Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week we received full year results from Luxottica, one of our favoured consumer stocks based in Italy but with a listing in New York. In case you forgot Luxottica, according to their website, is the leader in design, manufacture, distribution and sales of premium, luxury and sports eyewear. Trademarks include Ray-Ban, Oakley, Vogue Eyewear, Persol, Oliver Peoples, Alain Mikli and Arnette. Licensed brands include Giorgio Armani, Bulgari, Burberry, Chanel, Coach, Dolce & Gabbana, Donna Karan, Michael Kors, Paul Smith, Polo Ralph Lauren, Prada, Starck Eyes, Tiffany, Tory Burch and Versace. You get the picture. The company wholesales these products in more than 130 countries across 5 continents. Along with all of that they operate over 7000 retail stores under the Sunglass Hut brand.

They are also dominant in the prescription and vision care business around the globe. This gives them a solid healthcare element. Vision is of course imperative when it comes to healthcare and the quality of life.

Lets look at the numbers. 2014 was a record year for the group. Sales topped 7.6 billion Euro which was up 5.3% on the previous year. This equated to a 15.3% increase in operating profit to 1.18 billion Euro. Net income increased 8.9% to 687 million Euro which equated to 1.44 Euro per share. Of course there are currency complications here. As the dollar has strengthened the dollar denominated ADR we are invested in has under preformed the share in Euros. But because your shares are denominated in a strengthening currency, your buying power improves compared to every other currency. Having said that even in dollars Luxottica has a had a solid period.

The share price has improved from $47 (the shares took a dive because of ownership issues, I will explain later) in October last year to $60 a share today. In Euros the price has gone from 37 Euro a share to 57 Euro a share in the same period. When or if the dollar reaches parity with the Euro the share prices will cross over. Currencies are a funny thing. If the Euros bond buying policies work and the zone starts growing we will see flows going back to the Euro. We don't let currency movements determine our investment decisions although it is a factor we consider.

Trading at 56.4 Euro whilst making 1.44 Euro a share, the stocks trades on a historic multiple of 39. Certainly not cheap! Next year earnings are expected to come in at 1.81 Euro and 2 Euro for 2016. That puts the stock on a forward multiple of 28 with an average annual growth in earnings of 13.2% expected. Earnings growth like that, for a huge multinational with a solid and reliable customer base is almost unheard of in these markets, that is why the stock affords the multiple it does.

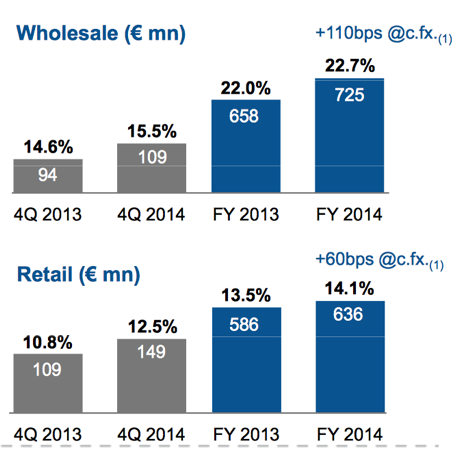

Operationally the business is split into 2 divisions, retail and wholesale. Here is how they faired (see image below). As you can see both divisions showed solid growth with earnings split fairly equally between the 2.

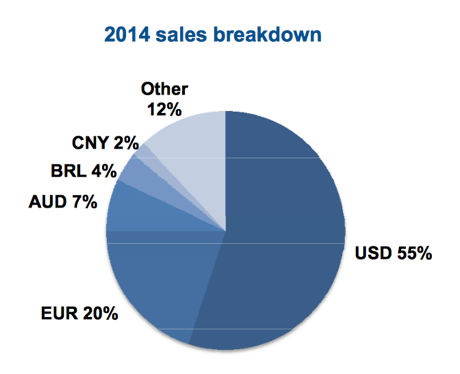

Geographically this business has huge exposure to the US as you can see from the image below. That is good for a company earning in dollars and reporting in Euros. Because of the strength in the US economy it is also their fastest growing region amongst their established regions. Emerging markets grew sales 17% wholesale and 10% retail.

The company does have a few risks. Volatile currency movements could have a short term impact but the biggest concern is the the ownership structure. We covered the debacle in details last year, click on the link Luxottica Corporate Governance Issues for all the details. In short, the situation has been dealt with and new management are in place. It is not ideal but at least your interests are heavily aligned with Del Vecchio even though he is not willing to give up power. He is certainly an exceptional man to have built the business to where it is today.

Free cash flow and net debt are almost equal, room for further capital expansion is huge. I love the theme of fashion, consumer necessity, healthcare and even sport through their active eyewear division. Even though the stock is expensive we buy shares because we believe the theme will out preform what the market predicts. This is certainly one of those themes. We continue to add.