"Two of the big oil companies reported numbers on Friday. The lower oil price has been telling with Exxon Mobil's revenue dropping 33.4% YoY and their EPS dropping 51%! Chevron's revenue dropped to $40 billion from $57 billion the same time last year but their EPS was down a staggering 89.9%!"

To market to market to buy a fat pig. The news all over the financial channels this morning is the reopening of the Athens stock exchange, it has been closed for 5 weeks due to all the uncertainty that surrounded Greece getting and accepting a bailout. Unlike the Lisbon stock exchange that only has a handful of companies (78 to be exact), the Athens exchange has 258 listed companies. As you would imagine there has been a very big sell off, it is currently down 23%! The market pays a premium on listed stocks due to liquidity, the ease of getting your cash out. There are many factors that determine the value of a company but consider that private companies normally trade around 3 - 6 times their earnings, where public companies normally trade around 10 - 20 times their earnings. It makes sense that the market gives a premium to liquidity, how long does it take to get your cash out of a property? In my experience it is between 2 - 3 months and you pay an estate agent around 5%!

This is the sage of Omaha's (Buffett) view on stock markets,

"I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for ten years.". With TV, Twitter and news agencies always bombarding us with what the stock market is doing and the ease at which we can see what our portfolio did over the last 30mins, it is very difficult for investors to ignore the short term noise of the market and only focus on the company and its long term prospects. I remember it being a difficult mental shift from short term fixation to being okay with not worrying about the share price fluctuations over the short run. Here is another quote I found,

"Stop trying to predict the direction of the stock market, the economy, interest rates, or elections.". Here are a whole bunch more, they make for very interesting reading -

101 "Hand-picked" Warren Buffett Quotes On Investing.

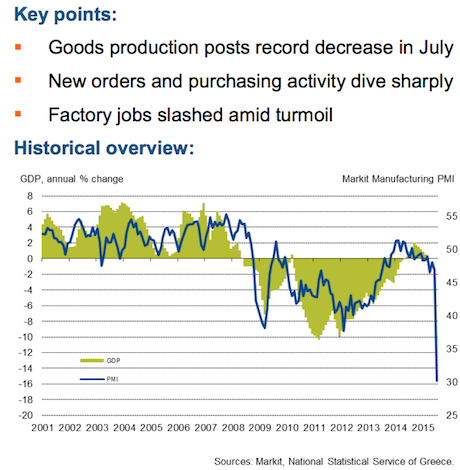

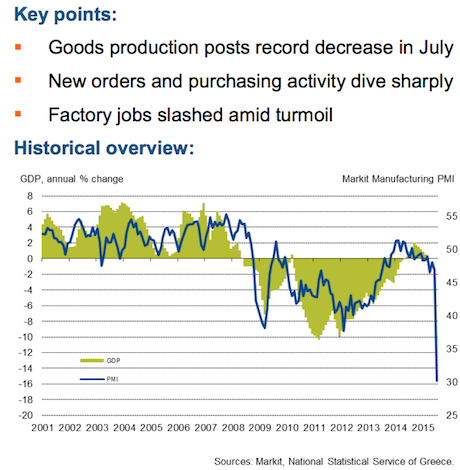

What did all the uncertainty and cash restrictions do to the Greek economy last month? Here is the production report -

Markit Greece Manufacturing PMI. The graph below tells the whole story. When people are uncertain about what the future holds, you don't want funds sitting in stock that is not easily converted to cash. Lets hope that this is a blip on the radar and Augusts numbers increase enough to compensate for the poor July figure.

Company corner

Two of the big oil companies reported numbers on Friday. The lower oil price has been telling with Exxon Mobil's revenue dropping 33.4% YoY and their EPS dropping 51%! Chevron's revenue dropped to $40 billion from $57 billion the same time last year but their EPS was down a staggering 89.9%! Their prospects going forward don't look too rosy with oil staying rooted to the $50 a barrel region. The production numbers from OPEC showing record production numbers, with the goal of OPEC being to maintain market share as opposed to maintaining a price. OPEC currently supplies around 32 million barrels of oil a day, where analysts estimate an over supply of 3 million barrels per day. Going forward, with the Iran sanctions being lifted, they are expected to increase their production by a further 1 million barrels of oil a day. I saw a stat this morning that said due to productivity and technology increases in the shale industry, the production costs for many oil fields has dropped 40% over the last 2 years. Thanks to human innovation it would seem that oil (and commodities in general) will not see a sharp increase in their prices any time soon.

On the local front

Telkom released their

Trading And Operational Update For The Three Months Ended 30 June 2015. The market must have really liked the numbers as the stock ended up over 7%. The number that I think the market was focussing on was the growth in their Mobile net revenue which was up 68.5% to R350 million. The main profit driver is still their fixed line operations which is seeing steady decline in the business, voice revenues were down 13.7% with a drop of 5% in voice lines. There was growth in the ADSL side of the business, with a 4.8% increase in the number of customers there. Going forward the key drivers for them is their mobile offering and fixed line access to the web, coupled with their ICT drive which will be boosted by the Business Connexion purchase which should go through in the coming quarter.

Big news out from one of the smaller JSE players,

Ascendis Health -

Acquisition Of Initial 49% Of Farmalider S.a A Spanish Pharmaceutical Group. They are paying R210 million for a 49% stake in the Spanish Pharmaceutical Group and have the option to buy the remaining stake in a year to come. The stock is only up 0.4%.

Linkfest, lap it up

Germany is moving intentionally to greener energy -

Germany met 78% of its daily energy needs with renewables. The biggest problem with renewable energy is how the power generated fluctuates.

Here is another casualty from the drop in commodity prices. In the long run the unprofitable companies will go out of business and leave only the most efficient players, it would seem that size and scale are where all the efficiencies are to be found -

Three Years Ago This Coal Mine Was Worth $624 Million. Now It Sold for $1

Home again, home again, jiggety-jog. I am seeing more red than green on my screen today, with commodity companies leading the charge lower. Anglo is down 4.4% along with Goldfields and BHP Billiton which is down 1.4%. The Rand has shot over the R/$ 12.70, not great considering that a year ago it was around the R/$10.50 mark. The week ahead is all about jobs, the market will hold its breath to see if strong jobs numbers will result in an interest rate increase in September.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.