"Democracy itself is a very new concept, much of the world does not practice full blown democracies with all of the freedoms that others enjoy. For example, in Sweden, Norway and Iceland, as well as New Zealand and Denmark (and throw in Canada), those countries score really highly on the pillars of democracy, functioning government, civil liberties, political participation, functioning of government and electoral processes and pluralism. There is absolutely no coincidence that the countries that do score high here are rich."

To market to market to buy a fat pig It is Bastille Day today. The reason that Trump and Macron get to have their awkward moments together (anti-bromance) is simple, Trump is in Paris to see US troops march ahead of the normal French festivities, celebrating the 100 year entry into WW1 by US troops. Some of them are even going to be wearing WW1 helmets. Only 200 odd folks from all the military departments, it is a "sign" of continued French-US relationships, something that dates back to those first moments when people decided to storm the Bastille, and set in motion democracy in some sense in a Europe that was still dominated by Monarchs. Of course the Greeks and Romans may have something to say about that. And remember that the British monarchs managed to transition to democracy with a far easier path. Let them eat bread!

There are still 12 monarchies in Europe. There are very few absolute monarchies (and theocracies) in the world. Democracy itself is a very new concept, much of the world does not practice full blown democracies with all of the freedoms that others enjoy. For example, in Sweden, Norway and Iceland, as well as New Zealand and Denmark (and throw in Canada), those countries score really highly on the pillars of democracy, functioning government, civil liberties, political participation, functioning of government and electoral processes and pluralism. There is absolutely no coincidence that the countries that do score high here are rich. If you have the freedoms to do whatever you want, with access to capital and your rights fully enforced, then you are of course going to invest and make progress.

The Economist lists those above pillars as the hallmarks of democracy, in the

Democracy Index, as per the Wikipedia entry. From Africa only Mauritius appears in the top 19 Full Democracy category. There are another 56 countries in the "flawed democracy" category, including ourselves, with 6 other African countries (Sub-Saharan). Unfortunately more than half the world's countries are either a "hybrid regime", Turkey, Venezuela and the Ukraine, or a full blown Authoritarian environment. Think Cuba, Russia, Zimbabwe and then the pits, North Korea, Syria and Chad at the bottom of the list. Even China falls into the category. They seem to "function" as a result of a general cause, a collective ambition.

For example, yesterday, (FT story) -

China's best-known dissident Liu Xiaobo dies in custody. If there were full blown democracy in China, would that lead to major global investment? Perhaps it would. Perhaps it would even lead to full blown migration of rich people from China, now that they have their freedoms. Who knows!?

One of my great go-to places on the web for what humanity has achieved, during these trying times, is the

HumanProgress.org Twitter stream, or their

website. Here you can find myths debunked about capitalism and democracy. Here you can see progress made by humanity, notwithstanding the negative narrative. For instance, according to Cap-X, the stat of the day was that in real-terms, the price of clothing in the UK fell 80 percent from 1974 to 2008. No wonder grandad only owned one pair of everything, right?

Of all the "things" that we can be grateful for, democracy certainly is one of the finest achievements. Now, about that military parade and a show of force?

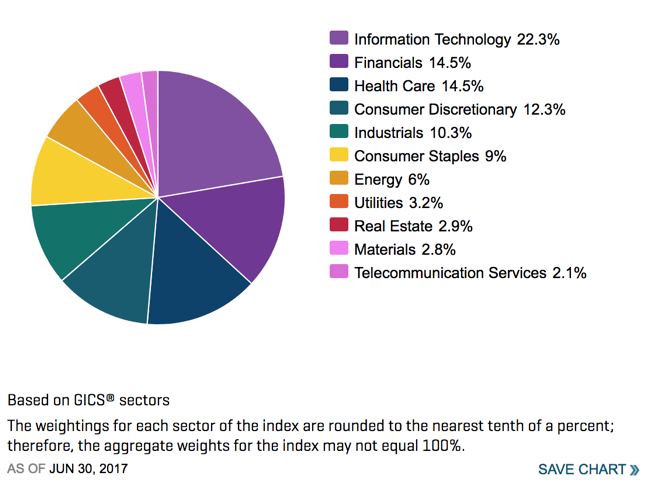

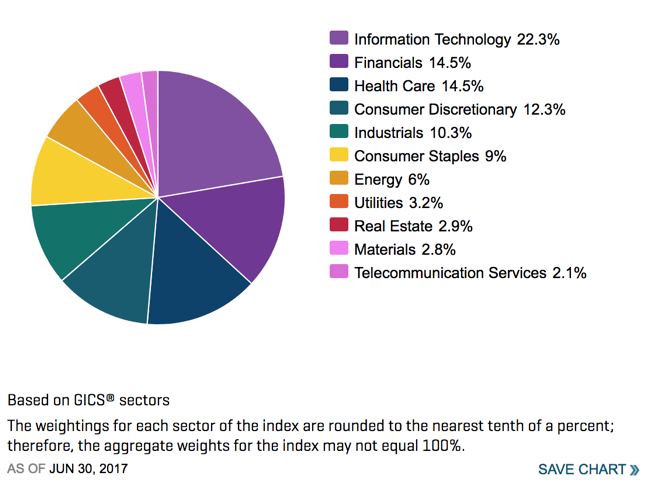

Stocks across the Atlantic Ocean, in New York, New York, closed up, even if just modestly on the day. The Dow Industrials added one-tenth of a percent on the day, the broader market S&P 500 added nearly one-fifth of a percent, and just over one-fifth of a percent for the nerds of NASDAQ. Healthcare stocks fell a touch by the close, utilities slipped around one-quarter of a percent by the end of trade. Apple was a big gainer on the session, technology as a whole over the years has formed more and more a part of the overall index, the S&P 500, see from their website below:

Healthcare and financials are of equal weighting in the S&P 500, technology is now 1 in every 4 Dollars represented in the US. If you drill down a little more, where you can find the weightings inside of the S&P 500, the top constituents of the SPY (

SPDR S&P 500 ETF), which tries to track these things, is as follows, the top ten, which make up nearly 25 percent of all of the top 500 stocks in the US:

It matters mostly to the index what happens to these specific stocks, above.

It matters mostly to the index what happens to these specific stocks, above.

Stocks locally in Jozi added three-quarters of a percent by the end, Naspers and Capitec were at the top of the leaderboards. Kumba and Aspen amongst the majors were at the bottom of the leaderboards, a marginally firmer currency (in response to a weaker Dollar) may have had something to do with that. The minister of Finance was at the JSE, Paul bumped into the entourage. The minister was bravely trying to put forward a 14 point plan ->

Government's inclusive growth action plan. It is in point format there, more detail to emerge. As ever, you can talk until you are blue in the face, implementation is the only thing.

The most important company news on the day was the after-market release of a trading update from Woolworths -

Trading update and trading statement, 52 weeks to end 25 June 2017. They make for "very average" reading. Adjusted diluted Headline Earnings per Share are likely to be between 5 to 10 percent lower (as is HEPS), whilst Earnings per Share is likely to be 20 to 30 percent higher. Why the big variance? They have disposed of a significant property in Australia, Market Street in Sydney.

What becomes apparent is that food sales for their local business is "just fine", the clothing and merchandise division is effectively going backwards (after accounting for inflation). In Australia it looks "okay", with not too much excitement or negative sentiment one way or another. At face value this is reflective of both a tough operating environment here and there (South Africa and Australia), yet it may well be that they have more than enough cash to meet their obligations to shareholders, namely the dividend. And as such the share price is actually up one percent this morning, admittedly just off what are 12 month lows. The results themselves are expected towards the end of August.

Linkfest, lap it up!

This is good news for MTN and Vodacom, the key here is for data consumption to grow faster than the pace of falling data costs -

Mobile subscriptions are still growing faster in Sub Saharan Africa than anywhere else. The next hurdle for these companies will be the costs of 5G installation.

The way I understand it,

DNA is a huge storage bank of data for the building blocks of life. Going forward scientists are looking to be able to store data in DNA as a next generation of technology -

Images can now be stored in the DNA of living things.

Thanks to increased travel and the power of nostalgia, Disney has a booming business -

Disneyland has raised ticket prices 70% to ease crowds - but attendance is soaring

Home again, home again, jiggety-jog. An amazing accomplishment by Paul today, he has completed three straight years of his running streak. In case you do not know what that is, here goes -

United States Running Streak Association. You have to run a mile a day. Paul does that once a week, on a Monday. All the other days are training days. A remarkable achievement, well done. He has run around airports before, and many other interesting places, in order to keep up the daily streak, that is 1097 days. Discipline is a great trait in a sensible investor.

Stocks have started lower to begin with, let us hope the Proteas and the other Fed can put up a monumental display!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.