"I don't see the share price outperforming over the short term, there needs to be a sustained turnaround in the international business first. I would still be buying the stock though, their stable of brands is quality and runs deep, which gives them a 'moat' around their business and gives them a platform to continue growing as the middle class grows."

To market, to market to buy a penny bun. Markets locally ended in the red, off the very worst levels for the day however. Resources were the stand out, this time in the positive column. Is there the ability to trade volatility around a specific index? There must be, there are so many smart people in our industry with one goal in mind, unfortunately ethics is not as high as you might want. When you read of major financial businesses that would have better screening systems than most institutions employing people responsible for such bad transgressions of the law that lead to fines totalling billions of Dollars, you must ask yourself, can people segregate doing right and greed? It is all rather disappointing. More than disappointing, shocking, sad, a whole host of adjectives, perhaps I should have used the superlatives. See, I am learning English as we go along here too.

Greed is something that we all unfortunately "have", it is how we control that and channel it that counts. The one that really grates me up the wrong way is one of the chat room line:

"if you aint cheating, you aint trying." Pfff .... For these FX fines and fixing scandals alone, according to a Bloomberg article written by Matt Levine (

Bank FX Fine Scorecard (Follow Along at Home!)), banks have paid 10.288 billion Dollars in fines. By December last year, according to MarketWatch,

The biggest banks have paid $180 billion in fines since the financial crisis. Wow. Add this nearly 6 billion in FX fines, we are heading for a bigger and bigger number.

James Titcomb in this Telegraph piece titled:

The banking industry's bill for bad behaviour: $300bn references Morgan Stanley research that suggests we are heading for 300 billion Dollars in fines. And the suggestion is now that banks provision for this and this is just part of the business of doing business, how does that feel as an investor in these companies? These are not small. And financials as a whole have made a serious comeback, some like Citi are still 88 percent lower over the last ten years. Up 46 percent in five years. Not all institutions are the same, Wells Fargo for instance one of the most stable and not really responsible in the financial crisis, is up 82 percent in ten years, 86 percent in the last five. Wells paid around 35 million Dollars earlier this year in mortgages related kick backs. So, they are not immune, they have not fallen into the category of very worst offenders. They were fined 85 million Dollars back in 2011 for pushing people with good credit scores towards more expensive mortgages.

Could you, or would you reliably want to own a business in which you knew that there were shenanigans going on in the background? One of the reasons why we give financials a wide berth. I do however think that it is the most critical of all sectors and the reason why regulators, the Fed, government officials all worked really hard at getting the trust back between the companies. Trust is everything, if that is eroded then I am afraid it takes forever to get back. And you always remember that one moment. It is the same in any relationship of any sort, be that in any industry. I don't know, what do you think?

Company corner

Whoa!!

Why did Mediclinic get trounced so much yesterday? Concerns over the margins in Switzerland and the UAE falling. The falling margins in Switzerland are related to specifically billing systems that have been installed to bill the state. Costs have had to rise with the new system having been implemented, new people. Equally, added to that was accepting more state patients, which is less profitable business than the folks with private insurance. You must remember that out of pocket spend in Switzerland is higher than anywhere in the world, the concentration of older and richer people in Switzerland is higher than in most places. The World Health Organisation estimates that it (out of pocket spend) is around 2500 Dollars per household. At the opposite end of the spectrum is a country by the name of Kiribati. 100 thousand permanent residents have an average out of pocket spend per household of 20 US cents. The climate in Kiribati, looking at their Wikipedia page looks the same for each and every month of the year.

Margin compression means that you are less profitable on the same revenues. Your cost base is rising faster than income from your service/good produced, in this case obviously it is a service. That is not good under any circumstance, most especially when the market is priming the stock for perfection. The stock trades forward on less than 20 times, and growth rates are expected to be somewhere in that region. The stock is now down 15 percent over the last month. On the flip side of that, the stock is up 18 percent during the last 6 months, 46 percent over the last year. Make no mistake, the expectations of the market are very high, they should be high. I have no idea where the stock will end or start to bottom out, I really think however that the company is very well positioned. They are growing all of their businesses, they know their local market well, Switzerland is a fabulous place to do business and the UAE must be well pleased with the development of their own healthcare industry.

We continue to add on weakness, this is certainly a buying opportunity.

Richemont results have hit the screen this morning. Another "Swiss" company, this one of course has a primary listing in Zurich. Something that I guess could happen with Mediclinic in due course. The South African listed entity is the GDR, a Global Depositary receipt, for every ten shares that you own here in South Africa, it is equivalent to 1 share of the listed entity in Switzerland.

These results contain a number of moving parts,

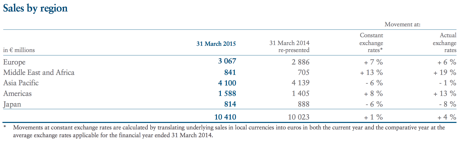

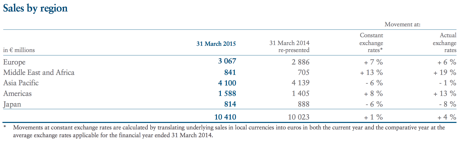

an investment property gain as well as a significant mark to market loss on cash (huh?). Sales grew by only 4 percent in Euro terms, only 1 percent at constant exchange rates. It was a tough year, the fastest growing segment of yesteryear, the Asia Pacific region registering lower revenues than in the prior year, both in constant and actual exchange rates. The reason why multi national companies have seen these currency headwinds or in the case of others, the wind at their backs is the vicious moves in global currency markets. Companies can try and hedge, there are always going to be factors out of their control, such as the losses incurred as a result of the Swiss National Bank removing the Dollar peg. Here is the global sales table:

Where do the cash mark to market come from? In the Chairman, Johann Rupert's overview, he explains:

"In the short term, the revaluation of the franc against the euro resulted in a loss of some 686 million Euros for the Group, recorded as part of net financial expense in the profit and loss account. This was principally attributable to losses on Richemont's cash and financial investments. In addition, foreign exchange forward contracts taken out in line with the established hedging policy of the Group also lost value as a result of the euro's devaluation. Overall, exchange losses resulted in the 35 % drop in reported net profit for the year."

As he points out, that whilst the company is in Switzerland, they report in Euros. The companies that however hold the money market funds (Euros) and other cash are Swiss companies of Richemont. So when the year end was up, 31 March, the companies holding the Euros recorded Swiss Franc losses, due to the revised exchange rate. Not really complicated, yet unfortunately a reality and outside of their control. There were major financial institutions globally that were whacked by the Swiss National Bank moves.

So, I would say that possibly the best numbers to look at are a) Their cash position is higher than this time last year and b) the dividend is higher this year, meaning that the company is more confident with their future.

I suspect that there are always good reasons to own this company. As there are richer people on the planet that want the real deal, they want the quality in terms of brands and most especially the piece, be that jewellery or a watch. I often make the same observation about natural beauty, you cannot replicate the beauty of Cape Town, the tourism industry should thrive in that part of the world on an ongoing basis. Nice to look at, equally with brands centuries old, you cannot replicate that in a heartbeat, it takes forever. It is the standards that need to be maintained, as Richemont points out in the release, their costs are undoubtably going to be rising, they are however committed to Switzerland. That made in Switzerland is an enduring part of their business, core to quality.

Chairman Johann Rupert sums it up:

"We believe that long-term demand for high-quality products will continue to grow around the world. Richemont is committed to supporting its Maisons to conceive, develop, manufacture and market products of beauty, individuality and the highest quality. These values are enduring and will see Richemont well positioned to benefit from an expanding market in the years to come."

In the same way that the company has these enduring brands, I think that the stock is undervalued. After having done some heavy lifting early, after BATS was unbundled, the share price has been quiet for a while. The stock first crested 100 Rand in August of 2013, in market terms (nowadays) that is light years ago. We first recommended them at the bottom of the market in 2009, the timing was excellent, it was both a strong rebound for the luxury goods industry, as well as the share price from very depressed levels. I suspect that we are at the same sort of levels now, after a crack down on gifting has come out of the system, the company is once again poised for growth, we maintain our strong buy.

As mentioned earlier in the week, Tiger Brands released their 6 month interim numbers on Wednesday. It is a storey of their local division that has done well and the international businesses pulling the group down.

On the local front they increased their turnover by 8% (6% inflation), their margins grew very slightly from 13.9% to 14%, the volume of goods sold was up 2% and they increased operating income by 9%. These are solid numbers, they showed growth in all the numbers that counted and are inline with their competitors growth numbers.

Moving on to the international side of things, where all the pain was felt. In Kenya, their Haco operation had fudged the numbers in the last reporting period resulting in R108 million worth of costs in this period. Tiger say they have taken corrective action and that they still back the management team there.

A more well known problem is their operation in Nigeria, Dangote Flower Mills (DFM). They made an operating loss of R128 million for the half year, which is 29% lower than the same period last year. Add to that another R134 million loss arising from the sharp devaluation of the Naira, management expects a further devaluation of the currency over the medium term. Part of the problems mentioned in DFM, was sending South Africans initially to run a company in a country they didn't fully understand. There has been a big push now to get people into DFM who understand Nigeria better, which is a positive move. Another positive number is that they grew their volumes by 16% for the half year. When will the numbers be in the green? I don't think anyone knows but it wont be in the near term.

I don't see the share price outperforming over the short term, there needs to be a sustained turnaround in the international business first. I would still be buying the stock though, their stable of brands is quality and runs deep, which gives them a 'moat' around their business and gives them a platform to continue growing as the middle class grows.

Things that we are reading

Whoa! If the Saudi's "think" that this is going to happen, then what else is going to happen? The FT headline says it all:

Kingdom built on oil foresees fossil fuel phase-out this century. A similar and related story, this time from Europe:

Coal and gas power dying out in Europe, says energy chief. Makes you wonder about Eskom and perhaps how far they are behind.

Frustrated that someone who got to Twitter early has more followers than you? It actually goes a little further than that, for news organisations being earlier it may determine how quickly their readers/viewers are informed:

The Cost of Being Late on Social Media. It almost is like High frequency trading for media, being first to market.

This article highlights why there is a need to have a long term view/plan when it comes to investing. Would you be able to stick with your plan during 6 years of under performance? -

Why Is Value Investing So Difficult?

Here is another way of producing fuel without the need for oil -

Could algae save the world?. They say in the process they are taking CO2 out of the atmosphere and they produce fresh water as a by-product.

Stats can be moulded to say whatever you think they should say.This is done by changing assumptions, changing time periods, changing data samples -

Do CEOs Make 300 Times What Workers Get? Not Even Close.

Given how society has been using these emoji's what is the official meaning of them? Is it what the masses think they mean or what their creators meant them to mean? -

We're All Using These Emoji Wrong. I think the masses win this one.

Home again, home again, jiggety-jig. Chinese shares at a seven year high, the S&P 500 closed at an all time high last evening. The Rand is stronger, perhaps with the SARB being cautious, ready to act. The search for yield, you know. A modest rally across the board here locally!

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.