"I also think that what is lost on many in this argument of a company saving costs is that the above shareholders also act on behalf of their pensioners. They also act on behalf of public servants and entrepreneurs who save with their institutions. The shareholders act for pensioners present and future, teachers, fireman, policeman, etc."

To market to market to buy a fat pig Wow. It was so quiet yesterday in the city founded on gold, part school holidays and part the economy finds itself in a little bit of a quagmire at present. Also, when I went to the JSE yesterday for the usual lunchtime Monday interview at CNBC, the mood was glum. Unfortunately as a private entity, the JSE is under some pressures themselves. As such, they announced staff reductions last week, perhaps escalating them even further in the coming months. It is part of the natural cycles and one MUST be in a position to save the existing jobs in order to make the business stronger when the upswing arrives.

I am always surprised with the response from civil society, it sucks really bad to lose your job and I have a huge amount of empathy for all of those concerned. I really do feel for people who find themselves out of work, mouths to feed, kids to clothe and bonds to pay. There are equally other people working in the business who have the same obligations to meet. If the business is not put on an even keel, and if that means cost savings in the form of layoffs, then by extension you put all the jobs at risk.

The other option is of course to ask for a vote if all want to take a pay cut up to a certain level, i.e. percentage cuts for highly skilled (and therefore well paid) individuals are not the same as percentage cuts for less skilled (and lower paid) employees. At the end of the day,

the JSE is a public company answerable to the shareholders of the business. In the case of the JSE, which was once upon a time member owned, i.e. the stockbroking firms owned seats which were worth a lot. Since the business listed in the middle of 2006, in Rand the stock has delivered a 452 percent return. By global standards, in terms of the overall market capitalisation, we punch comfortably above our weight.

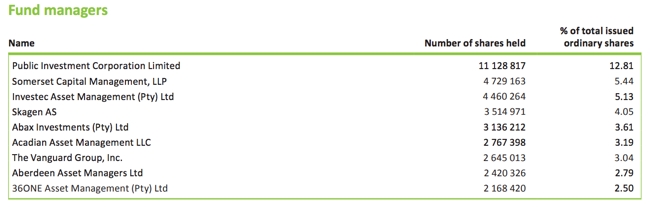

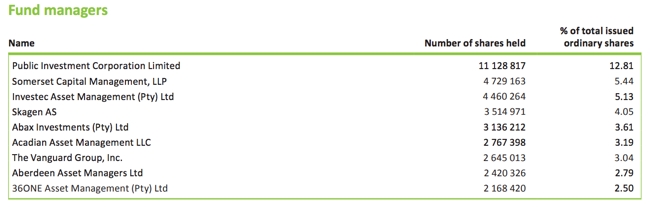

The PIC (as of the end of December 2016) owns 12.81 percent of the JSE.

There are a whole host of global investors who are in the mix, investors who are interested in owning regional stock exchanges, looking for mergers and acquisitions (it has always been a desirable place). Here goes the complete list from 31 December (I am very sure it has changed):

I also think that what is lost on many in this argument of a company saving costs is that the above shareholders also act on behalf of their pensioners. They also act on behalf of public servants and entrepreneurs who save with their institutions.

The shareholders act for pensioners present and future, teachers, fireman, policeman, etc. and of course need to act in their best interests too. The funds have the flexibility to buy and sell at the drop of a hat. Or they can choose to be part of the business, part of the journey. Shareholders have rights, employees have rights, the balance means that sometimes jobs are shed in order to meet the obligations of the savers (the shareholders) and the future salaries of the current and left over employees.

As CEO Nicky Newton-King said in the release Friday:

"on a macroeconomic level, the country continues to be plagued with low economic growth, rating downgrades and a loss of business confidence. This has negatively impacted financial market activity this year." She also said something that is worth exploring, I am not sure where to begin, it is worth thinking about:

"In addition, global securities exchanges and other players in the financial services industry are changing the way in which they operate in response to regulatory and technology developments." Is this the rise and advent of the ETF and that means lower trade volumes for the JSE? I am not entirely sure.

So ..... the JSE have to get rid of a lot of technology staff, perhaps that due to the fast tracked pace of technology, the machines have been harder at work. Perhaps. Without knowing the full story of what is going on in the background. It is just a sign of the times. Equally, it is no good for a business to fall on bad times and then worse times, losing many more jobs and destroying longterm capital. Get my drift?

Session end here in Jozi, stocks closed up over half a percent in a pretty broad based rally. Resources added comfortably over a percent to the mix. I was having a cursory glance at the JSE construction and materials index, the ten year performance. This time a decade ago, we were all feverishly preparing for the World Cup Football in 2010, construction of multiple facilities was ongoing.

Construction companies had a lot of work. Fast forward ten years and stocks are DOWN nearly 75 percent since then.

To say that this is an industry with huge troughs and peaks is an understatement, this is truly a business that is either feast or famine. For private and retail investors it is a sector that we tend to avoid altogether, far too cyclical and the margins are razor thin at best. To put that into perspective, gold miners are down 53 percent over that time.

When investing, it is sometimes the sectors that you avoid that is just as important as the sectors that you pick. We prefer healthcare, consumer related activities (from luxury to household consumption) and technology, which in itself is broad.

Stocks in New York, New York were mixed by the close of business last night, the Dow Jones falling a bit at the death. Although hardly, down 0.03 percent at the close, healthcare stocks and utilities were lower as a collective, basic materials and technology stocks were the main winners. Many of the majors rallied hard, Amazon, Alphabet (Google), Facebook and Apple were all amongst the major gainers on the day. The Nerds of NASDAQ closed out shop up nearly four-tenths of a percent. The broader market S&P 500 tacked on around one-tenth of a percent by the time all was said and done.

Some fringe (yet somehow BIGLY) news was that Snap Inc., the owner of

Snapchat, closed below the IPO price of 17 Dollars a share for the first time. Snap has only been listed since March, the stock price from the highs of 29.44 Dollars a share is now 16.99 Dollars. How so? The same issues that Facebook faced once upon a time, monetisation of their platforms.

I can understand how many would want to advertise on the Facebook platform, my concerns for Snap is their user base. Let me try and explain. Twitter attracts many eyeballs, and many professional ones too (people who work, etc.) and they have struggled to monetise their platforms effectively. Snap is directed at millennials, perhaps who do not have the same amount of spending power as Facebook and Twitter users. I think that Snap is fun and addictive, it may not necessarily be the investment of a lifetime though! We prefer Facebook by a country mile.

Linkfest, lap it up!

One of the problems with social media is that we generally only come across views and arguments that we agree with. Even though it is global we still live in bubbles, these bubbles have a big impact on the way that we then see the world -

One graph shows how morally outraged tweets stay within their political bubble.

When we think about the internet we generally think of something that wirelessly reaches our computer and cellphone where we connect to data stored in the cloud. We generally forget about all the cables needed to connect us to the rest of the world and to massive data centers -

Animated map reveals the 113,000 miles of cable that power America's internet.

This technology sounds like a novel idea, my only question is "Who will the customers be?" Might be useful in more rural areas where electricity is hard to come by -

Researchers create a 'battery-free' mobile phone.

Home again, home again, jiggety-jog. Stocks across Asia are pretty mixed at present, Tencent is up over two and one-third of a percent, that should at least give us a decent start with Naspers being a big constituent of the overall index. On that note, we should start better!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.