Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

We had numbers from Luxoticca on Wednesday. If you need reminding they are the guys that make sunglass brands Ray Ban, Prada, Oakley and a whole host of other brands. Over the past few months, most of the companies that we have written about talk about strong dollar head winds, Luxoticca is a European company which results in strong dollar tail winds instead. Group sales are up 15.4% compared to the same quarter last year but if we strip out the strong dollar tail wind, sales are only up 5.5%. If we look at EPS, in Euros it is up 19.8% but in US Dollars it is only up 0.5%.

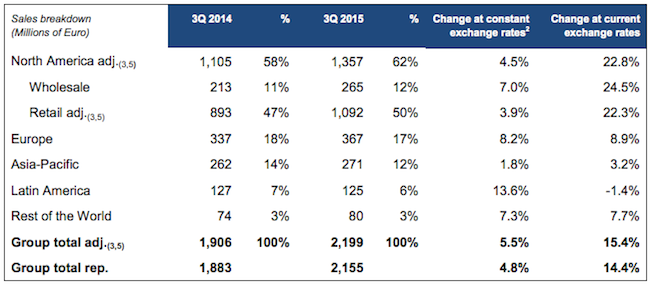

Here is a breakdown of the sales in each region and their respective weighting for the business:

Note the solid growth in North America, which is a good indicator of how things on the ground for the consumer have improved. A key figure to look at though is the Asia-Pacific region which only accounts for 13% of sales and if you drill down further China only accounts for 3% of sales. Given that figures from China have been showing a strong shift to consumption (Apple and Nike both confirming this with their numbers), China is going to be a key growth market for them. Consider that China has 30% more people that both Europe and the US combined, so a region that will grow with in significance.

Then the last number of interest was that they grew their E commerce sales by 50%. Most people I know try on many pairs of glasses before they buy a pair, maybe this is people who are buying glasses they have already tried on in the shops? The stock is not not cheap, trading at a P/E of 30 for next years expected earnings. The reason is due to the huge growth that is expected to come out of China, which at the moment can be considered a blue sky market.