"Whoa! Deutsche Bank has been in the news for all the wrong reasons lately. Mostly concerns on whether or not their capital requirements would be met, in the event of them having to pay this monster 14 billion Dollar fine that is pending."

To market to market to buy a fat pig Whoa! Deutsche Bank has been in the news for all the wrong reasons lately. Mostly concerns on whether or not their capital requirements would be met, in the event of them having to pay this monster 14 billion Dollar fine that is pending. Where does the fine stem from, i.e. what prompted the regulators to think that they could fine a German bank, in the US, that amount of money? What did the institution do that was that wrong? It stems back to the time before the financial crisis and the mis-selling of mortgage securities. i.e. The bank knew that the securities that they were holding was a turd pile and sold it to unsuspecting investors, misleading them. So I guess it is a lie, if you mislead someone, there should be some call back of some sort, including a fine from the pockets of shareholders that were supposed to be overseeing all. And the management of Deutsche? That is another story.

Citi was fined 12 billion Dollars in a similar case in 2014, eventually settling for 7 billion Dollars. Goldman Sachs settled a 5.06 billion Dollar fine for something very similar, in April of this year. Let us just say that despite the fact that there have been very few high profile cases resulting in jail time of any senior staffers at these institutions, the shareholders have been obliterated in some instances. Deutsche Bank have already paid 1.9 billion to settle a case in which they sold mortgage backed securities (turds at the time) to Fannie and Freddie, which essentially were government institutions tasked with keeping mortgage rates low in the USA. Their job (Fannie and Freddie) is to buy packaged mortgages.

In fact, let Freddie Mac tell you what they do, as per their website:

"Freddie Mac was chartered by Congress in 1970 with a public mission to stabilize the nation's residential mortgage markets and expand opportunities for homeownership and affordable rental housing. Our statutory mission is to provide liquidity, stability and affordability to the U.S. housing market. We participate in the secondary mortgage market by purchasing mortgage loans and mortgage-related securities for investment and by issuing guaranteed mortgage-related securities, principally those we call PCs. The secondary mortgage market consists of institutions engaged in buying and selling mortgages in the form of whole loans (i.e., mortgages that have not been securitized) and mortgage-related securities. We do not lend money directly to homeowners."

So ... their job is to help the little guy. And when the big banks offloaded mortgage backed debt that wasn't what they said it was (a fault of a combination of parties, including the ratings agencies, people not doing their homework and the banks themselves), this impacted on middle America and their ability to be able to service those loans. i.e. the worse the quality of the mortgage book, the worse for home owners ability to get decent mortgage rates. So I can understand why these government agencies are still under

Conservatorship, 8 years on from the mortgage crisis.

One of the main aims of the current chief, John Cryan, is to close the four biggest litigation cases against the bank. Spending time fighting the long arm of the law hardly sounds like a very productive way of doing business. The stock is down nearly 93 percent (the ADR program in New York) from the middle of May 2007, a long time ago. When these practices were happening no doubt. The stock is nearly half of what they were when the market bottomed in the first quarter of 2008. The Deutsche Bank ADR traded at an all time low last evening in New York trade, the Frankfurt listed entity is likely to trade at another all time low today too.

Someone on Twitter pointed out that Twitter has a larger market cap than Deutsche Bank. How? Germany's largest bank, and the biggest investment bank in Europe. Sigh. Meanwhile, Commerzbank, the second biggest bank in Germany is shedding one in five workers, suspending the dividend, and doing other restructuring which includes winding in their securities trading business.

I suspect what will happen is that there will be a whole lot of scrambling going on in the background to assure the general public and more importantly the funders of the bank that everything is going to be OK. The company needs to settle quickly with the regulators. The company possibly needs to act really quickly to shore up confidence and if that means drastic cost cutting and worst case scenario a combination with their aforementioned Commerzbank. And the bondholders taking a haircut, it seems too politically incorrect for the German government to step in and shore up reserves at Deutsche Bank when they suggested it shouldn't happen elsewhere. There have also been suggestions that the bonus pool and forfeited share options could save the bank 2.8 billion Euros. Desperate times call for desperate measures, that could and should be the first port of call. And perhaps some fire sales of Chinese assets. Cryan wants more time, he may have to scramble with every minute he has currently.

The upshot of all these liquidity concerns last evening, halfway through the session, led to a broad based sell off of many stocks. Financials sank nearly a percent and a half, Deutsche leading the charge amongst the majors, down six and two-thirds of a percent. Citi fell over two and one quarter of a percent, Wells Fargo sank over two percent as their chief was grilled in DC on the "hill". Sis.

Once again we are left with the impression that bankers are greedy and evil people in society that are there to stick it to the man on main street. That is wrong. Banking, modern banking at that, is a wonderful business that does more for society, contrary to popular belief. Where else would you get a loan to buy a mortgage or a business? Or a credit line? Or a checking account?

Mount Gox where you store your Bitcoins? How did that end?

The Dow sank by over a percent, the broader market S&P 500 gave up 0.93 percent, as did the nerds of NASDAQ. Back at home, stocks had a smashing day, up 1.79 percent by the close. Resources roared ahead, up four and one quarter of a percent by the time all was said and done. Thanks to OPEC, many resource prices rallied in unison, that seems to be reversing a little this morning. In fact, all of the gains from yesterday seem to have been eroded by the jitters around the liquidity of Deutsche Bank. That will pass, I wouldn't get too anxious. We don't own German banks, we don't own any investment banks. There is of course the big matter of confidence, I am expecting something to come out of this weekend, and by Monday, it may well be different.

Linkfest, lap it up

I am not too sure I agree with all of these, interesting nonetheless to see what the website (and futurists) from Futurism thinks

The Most Popular Jobs in a Decade. Get yourself up-skilled to be the job seeker standing first inline in the next decade.

You may have seen what this amazing drone can do before, I am sure that we have included this link here before. It is now commercially available -

Introducing the Lily Camera. Pretty cool hey?

Bloomberg Pursuits has a really cool article on three cities around the world,

Amsterdam, Paris and New York, and what 5 million Dollars will buy you -

What Does a $5 Million Townhouse Look Like in Three Different Cities? Paris the most expensive? If you had a choice, which major city in the world would you live in?

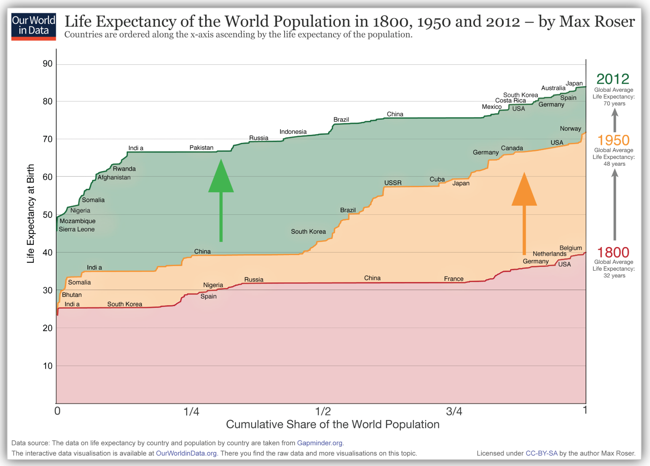

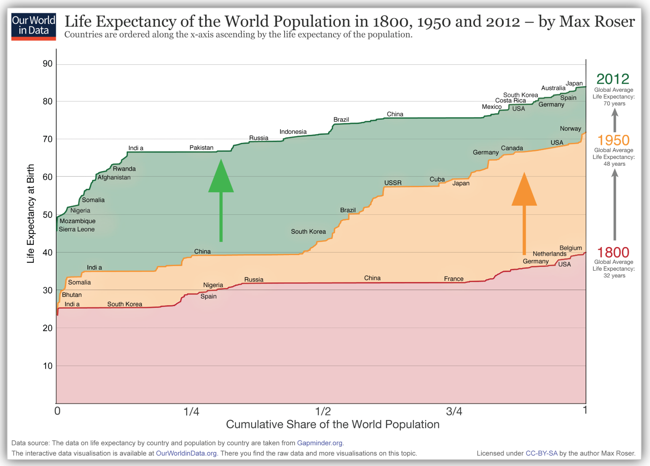

This is a great set of slides from Twitter via Bill Gates, you know him of course from Microsoft, the Bill and Melinda Gates Foundation and of course he is an all round nerd and rich guy. Seems at face value like a good guy. These slides are from Our World in Data -

The Visual History of Global Health. This is the most important slide, from the back end of the slide show -

Life expectancy in all countries in the world is much higher than it was 200 years ago!

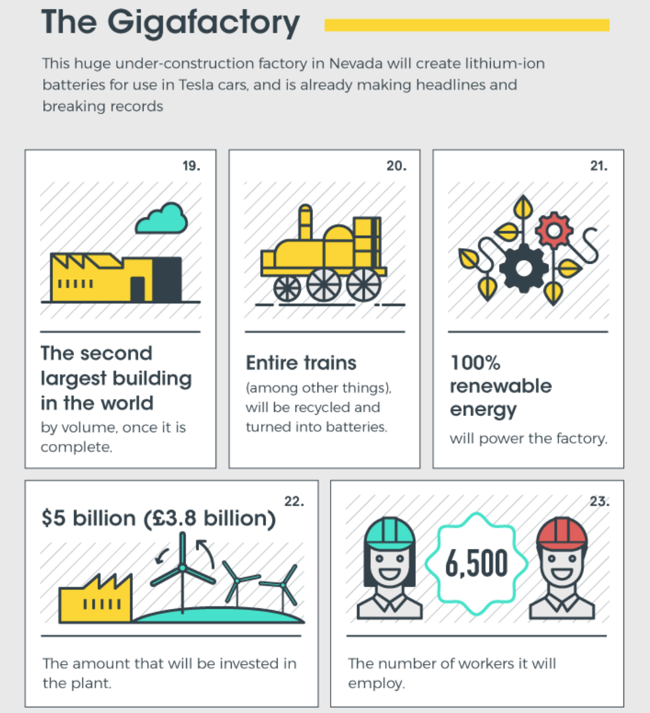

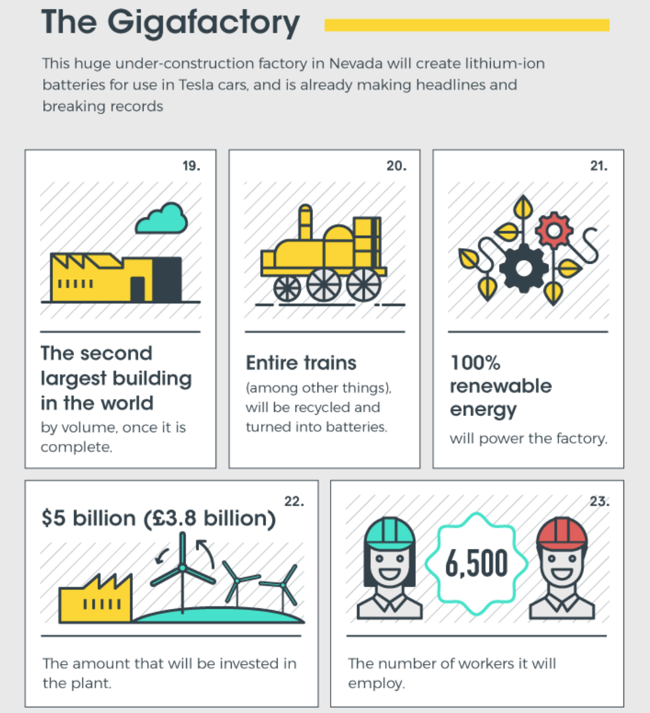

The Visual Capitalist always has cool graphics, you should sign up, it will make your life better. Yesterday they had

41 Interesting Facts About Tesla Motors. These are some selected cool facts (that I am sure that you have seen before) about the Tesla Gigafactory:

Home again, home again, jiggety-jog. The market off the bat is trading much lower, Deutsche Bank is plumbing new lows. I guess that is expected at some level. Sis. What can we do about it? Nothing, do not react, just hold onto the businesses that you have. Last I checked, none of them had dealings with that institution.