"As you know, we really like the sector, it is changing, growing and getting exceptionally better as we speak. Our job is to find the best companies who are spearheading this change. Stryker is certainly one of them, we reiterate our buy rating."

To market to market to buy a fat pig Oh no, the little steam engine of the Dow Jones variety did not make it to the top of the hill. There is an enormous amount of company related news that we have to deal with, we should definitely bounce directly into these events immediately. As we say, we do companies and not economies and announcements from governments. And global bodies and their predictions. Besides, who remembers what the last one was, or the one from five years ago? Or what it is likely to be in five years time? You don't know what is going to transpire, I don't know, collectively we can work towards what we think is reasonable.

Before we do a quick scoreboard check, there was a rates decision locally yesterday. The trajectory for inflation was lowered in the long run (out of the band in the short term), that is a good thing. What is not good is that the trajectory for growth was also lowered. To flat. Eish, it is tough out there chaps. It certainly doesn't always feel like it in the big bad Jozi, things are always going on. Whilst this lovely province off ours hustles and bustles and is filled with economic activity that is ahead of the rest of the country in terms of the contribution, it does not represent all of South Africa. Don't make that mistake, the cranes in Sandton might represent what is happening in the most powerful economic hub across the continent, it certainly isn't the lived reality of many ordinary South Africans.

That said, we should be grateful that we are not Turkey, or Russia, it hardly looks that encouraging politically in those parts of the world. We have elections in a couple of weeks, if not national ones, perhaps the more important bread and butter issues around municipalities. At the end of the day, all people want is accountability. If we deliver you consistently poor returns, no matter what we say, you are going to pull money.

The same is true for Bill Ackman, the hedge fund manager according to Yahoo! finance

made his conference call sound like a victory lap, after getting "stomped". He may well be right on Herbalife, the market always has deeper pockets than you. Remember that. That almost buried Michael Burry, he was right in the end. The eccentric drum playing fund manager, who could have been a full time neurologist, was wrong forever during a time the market flew. He ended up being very right. If you haven't read the Big Short or watched the movie, definitely read up about the weird antics and his ability to crunch the numbers better, and to hustle. Strangely, last I read of him is that he advocated growing food and sending it across to places with less water. Yip.

Scoreboard check quickly, the Dow Jones fell for the first time in over 8 sessions, down over four-tenths of a percent by the end of the session. The nerds of NASDAQ lost just over one-third of a percent and the broader market S&P 500 was somewhere in-between the two. Well, records are there to be broken, earnings are going to continue to drive share prices and broader markets. Financials, in a very tough environment have been able to stay extremely profitable. Intel was weaker during the session, the stock has been completely flat since the beginning of the year, over the last 12 months the stock has returned a little over 16 percent, that sounds pretty darn good. The last two years have been a slog however, most chip makers in the PC and server space have struggled. The Internet of Things is likely to change that.

Talking of which, on the local front Vodacom reported subscriber numbers that were good, having gained market share here in South Africa. As we saw however from that Cisco report about the internet of things the other day when we covered the MTN trading update -

6 month trading update - swing to loss, there will be 1.5 devices connected per person by 2020. If you think that is a lot, just look around at your phone, your computer, perhaps an iPad and even a fitness device. There, you account for four already, comfortably ahead of the rest.

Locally stocks slid off the highs into the close, we did still however manage to end the day in the green, up just a smidgen over one-quarter of a percent by the time all was said and done. Industrials lower, resources much (much) higher on the session. Financials up the same amount as the market. Vodacom was the biggest loser on the day, down two and one-quarter of a percent, Amplats soared over six percent, whilst Glencore added over four. Shoprite gave a little back after a magic day in the session prior (up over ten percent), the stock is still flirting with multi month highs. And with the inflation outlook improving, perhaps they would be the first beneficiaries. The market is telling you exactly this, Pikwik, Massmart and Pick n Pay all clocking new 12 month highs during the session. Into company news sports lovers, dive below the line to find it.

Company corner

Discovery made an announcement yesterday that needed closer and further inspection. The headline reads

Discovery to introduce Vitality to Japan. Japan of course is a country with over 125 million people, where the average age is around 45 and is possibly one of (if not the) most sophisticated societies on the planet. Organisational skills and attention to detail is not lacking.

OK, so how do discovery plan to do all of this? Simple, at least if you read it at face value -

"a strategic partnership with Sumitomo Life Insurance Co. (Sumitomo Life) and SoftBank Corporation (SoftBank) that will see shared value insurance introduced to the Japanese life insurance market through the joint development of insurance products incorporated with Vitality, Discovery's globally recognised wellness programme."

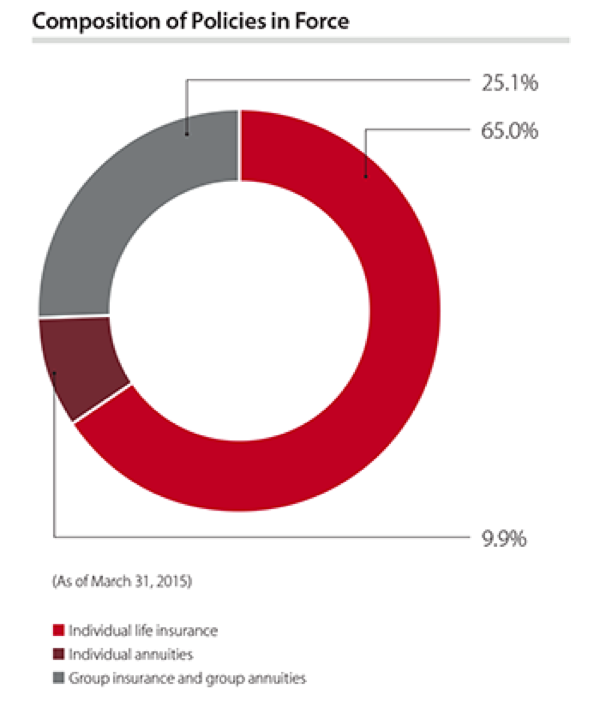

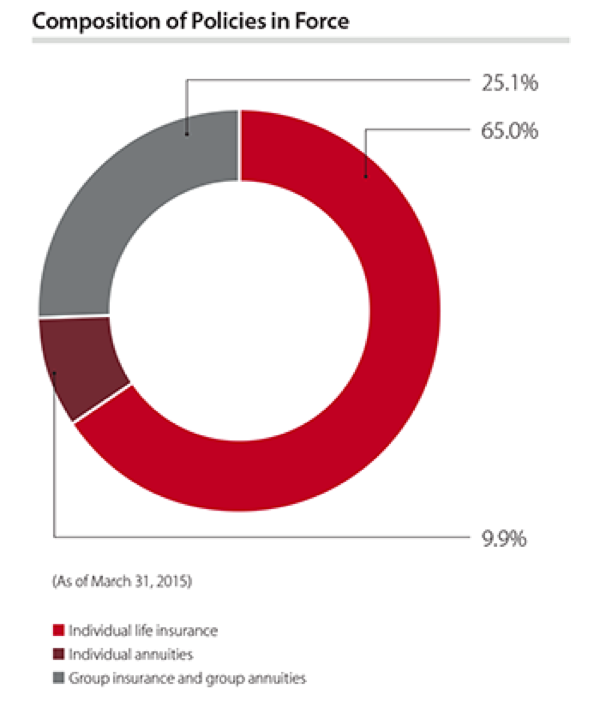

Sumitomo is an insurer that is over 100 years old, it produces profits in excess of 3 billion Dollars per annum, it is headquartered in Osaka (my aunt used to live there), employs over 42 thousand people and most impressive, has policies in place in excess of 1.1 trillion Dollars. Individual life insurance is where their business is at, from their website:

If the Vitality program can boost the company profitability by making those with life insurance eke out a few more years (by having healthier habits) then the payout ratio is extended. Life insurance is a what if I die before I have accumulated enough assets purchase, before I pay down my debt. It is designed to give the remaining behind people, if you happen to die before the actuarial calculations say you will, the same life style that they would have afforded you in the past. There are different forms of life insurance that are also designed to act as investment products, obviously the costs increase as you get older, none of us are Benjamin Button.

For companies such as Sumitomo, it makes sense to use the tried and tested Vitality model. The model is not too dissimilar to the Tesla one, each and every day that data is being sent back to the databases to be crunched by Vitality, the better the systems become. By being healthy, eating right, most importantly exercising and generally being responsible, the company is able to get a better idea of your risk to them. Doing it slightly differently is Discovery, eking out small percentages on giant amounts makes these companies a LOT more profitable and subsequently, the savings are shared as spoils, this is where you benefit as a Discovery shareholder. Softbank, you may recognise that company, they are real operators and I suspect a great partner to be introduced to for the Discovery team. A net positive, the share price rallied one and a half percent on the day.

Visa takes you places. Visa will be in your face over the coming weeks as a

Worldwide Olympic Partner, those are two weeks away sports lovers. An amazing thing really, the Olympic Games, this one will of course be no exception. Equally, Visa is an amazing company. Their ability to run a network that will switch your transaction in a single swipe, regardless of whether you are in any of the major cities of the world and regardless of where your bank is. The fact that there can be guaranteed payment to the merchant, no cash ever exchanges hands and your risks are greatly reduced, that part you just take for granted. We don't even bat an eye.

Yet payment methods continue to evolve to the point where no physical card will be produced, you can with your thumbprint exercise your right to acquire the goods. Just like that. Remember travellers cheques? I remember going on Honeymoon with a whole lot (back then a kings ransom) of them, changing them, fees and all. Visa, along with all the switching networks will be at the forefront of the new technologies, nobody wants to reinvent the wheel just yet. Apple Pay still requires your "card", even if in the future you won't ever produce the physical. If you know your card verification value (the last three digits on the back) in many cases you can complete an online transaction without ever having to see your card again.

Visa numbers from last evening quickly, this was for their

third quarter. The meet on the revenue line was also met with a beat on earnings, slightly ahead of Wall Street expectations. The company has also made the share buyback larger, to 7.3 billion Dollars. The market cap last evening was 189 billion Dollars, this represents a really large amount, shareholders only feel the impact much later. Fewer shares in issue with incrementally increasing earnings.

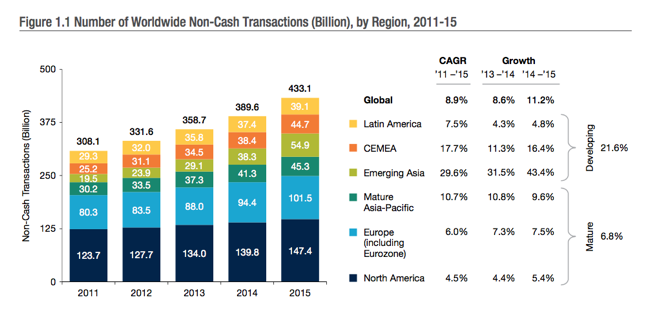

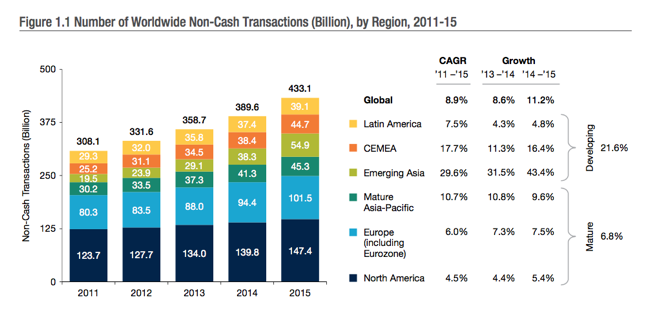

Volumes continue to increase in the low double digits, as consumers and governments are encouraged to do more digitally. We often point out that many transactions are still cash in Europe, the more done with cards, the cheaper it gets eventually for everyone. Visa Europe was integrated into the company, the total consideration remember was upfront 12.2 billion Euros, plus an extra Pref share issuance of 5.3 billion Euros and a closing 1 billion plus 4 percent per annum in interest on the third anniversary of closing. In total around 21 and a half billion Dollars. A truly big deal! Part of the buyback is to minimise the impact of the prefs issued here.

The stock has always looked perpetually expensive. Now is no exception either. Even with guidance given of high single digit revenue growth, margins to die for and the ability to generate free cash of 7 billion Dollars per annum, the market always has high expectations. There are an astonishing 2.5 billion cards out there. According to

this report from competitor MasterCard,

"cash still accounts for 85% of all consumer transactions throughout the world." A non-cash (i.e. Electronic and Card) payment transactions are understandably at a much lower percentage in developing countries than developed countries. Still, there is plenty of room for growth, as you can see -

We suspect that Visa and the others who operate the networks for switching will continue to benefit from all the switching away from cash. I am pretty sure that cash as we know it is living on borrowed time, at least in more developed societies. The carrying costs are too high, it needs to be guarded and buried in a hole in the ground. Sounds like gold.

We continue to accumulate what is a very well positioned business that benefits from globalisation and changing consumer patterns. The stock price is flat after-hours.

Sometimes markets work in mysterious ways.

Last night Stryker beat earnings estimates, but lowered expectations for next quarter. The stock is down 4% premarket. The reason I am perplexed is because they actually raised estimates for the full year. Estimates for the year increased, but the market is only focussing on next quarter. Sounds like an opportunity to me. Long term shareholders will not be too upset however, the stock is up nearly 30% year to date and it is the best performing stock in the Vestact portfolio so far this year. Let us look at the numbers.

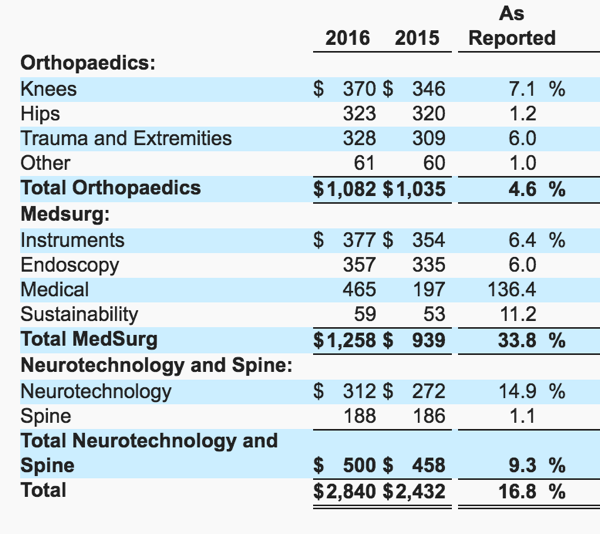

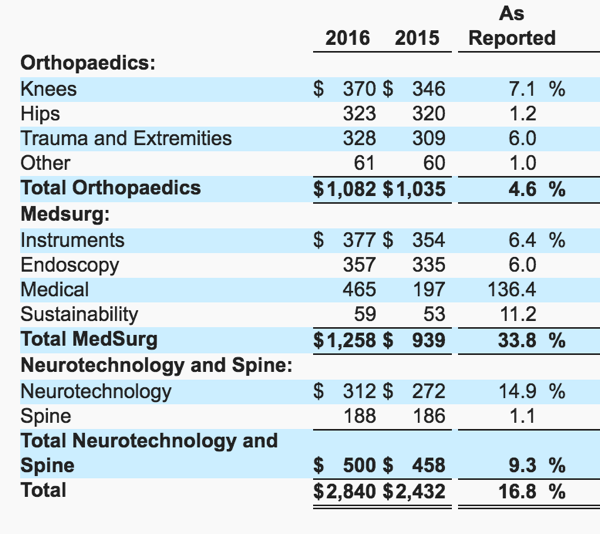

When reporting sales the medical devices business splits their sales into 3 categories. Net sales for the group grew 16.8% to $2.8bn, 6.6% if you exclude acquisitions.

The image below not only shows you these three categories but it further details the divisions.

As you can see, the acquisition of

Sage Products and

Physio Control International had a strong impact on the MedSurg division. If you click on the links and browse through the websites it is pretty impressive seeing all the new products and devices they are coming up with to improve our standard of living. Your body is your greatest tool, these are the devices that will fix it. What bigger priority can you have than the physical well being of yourself and your loved ones? Back to the numbers.

This growth in sales resulted in a 15.8% increase in earnings to $1.39 for the quarter. That is excluding the costs and intangible write downs form the acquisitions.

Gross margins are a whopping 66.2% and operating income margin came in at 24.8%. They sure do charge you for these high end products. It is an incredibly profitable business. 10% of these gross profits goes back into Research and Development. Trading at $118 a share and expecting full year earnings of $5.75 the stock trades just above 20 times. Slightly above the S&P500 forward average of 17, and current trailing 19.3 times.

When you look at the quality of the business, I am not surprised. The majority of doctors we speak to rave about their products.

If you work in healthcare and have some extra insights please let us know what you think of Stryker products. Having said that, 72% of their sales comes from the US (although they seem to have a decent presence in SA). This presents a good opportunity for global expansion.

Another exciting prospect could come from further acquisitions. There is a huge amount of innovation in the healthcare sector and products are being created all the time independently. Stryker has a market cap of $46bn and is sitting on $3bn in cash. I am sure there are lots of consolidation opportunities.

As you know, we really like the sector, it is changing, growing and getting exceptionally better as we speak.

Our job is to find the best companies who are spearheading this change. Stryker is certainly one of them, we reiterate our buy rating.

Linkfest, lap it up

Two of our US holding are teaming up to help save students money (and grow their market share) -

Amazon and Wells Fargo Team Up to Offer Cheaper Student Loans

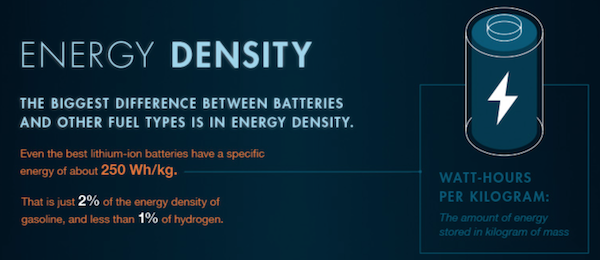

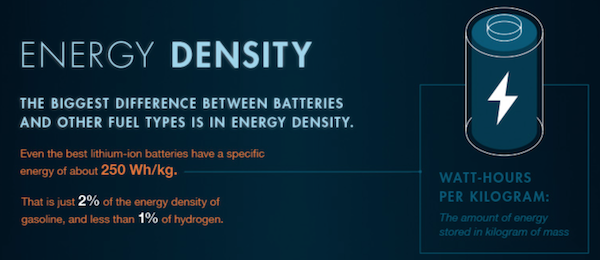

Following on from our Tesla piece yesterday, batteries are a very big factor as to whether Elon Musk's dreams will come true -

Our Energy Problem: Putting the Battery in Context. As you can see batteries still have a very long way to go until they are in the leagues of other energy sources.

Streaming has already won the music wars

Streaming has already won the music wars, who will win the streaming wars is the next question. Who wins the streaming wars will also impact how artists will be paid for their content going forward -

Apple wants a 'simpler and more transparent' royalty scheme for music that would also seriously hurt Spotify.

The more people I speak to about finances, the more you realise that it is an area where society does not understand enough -

Nearly two-thirds of Americans can't pass a basic 5-question financial literacy test, can you?. I was apprehensive to take the test but glad to say that I managed to get 6 out of 6.

Home again, home again, jiggety-jog. Stocks across the globe are lower, we are off the best levels, I am guessing that we shouldn't complain now should we. So far on the earnings front there haven't been too many disappointments and I am sure in the coming months we are going to see a return to normality. Whatever Mario Draghi and his team, and Janet Yellen and her team do, they will do. That goes without saying, they definitely are given stick, yet everyone equally wants their comfort blankey from the central banks.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.