew 5 percent to 1.3 trillion Dollars.

It always boggles the mind that with the lowest rates historically in US history, that cash deposits are still growing. Is it perhaps a lack of confidence in both individuals and businesses to borrow, scared by the events of nearly ten years ago now? Once bitten, twice shy. Why would people not want to take more risks in an environment like this? Or, is it more likely that we are in the early stages returned confidence which may well coincide with the Fed hiking rates. If ever you needed a sign that generally "things" are not white hot, this certainly is a pointer. The company does offer some pointers as to what is happening -

"growth in consumer and small business deposits was offset by lower commercial deposits."

There are many areas in which the bank can change customer experiences and massage them towards the "less physical". In other words, there are just under 6000 retail bank branches across the US, and the company employs 1 out of 500 people with a job in America. That number equally boggles the mind. They (Wells Fargo) according to their fact sheet, employ over 270 thousand people (271 thousand to be exact). The company has identified 2 billion Dollars in savings, including my bugbear, corporate travel. Of course, for client events, all good. Annual savings of 100 million Dollars:

"Reduction in non-customer facing travel and expenses with focused efforts on virtual conferences and telepresence, as well as leveraging internal meeting spaces and services"

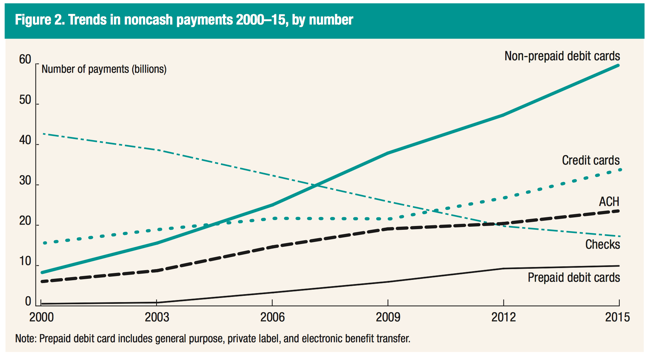

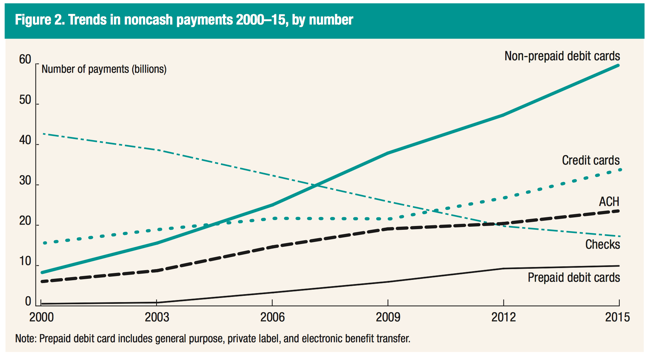

The company will also close 450 branches. That is pretty huge. Most of the savings will come from "Centralization and Optimization". I suspect that the company has reached "peak employment". I suspect that the US consumer has to adapt to evolving payment options, they all exist. The "check" is a thing of the past, and it is reducing at a serious pace, having halved since 2000, according to a Federal Reserve release -

The Federal Reserve Payments Study 2016:

ACH stands for automated clearinghouse. With fewer physical branches and more automation, that may not bode well for the staff at Wells Fargo and future employment, I think that it bodes really well for cost savings and a general better consumer experience. South Africans are well used to not going to branches and being able to exist without cash, it is a mindset shift that will take place.

The stock is not particularly expensive at current levels, the market is expecting around 4.15 Dollars in earnings for this year, and 4.52 Dollars for next year, putting the stock on a multiple of closer to 12.2 X next year's earnings. The yield is around 2.8 percent (two and one-quarter percent after dividend withholding tax), which is pretty handsome in an environment in which you can expect that to creep higher. And that is on account of the Fed having loosened requirements. Traditionally at Vestact we have been reluctant to own banks and financials, too many issues and too cyclical. We have however picked the best quality of the lot here, and they have come through a pretty trying time from a reputational point of view. We continue to accumulate what is a fine business.

Linkfest, lap it up!

Think you are hooked and that is a "bad thing"? We are talking coffee here friends. Fear not, this has been widely circulated last week,

the overwhelming feeling is to stay long Starbucks -

Two big studies bolster the claim that coffee – even decaf – is good for you

Growing fruit out of a container? In the Northern Hemisphere it is trickier, the weather is worse in January. There is possibly going to be more of this

This shipping-container farm could someday solve the food desert problem. Vertical farming, I suspect that there is going to be a "lot" of that in the future.

I loved this -

How Amazon Prime Day Compares to Other Shopping Bonanzas. What is quite interesting is that this graphic from the Visual Capitalist is that

Chinese Singles Day dwarfs Amazon Prime Day. Astonishing.

Home again, home again, jiggety-jog. Stocks have started mixed here, earnings season is starting in earnest this week, with a bigger and more exciting week after that. Stand by sports lovers! As for the forests of Nottingham, let us hope the English top order can't see the wood from the trees.