"Funnily enough a late winter in both Australia and South Africa took much of the headlines. CEO Ian Moir even said on the radio that they had employed meteorologists to try and predict the seasons. Thats what fast clothing retail has become. Gone are the days when one leather jacket would last you 15 winters."

To market to market to buy a fat pig Yesterday marked the 34th straight day that the S&P 500 moved less than 1% in a trading day. From having a very volatile end to last year and start of this year, we have now had rather smooth sailing since July. Today we might see a bit more movement, there is a GDP number out of the US and Janet Yellen is speaking 30 minutes into the trading session. I don't expect her to say anything that the market doesn't already know and the GDP read will probably be in the ball park of what economists have forecast, so maybe we can make the 1% streak 35 days. The S&P 500 was down 0.14%, The Dow was down 0.18% and the NASDAQ was down 0.11%.

Our market was also in the red yesterday, down 0.14%. Sibanye was down 3.2% yesterday after their 6 month numbers were released. The results were good but the market was expecting a bit more, maybe unfairly so. The stock is up a whopping 340% over the last 12 months. The management team have done well to manage their local assets and then move into platinum when people were running for the exits, time will tell though if that was a master move or not.

Behavioural economics is the only segment of economics that really excites me. To me, Economics is not a perfect science, nor is it math, it is the interpretation of statistics and what it means. If government x acts like y, the outcome isn't always the same as the last time, you have people who can u-turn at the drop of a hat. Governments can spend and reign in spend at the drop of a hat. Individuals react to situations today that have long lasting and reaching effects for tomorrow. For example, the financial crisis forced children to stay at home for longer (their parents may complain, secretly they are happy about it) and delayed plans to buy houses. Houses became harder to buy. Millennials saved more than they spent. Financial institutions were forced to become less risk averse and hopefully never to return to reckless lending.

This is "fun and easy and I am good at it" suddenly didn't exist any more. At a micro level, you can get children in the same family that spend or save, same background, same lessons. Human behaviour dictates that whilst we are given foundations in order to act in a certain way, our hard coded DNA is all wired differently. The Chicago Board Options Exchange tries to measure and replicate "fear and greed", both very different and bad emotions to have when investing in the stock market. When trading, perhaps not so much, this may well be a very good set of characteristics. As I often say, we haven't tried it (trading), so I wouldn't know. Trading I suspect, you either have the knack, or like many golfers who are at the edge of really cracking it (excellent at what they do, just can't make any money), mentally you need it all there.

What makes George Soros tick and what makes Carl Icahn tick are probably very similar and different at the same time. Icahn hustles, Soros may be out and in before you catch wind of it, and he may be telling you very different things. David Tepper, Kyle Bass and John Paulson all essentially made money on different sides of the cycle on essentially the same thing. Bass and Paulson bet against the mortgage market, Tepper bet that banks and financials would recover in the aftermath. Same event, the financial crisis which involved reckless lending and borrowing (it takes two to tango), different trading methodology and same outcomes. Whilst these were "trades", they were also longer dated bets on specific events. In so much that some people won huge, many financial institutions had to hand out pink slips on many a trading desk. The untold stories.

Greed had much to do with the financial crisis. And right now, somewhere and somehow, the next crisis is brewing. Jamie Dimon replied to his teenage daughter who asked what is a financial crisis, that it was something that happened every 6 to 8 years. Economic cycles come and go, the last downturn may have been overdue and far deeper than most expected, what is important is that you do not act with fear as an investor. There is nothing you can do about the economy, there is very little you can do about stock prices of the businesses you own. There is everything you can do about whether or not you should own that specific business, that part is very clear, yet this gets lost in the cloudiness and blur between company and stock price.

Speaking to retail investors is very rewarding, genuinely helping people save for their dreams and meeting goals can be fun for all concerned. Having to act as a shock absorber during the tough times is equally rewarding, provided the thesis remains true and that the desired outcome (in the subsequent earnings bounce back) holds true. It is much harder to tell someone that they should not follow their fear instinct and should "flight". In the case of holding quality equities, your flght instinct is often more valuable in these cases. Fight, as it is right. Quality outlives the troughs of equity markets. Don't let your fright spook you into doing something you will regret. Fight, not fright.

Company corner

Yesterday we received another set of solid full year results from our favoured retail stock, Woolworths. Lets delve into the numbers straight away and then we can discuss the different segments.

Group sales increased by 16.4% to R72bn. Basic headline earnings increased 44% but if you include the extra shares from the rights issue headline earnings per share increased 8.9% to R4.56. Trading at R87 a share the stock affords a respectable multiple of 19 and a dividend yield of 3.6% before tax (313c per share to be paid this year).

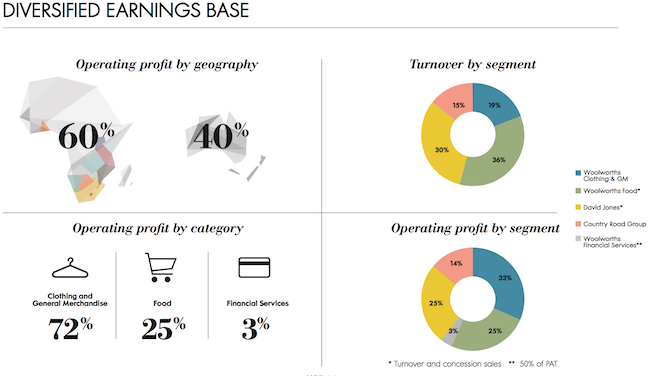

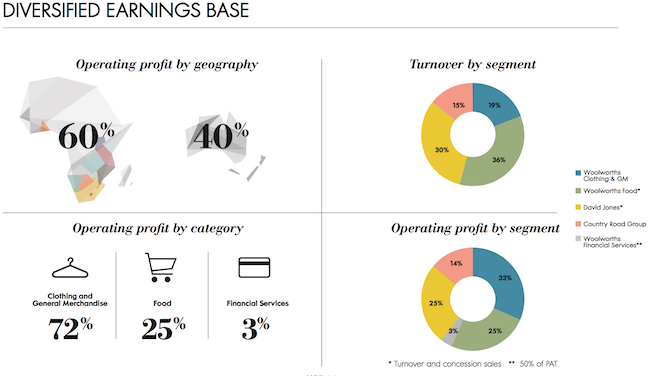

Sometimes a picture says a thousand words, this infographic from the presentation says more.

Often referred to as a grocer, Woolworths only makes one quarter of their profits from selling food. That segment grew 11.9% due to a 5.7% growth in volume and a 6.7% growth in price. The Woolies client is still happy to pay up for quality. Profits in this segment grew 15.6%.

As you can see, the clothing division is divided into 3 segments. Clothing and General Merchandise, David Jones and Country Road. Funnily enough a late winter in both Australia and South Africa took much of the headlines. CEO Ian Moir even said on the radio that they had employed meteorologists to try and predict the seasons. Thats what fast clothing retail has become. Gone are the days when one leather jacket would last you 15 winters. These days you have to stick to the trends. A cold winters breeze on your skin sends you straight to the Woolies to buy the latest jackets. Despite this, Clothing sales grew 9.6%, David Jones grew 8.4% and Country Road grew 5.5%.

When they bought David Jones the business needed a fresh turn around and that is exactly what we are seeing. Woolies management have a great knack for creating a world class retail experience which draws customers in. They have sold one of the old legacy properties for R3.8bn and will be using R2.1bn to build a brand spanking new, 7 story department and food store in Sydney. I am sure it is going to be fantastic. Because of its proximity to Asia,

Australia is fast becoming a big luxury goods destination. I am very confident in that economy's ability to diversify and thrive even with lower commodity prices.

And that is why we own the company. We back the fabulous management to continue to bring in clients and maintain quality products. Retail in general will remain competitive, tough and cyclical. These guys have the ability and quality to ride these waves and continue to produce stellar results.

I think at a historic PE of 19 and forward closer to 16.5 the stock is presenting a great buying opportunity. Plus you are getting paid over 3% yield as a bonus.

Linkfest, lap it up

Facebook is looking to get a return on their 19 billion investment. The key here is not be too invasive or for advertisers to dampen the user experience because once you lose a user you are unlikely to get them back -

Facebook Moves to Monetize WhatsApp With Business Messaging.

Tim Cook has been at the helm of Apple for 5 years now. Amazing how quickly time goes by -

How Apple Shares Have Performed in 5 Years Under Tim Cook. I was surprised to see Microsoft doing better than Apple over this time period, Apple was well ahead last year this time. All stocks go through times of favour and times of being unliked.

You will find more statistics at Statista

Uber only works with scale

You will find more statistics at Statista

Uber only works with scale and they are spending huge amounts of cash to get that scale -

Uber lost a whopping $1.27 billion in the first half of 2016. It is amazing that a company that makes a loss of over $2 billion a year and probably won't be in the green still for a couple of years, has a value of over $60 billion.

Home again, home again, jiggety-jog. Our market is flat today, bouncing between green and red this morning. The Rand is stable sitting around that $/R 14.10 - $/R14.20 range, I don't see it getting too much stronger (unless Yellen says no more rate hikes for another year this evening) until there is some political certainty going forward. Good luck to the Protea's & Boks this weekend.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.